KeyCorp (KEY - Get Rating) offers deposit, lending, cash management, and investment services to consumers and companies in 15 states via a network of more than 1,000 locations and approximately 1,300 ATMs under the KeyBank National Association. Cleveland, Ohio-based Key also offers sophisticated corporate and investment banking products to middle-market companies that include merger and acquisition advice, public and private debt and equity, syndications, and derivatives.

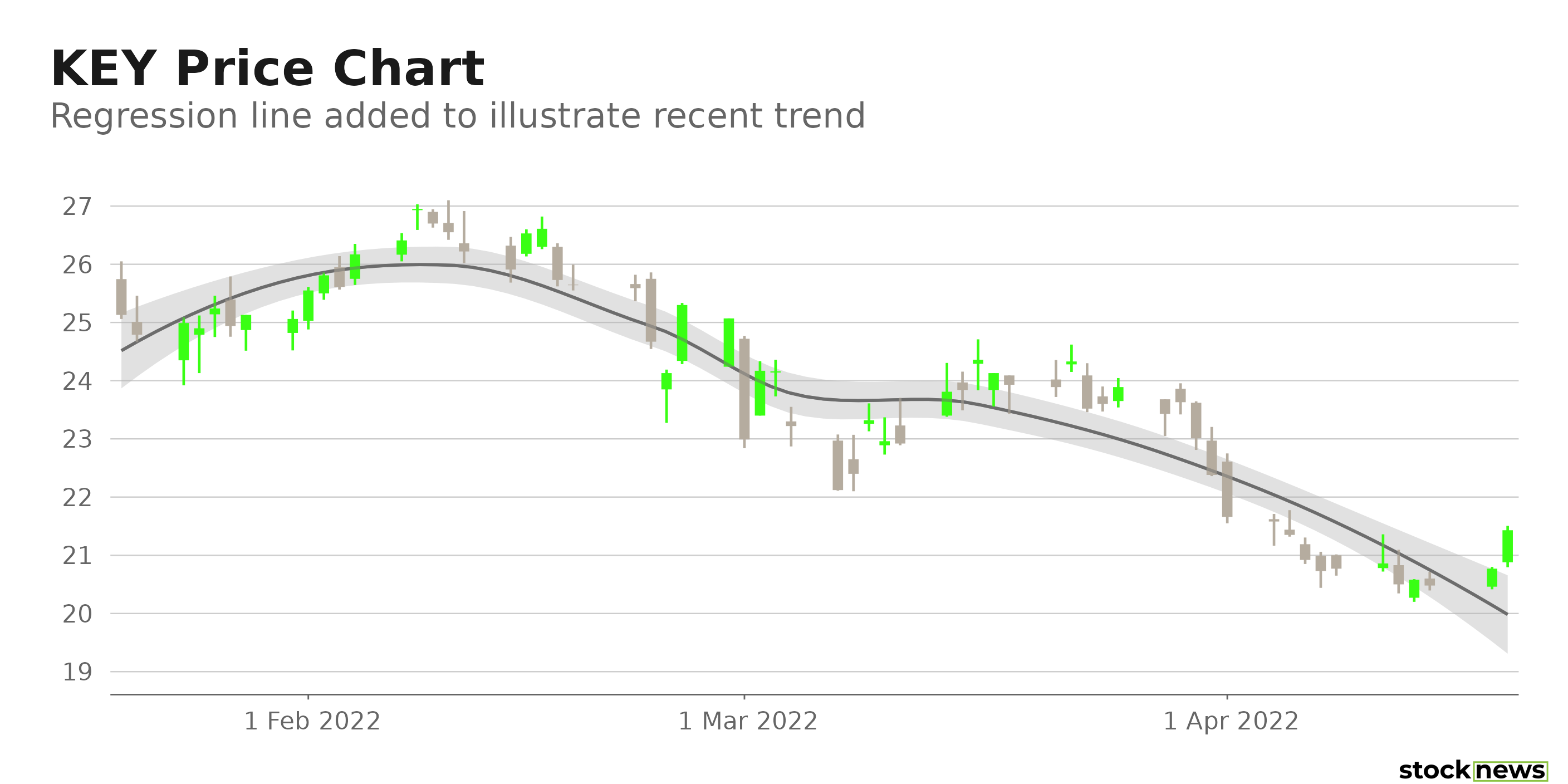

While the stock has gained 4.9% in price over the past year, it is down 16.3% over the past three months and 10.5% over the past month.

Rising mortgage rates and inflation were a drag on mortgage origination and refinancing activity during the quarter, harming KEY’s mortgage banking division. Furthermore, rising prices and economic growth uncertainties, owing primarily to ongoing geopolitical concerns, could impact consumer sentiments.

Here is what could shape KEY’s performance in the near term:

Market Headwinds

Unlike in previous quarters, KEY’s deal-making came to a standstill in March as the Russia-Ukraine war and roaring inflation rates impacted global corporate activity. Similarly, when the stock market’s performance foundered, IPOs and follow-up equity issuances dried up. As a result, KeyCorp’s investment banking (IB) business performance in the coming quarter is likely to be subdued.

Mixed Profitability

KEY’s 0.86% trailing-12-months CAPEX/Sales multiple is 44.8% lower than the 1.6% industry average. However, its 34.2% trailing-12-months net income margin is 11.7% higher than the 30.6% industry average. Also, its $1.15 billion trailing-12-months cash from operations is 663.6% higher than its $151 million industry average.

Mixed Growth Prospects

Analysts expect KEY’s revenue to increase 0.4% in the current year and 5.1% next year. However, KEY’s EPS is expected to decline 19.7% in the current quarter (ending March 31, 2022) and 16% in the current year. In addition, its EPS is expected to decrease at the rate of 1.6% per annum over the next five years.

POWR Ratings Reflect Uncertainty

KEY has an overall C rating, which equates to Neutral in our proprietary POWR Ratings system. The POWR ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. KEY has a C grade for Quality and Sentiment. The company’s mixed profitability is consistent with the Quality grade. In addition, analysts’ revenue and EPS estimates are in sync with the Sentiment grade.

Among the 10 stocks in the D-rated Money Center Banks industry, KEY is ranked #1.

Beyond what I have stated above, one can view KEY ratings for Value, Growth, Momentum, and Stability here.

Bottom Line

While KEY is upbeat about its prospects for the coming quarters, mounting economic risks that include inflation, a possible recession, and persistent geopolitical tensions may impact investor sentiment. In addition, it is currently trading below its 50-day and 200-day moving averages of $23.59 and $22.65, respectively, indicating a downtrend. So, we think investors should wait for the company’s prospects to stabilize before investing in the stock.

Want More Great Investing Ideas?

KEY shares rose $0.07 (+0.33%) in premarket trading Wednesday. Year-to-date, KEY has declined -6.33%, versus a -5.64% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing. In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| KEY | Get Rating | Get Rating | Get Rating |