- The Fed is not even thinking about thinking about ending fueling inflationary pressures

- Palladium rose to a new record higher last week

- Platinum broke out above a technical resistance level earlier this year

- Gold and silver are consolidating, but trends remain bullish

- GLTR has substantial growth potential in an inflationary environment

Taming inflation can be a challenge when the economic beast begins to rise. The US central bank made a not-so-subtle change to its inflation target in August 2020 when it boosted its target from 2% to an average of 2%. Measuring inflationary pressures is an art rather than a science. The variables the central bank employs determine the Fed’s perception of the condition that erodes money’s purchasing power. A little inflation can be healthy for the economy, but too much of a good thing can be highly detrimental.

In the aftermath of the 2008 global financial crisis, the Fed and other world central banks slashed interest rates to historically low levels. They rolled out quantitative easing to pushed rates lower further out along the yield curve. The price tag was a rise in many commodity prices to multi-year or all-time highs by 2011 and 2012.

The central banks used the same tools in 2020 as the global pandemic threatened stability in the worldwide financial system. The only difference has been that in 2020, the amounts were far higher than in 2008.

Albert Einstein once defined insanity as doing the same thing and expecting a different result. Commodity prices have already begun reflecting the same price action that followed the 2008 stimulus.

Precious metals can act as inflation barometers. While gold and silver prices have pulled back over the past months, platinum broke above a long-term technical resistance level in 2021, and palladium made new all-time highs last week. As the inflationary pressures mount, the prospects for higher precious metals prices are rising. The Aberdeen Standard Physical Precious Metals Basket Shares ETF (GLTR - Get Rating) holds long physical gold, silver, platinum, and palladium positions. Rising inflation could make GLTR a growth stock over the coming months and years.

The Fed is not even thinking about thinking about ending fueling inflationary pressures

At the latest FOMC meeting on April 28, they did precisely what the market had expected. The central bank left the short-term Fed Funds rate unchanged at zero to twenty-five basis points and told the markets it would continue to purchase debt assets to the tune of $120 billion per month. The statement acknowledged economic growth, an improving employment landscape, and rising inflation. However, the Fed called the increase in the financial condition “transitory.” At his press conference that followed the meeting, Chairman Jerome Powell said it is not yet the time to “think about thinking about tapering” debt purchases or short-term interest rate hikes.

The bond market is telling the Fed and markets just the opposite.

Source: CQG

The weekly chart of the nearby 30-Year US Treasury bond shows the decline from 183-06 in early August to a low of 153-29 in mid-March. At the 158-20 level, the bond market has ignored the Fed purchases as the path of least resistance of interest rates further out along the yield curve has been higher. The price action in the bonds signals rising inflationary pressure. So does the bullish path of the stock market, real estate, digital currencies, and many commodity futures markets.

Over the recent trading sessions, lumber rose to a new high at $1650 per 1,000 board feet. Grain prices rose to eight-year highs in explosive moves as the 2021 US crop year is underway. Copper traded to a decade high in April at over $4.60 per pound, a stone’s throw away from the 2011 $4.6495 peak.

Palladium rose to a new record higher last week

Palladium was another market that reached a new record high on the final trading session in April.

Source: CQG

As the quarterly chart highlights, nearby palladium futures climbed to $3019 on May 4. Increased demand for the precious metal that cleans toxins from the air in catalytic converters, as well as its many other industrial uses, drove palladium’s price to the lofty level. Palladium futures began rising back in 2016 at the $451.50 level.

Rhodium, another platinum group metal that only trades in the physical market, reached a low of $575 per ounce in 2016. On May 6, rhodium was trading at a midpoint value of $26,900 per ounce as industrial demand and tight supplies have driven the price to an all-time peak.

Platinum broke out above a technical resistance level earlier this year

Platinum is the precious metal that has been a laggard over the past years, trailing the price action in palladium and rhodium, its sister metals. Platinum has also lagged gold as the yellow metal rose to an all-time peak in August 2020 before pulling back. Platinum was once known as “rich person’s gold,” but at an over $570 discount to gold based on the nearby futures contract on May 6, platinum continues to trail gold and the other precious metals. However, platinum’s technical position could indicate that the price is heading a lot higher over the coming months.

