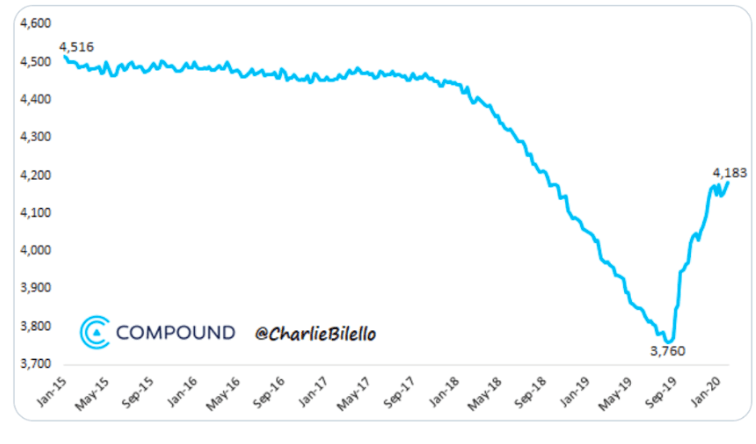

The stock market continues to power to consecutive new highs; as measured by the “SPDR 500 ETF (SPY)” already up some 6.5% for the first six weeks of the year. And, despite a variety of events, from the Iran/Iraq missile issue to the current Coronavirus, that could have provided valid reasons for a significant market decline, nothing seems to be able to derail this market.

In fact, that rally has been scarily controlled and linear, with 87% of the past 70 trading posting gains. It’s as if a flying saucer is hovering above, shining a beam drawing in dollars and driving prices inexorably higher.

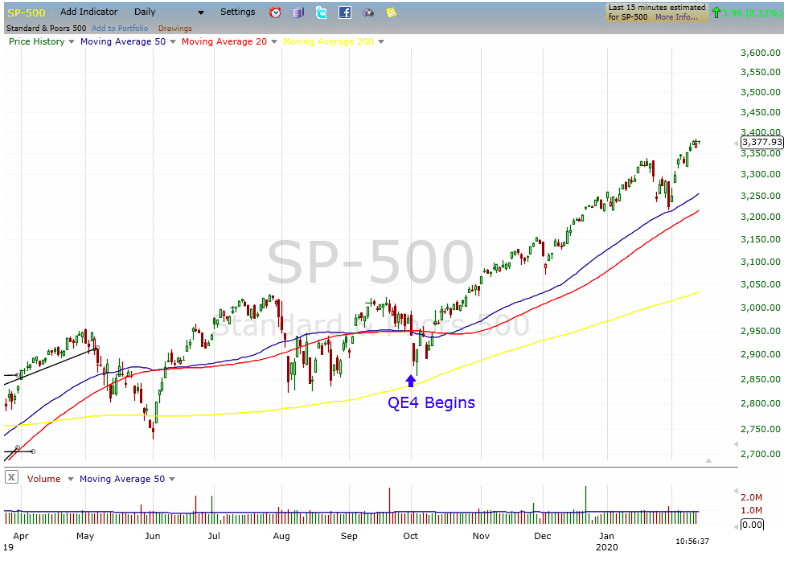

It’s probably no coincidence the lift-off began in earnest just after February engaged a new round, pumping liquidity into the market on Sep 18, 2019. They can claim ‘it’s not QE.’ But, it amounted to some $120 billion in funds made available via the repo market on a daily basis.

That was the all-clear for the machines to get long and leveraged — in the few months since the S&P is up nearly 20% with no sign of stopping.

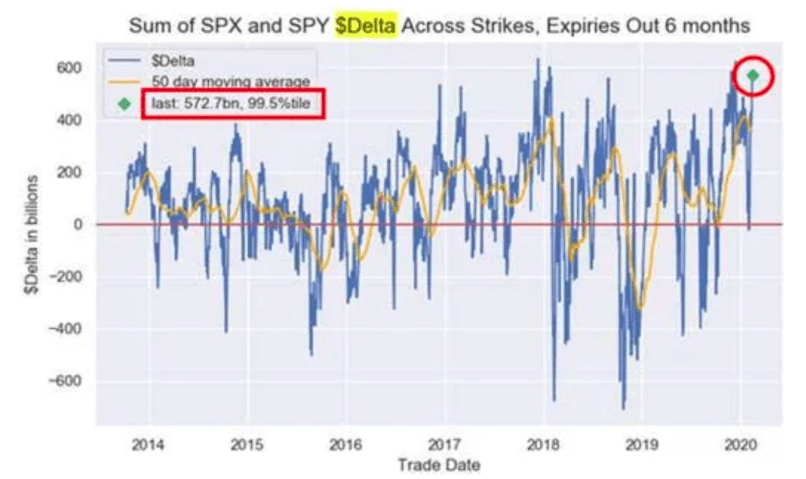

The confidence, or need to get upside exposure, has emerged in the options market too as money managers are buying call options at an increasing rate.

This is evident in the positioning of SPX and SPY options, which stand as proxies for the broad market. They have seen the delta exposure, or the measure of how long or bull or bullish positions, has jumped to 99.5%, just the 3rd time to hit such levels in the last 6 years.

While some of this call buying might be part of a stock replacement strategy, which seeks to limit downside while maintaining upside potential, it seems the majority of the call purchases are an attempt to performance chase and turbocharge returns in a market that increasingly looks set for a melt-up.

Can this be a sign of creping euphoria, or as I call it, ‘UFO oria’?

It remains to be seen. But, one data point suggests caution is warranted. Over the past 20 years, 11 times the Delta % has crossed above 95.5% the forward 3-month returns is a minus -1.9%, and 12-month returns minus -3.6%.

Not disastrous or even what might be classified as a mild correction. But, certainly a change for the up, up and away we’ve been experiencing.

.INX shares were trading at $336.84 per share on Friday afternoon, down $0.22 (-0.07%). Year-to-date, .INX has gained 4.65%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| .INX | Get Rating | Get Rating | Get Rating |