Cannabis supporters are hopeful that the Joe Biden-led government will decriminalize or even legalize recreational pot consumption at the federal level sometime soon. As a result, investors have given a huge thumbs-up for cannabis stocks recently.

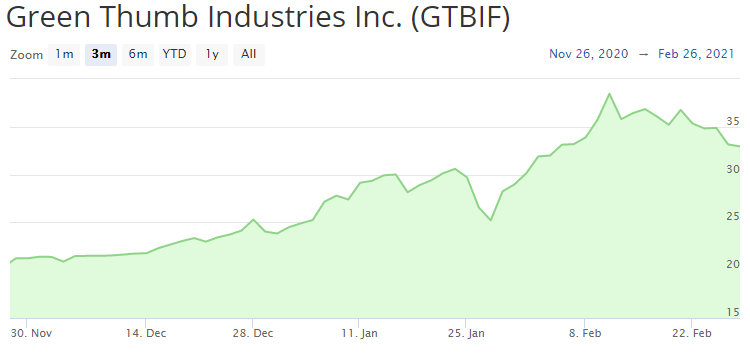

Shares of cannabis company Green Thumb Industries (OTC:GTBIF) have gained 63% in the last three months and are up a whopping 383% since July 2018. Comparatively, the S&P 500 has returned 45% in less than three years.

While past returns don’t matter much to future investors, let’s take a look to see if Green Thumb stock is a good stock to own in 2021.

Green Thumb Industries is a multi-state operator

Green Thumb Industries is a multi-state cannabis operator in the U.S. In Q3 of 2020, the company reported sales of $157.1 million, which indicated year over year growth of 131.1%. The pot heavyweight experienced revenue growth in both its businesses which include consumer packaged goods and retail. Green Thumb offers products via its consumer-packaged goods vertical which are then sold through multiple retail channels.

This stellar rise in the top-line also helped Green Thumb to increase its operating cash flow margin from -1% in Q3 of 2019 to 45% in Q3 of 2020. This margin is basically Green Thumb’s operating cash flow divided by total sales.

Green Thumb also reported a positive net income for the first time ever in the September quarter. Its net income rose to $9.6 million, compared to a loss of $14 million in Q3 of 2019. In Q3, Green Thumb’s adjusted EBITDA also rose by 50% year over year to $53.2 million.

The cannabis pot stock will have several opportunities to increase its revenue at an enviable pace over the long-term given its expanding addressable market. A report from New Frontier Data estimates the cannabis market in the U.S. to increase at a compound annual growth rate of 18% to $35 billion by 2025.

A huge presence in the Land of Lincoln

Green Thumb has a vast portfolio of medical and recreational marijuana products including brands such as Dogwalkers, Dr. Solomon, and Rhythm.

It has 48 retail stores in 10 states in the U.S. Eight of these stores are located in its home state of Illinois, a region that is forecast to touch $1 billion in annual sales this year. Green Thumb has the license to open two other stores in the Land of Lincoln.

Green Thumb stock valuation and more

On February 25, Stifel analyst Andrew Partheniou increased his price target on Green Thumb stock to CA$71.50 (USD$56.18), up from his previous target of CA$46 (USD$36.14). Benchmark’s Mark Hickey also increased the stock’s price target to USD$42 per share. Green Thumb is currently trading at about $33.

The stock is valued at a market cap of $7.54 billion which means its trading at a forward price to 2021 sales multiple of 8.5x, which is reasonable. Comparatively, it’s trading at a price to earnings multiple of 81x. Wall Street expects the company to grow sales by 50.2% to $825 million in 2021 while earnings are forecast to rise by 486% year over year to $0.41.

Green Thumb Industries provides investors with an unlikely combination of profitability, growth, and valuation, making it a top pick in the cannabis industry for 2021 and beyond.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

How to Ride the 2021 Stock Market Bubble

7 Best ETFs for the NEXT Bull Market

5 WINNING Stocks Chart Patterns

GTBIF shares were trading at $32.95 per share on Friday afternoon, down $0.22 (-0.65%). Year-to-date, GTBIF has gained 34.49%, versus a 2.95% rise in the benchmark S&P 500 index during the same period.

About the Author: Aditya Raghunath

Aditya Raghunath is a financial journalist who writes about business, public equities, and personal finance. His work has been published on several digital platforms in the U.S. and Canada, including The Motley Fool, Finscreener, and Market Realist. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| GTBIF | Get Rating | Get Rating | Get Rating |