Source: CQG

The monthly chart highlights the bear market in the platinum futures arena that began at the all-time 2008 of $2308.80 per ounce. Platinum made lower highs and lower lows until breaking the trend in early 2021. The spike low at $562 in March 2020 marked a significant bottom, and the price turned higher. Critical technical resistance stood that the August 2016 $1199.50 high. In February 2021, platinum traded to a high of $1348.20, ending the thirteen-year bearish streak.

Nearby NYMEX platinum futures was at $1238 per ounce on May 6. The $1200 level has become a pivot point for the precious metal as it continues to consolidate before making its next move.

Gold and silver are consolidating, but trends remain bullish

Gold futures reached an all-time high in August 2020 at $2063 per ounce. The yellow metal surpassed the 2011 high of $1920.70 in July and probed over the $2000 level in August.

Source: CQG

Since then, the price pulled back to a low of $1673.30 in March and has been consolidating and digesting the move to a record high in US dollar terms as well as most other currency terms in 2019 and 2020. Bull markets rarely move in a straight line, and selloffs can be severe. However, the bull market in gold began at the turn of this century at the $250 per ounce level and remains firmly in place as we head into May.

Silver can be a wild and volatile commodity. In 2020, the price fell to an eleven-year low before rising to a seven-year higher. Silver’s volatility tends to attract trend-following traders, speculators, and investors when the price begins to move because an ounce of silver is a fraction of the price of its sister metal, gold.

Source: CQG

The chart illustrates silver’s $18.175 trading range in 2020. The March 2020 low at $11.74 turned out to be a significant bottom that launched the price to a high of $29.915 only five short months later in August. After correcting, silver moved to a marginally higher high at $30.35 in February 2020.

As of May 6, gold and silver were starting to show signs of bullish life with the yellow metal above the $1810 level on the June futures contract and silver at $27.50 per ounce on July futures.

GLTR has substantial growth potential in an inflationary environment

Bonds, stocks, real estate, digital currencies, and a host of commodities, including palladium and rhodium, are flashing inflationary signals. The tidal wave of central bank liquidity continues to pour into the financial system in the form of artificially low interest rates and quantitative easing. Moreover, government stimulus programs in the trillions increase debt levels to historical highs and weigh on fiat currencies’ purchasing power. While the Fed continues to call rising inflationary pressures “transitory,” the price action in markets across all asset classes points to a more severe condition.

Precious metals remain in bull markets, with platinum joining the pack in February when it broke above its nearly five-year-old technical resistance level.

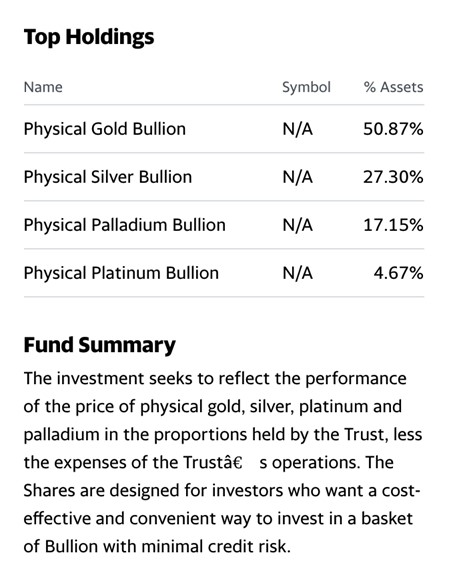

The Aberdeen Standard Physical Precious Metals Basket Shares ETF (GLTR) is a product that could be a growth stock over the coming months and perhaps years as it holds long positions in gold, silver, platinum, and palladium. GLTR’s recent top holdings and fund summary include:

Source: Yahoo Finance

GLTR recently had $972.097 million in assets under management. The ETF trades an average of 46,753 shares each day and charges a 0.60% management fee.

GLTR holds a basket of the four precious metals that trade on the CME’s COMEX and NYMEX division.

If inflationary pressures continue to rise, and more than a few warnings are out there in markets, GLTR could be a product that adds an inflation hedge to your portfolio. I view GLTR as a growth stock at around $100 per share.

Want More Great Investing Ideas?

GLTR shares were unchanged in after-hours trading Thursday. Year-to-date, GLTR has gained 1.75%, versus a 12.45% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| GLTR | Get Rating | Get Rating | Get Rating |