KeyCorp (KEY): Price and Financial Metrics

KEY Price/Volume Stats

| Current price | $16.46 | 52-week high | $16.47 |

| Prev. close | $16.13 | 52-week low | $9.50 |

| Day low | $16.13 | Volume | 14,594,331 |

| Day high | $16.47 | Avg. volume | 14,891,458 |

| 50-day MA | $14.54 | Dividend yield | 5.17% |

| 200-day MA | $13.85 | Market Cap | 15.52B |

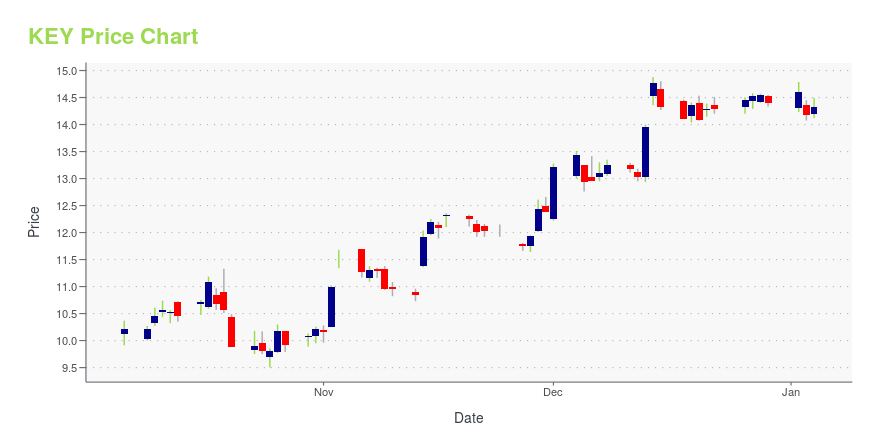

KEY Stock Price Chart Interactive Chart >

KeyCorp (KEY) Company Bio

KeyBank, the primary subsidiary of KeyCorp, is a regional bank headquartered in Cleveland and is the only major bank based in that city. KeyBank is 24th on the list of largest banks in the United States. (Source:Wikipedia)

Latest KEY News From Around the Web

Below are the latest news stories about KEYCORP that investors may wish to consider to help them evaluate KEY as an investment opportunity.

KeyBank Foundation Invests $1,000,000 to Support Several Non-Profit Organizations in Central New YorkFunding will lift up and amplify efforts that will strengthen communities through workforce training, financial education and economic development SYRACUSE, NY / ACCESSWIRE / December 28, 2023 / The KeyBank Foundation is investing a total of $1 million ... |

KeyBank announces charitable donations to Maine nonprofitsKeyBank and KeyBank Foundation announce (21) twenty-one charitable donations made recently to nonprofit organizations in Maine. The gifts focus support to address homelessness, food insecurity, financial literacy, preventative healthcare and more. The charitable donations total $347,000 and are part of KeyBank's community philanthropic efforts targeted toward education, workforce development, and safe, vital neighborhoods. |

Citi names GM, Delta, KeyCorp as top stocks for 2024Citigroup (C) has unveiled its top stock picks for 2024. Despite macroeconomic uncertainty, Citi analysts have named Delta (DAL), United (UAL), Boeing (BA) in aviation, General Motors (GM) for autos, and regional lender KeyCorp (KEY) among stocks it expects to outperform in the new year. Yahoo Finance's Brian Sozzi and Brad Smith analyze Citi's forecasts, providing insights into how the stocks have been performing throughout 2023. For more expert insight and the latest market action, click here to watch this full episode of Yahoo Finance Live. |

KeyCorp Chairman & CEO Chris Gorman Honored With Annual Humanitarian AwardNORTHAMPTON, MA / ACCESSWIRE / December 26, 2023 / KeyBank Award recognizes individuals who have left lasting legacies of diversity, equity, and inclusion in their communities The Diversity Center of Northeast Ohio recently honored KeyCorp Chairman ... |

The one-year earnings decline is not helping KeyCorp's (NYSE:KEY share price, as stock falls another 3.3% in past weekKeyCorp ( NYSE:KEY ) shareholders will doubtless be very grateful to see the share price up 35% in the last quarter... |

KEY Price Returns

| 1-mo | 21.66% |

| 3-mo | 13.58% |

| 6-mo | 15.48% |

| 1-year | 43.27% |

| 3-year | -0.91% |

| 5-year | 13.58% |

| YTD | 17.64% |

| 2023 | -11.53% |

| 2022 | -21.69% |

| 2021 | 45.92% |

| 2020 | -14.50% |

| 2019 | 42.72% |

KEY Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching KEY

Want to see what other sources are saying about Keycorp's financials and stock price? Try the links below:Keycorp (KEY) Stock Price | Nasdaq

Keycorp (KEY) Stock Quote, History and News - Yahoo Finance

Keycorp (KEY) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...