Green Thumb Industries Inc. (GTBIF): Price and Financial Metrics

GTBIF Price/Volume Stats

| Current price | $11.24 | 52-week high | $16.33 |

| Prev. close | $11.17 | 52-week low | $6.42 |

| Day low | $11.05 | Volume | 96,854 |

| Day high | $11.44 | Avg. volume | 518,922 |

| 50-day MA | $11.81 | Dividend yield | N/A |

| 200-day MA | $11.81 | Market Cap | 2.39B |

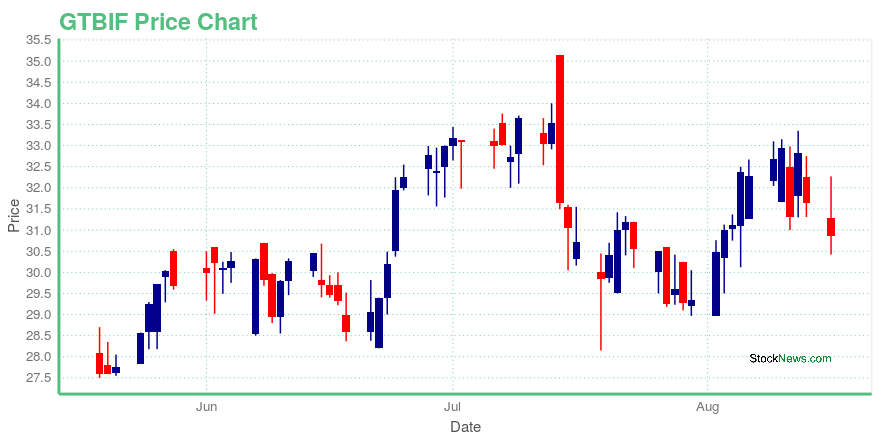

GTBIF Stock Price Chart Interactive Chart >

Green Thumb Industries Inc. (GTBIF) Company Bio

Green Thumb Industries Inc. manufactures, distributes, and sells various cannabis products for medical and adult-use in the United States. It offers cannabis flower; and processed and packaged products, including concentrates, edibles, and topical and other cannabis products under the Rythm, Dogwalkers, The Feel Collection, incredibles, Dr. Solomon's, Beboe, and other brands. The company distributes its products primarily to third-party retail stores, as well as sells finished products directly to consumers in its own Rise retail stores. As of October 21, 2020, it owned and operated 49 retail stores. It also had licenses for 96 locations across 12 U.S. markets. The company was founded in 2014 and is headquartered in Chicago, Illinois.

Latest GTBIF News From Around the Web

Below are the latest news stories about Green Thumb Industries Inc that investors may wish to consider to help them evaluate GTBIF as an investment opportunity.

Legal U.S. cannabis sales will triple in the next decade: Green Thumb Industries CEOGreen Thumb Industries Founder & CEO Ben Kovler joins Yahoo Finance Live to discuss the company's second quarter earnings. |

Green Thumb Industries Reports Second Quarter 2021 ResultsCHICAGO and VANCOUVER, British Columbia, Aug. 11, 2021 (GLOBE NEWSWIRE) -- Green Thumb Industries Inc. (“Green Thumb,” or the “Company”) (CSE: GTII) (OTCQX: GTBIF), a leading national cannabis consumer packaged goods company and owner of Rise Dispensaries, today reported its financial results for the second quarter ended June 30, 2021. Financial results are reported in accordance with U.S. generally accepted accounting principles (“GAAP”) and all currency is in U.S. dollars. Highlights for the q |

Green Thumb Industries Inc. (GTBIF) to Open Rise Warminster in PennsylvaniaGreen Thumb Industries to Open Rise Warminster in Pennsylvania, Its 62nd Retail |

Green Thumb Industries to Open Rise Warminster in Pennsylvania, Its 62nd Retail Location in the Nation, on August 10CHICAGO and WARMINSTER, Penn., Aug. 09, 2021 (GLOBE NEWSWIRE) -- Green Thumb Industries Inc. (GTI) (CSE: GTII) (OTCQX: GTBIF), a leading national cannabis consumer packaged goods company and owner of Rise™ Dispensaries, today announced it will open Rise Warminster, the 16th Rise™ location in Pennsylvania and 62nd store nationwide, on Tuesday, August 10. Profits from the first day of sales will be donated to National Giving Alliance (NGA) which works to improve the quality of life for homeless, l |

Green Thumb Industries purchase Summit pot dispensary in WarwickWarwick medical marijuana dispensary sold to Chicago company The Providence Journal |

GTBIF Price Returns

| 1-mo | -9.94% |

| 3-mo | -8.02% |

| 6-mo | -15.17% |

| 1-year | 69.07% |

| 3-year | -61.56% |

| 5-year | 10.74% |

| YTD | -0.44% |

| 2023 | 30.67% |

| 2022 | -61.01% |

| 2021 | -9.55% |

| 2020 | 151.28% |

| 2019 | 21.42% |

Loading social stream, please wait...