Marrone Bio Innovations Inc. (MBII - Get Rating) is a Davis, California-based provider of pest management and plant health products. The company promotes its product line as “effective and environmentally responsible,” with ingredients consisting of naturally-occurring substances including bacteria, microbes, fatty acids, plant extracts and pheromones. The company’s product portfolio includes more than 400 issued and pending patents.

Some investors group MBII with cannabis stocks because several of its products are marketed to fight fungicide on cannabis and hemp crops. In July 2018, the California Department of Pesticide Regulation approved MBII’s Grandevo CG and Regalia CG products for use on the state’s cannabis crops. In April 2019, the company received label approval from Canada’s Pest Management Regulatory Agency, which cleared its Regalia Maxx product for use on that country’s cannabis harvests.

Here’s how our proprietary POWR Ratings system evaluates MBII:

Trade Grade: A

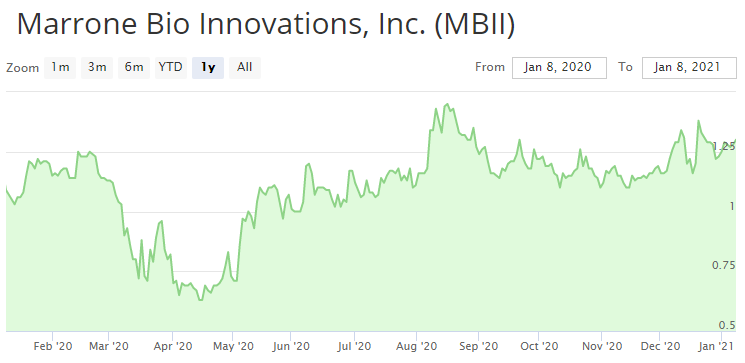

MBII is currently trading at $1.29, which is closer to its 52-week high of $1.50 than its 52-week low of $0.61.

The company, which was founded in 2006, raised $57 million its initial public offering in August 2013 and hit the NASDAQ at $13.75 per share – clearly, the situation is very different today.

Last April, MBII received a notice for a potential delisting because its NASDAQ stock was trading below $1.00 per share for 30 consecutive business days. The company righted itself within two months, but the incident left an embarrassing residue that continues to impact the next grade on our list.

Buy & Hold Grade: B

The stock’s proximity to its 52-week high is a key factor that our Buy & Hold Grade considers. MBII bounced back from its delisting woes by hitting its 52-week high on Aug. 11, the day after its Q2 earnings report came out. And while it might seem to be plodding along instead of soaring, at least it appears not to be in immediate danger of sinking.

MBII’s Q3 earnings report was something of a mixed bag. The company reported $8.8 million in revenues, a 27% uptick from the $7 million one year earlier, and its $5 million profit was a $40% spike from the $3.6 million from the previous year. But MBII’s net income (loss) was $6.1 million and its Adjusted EBITDA was a loss of $3.6 million.

Nonetheless, CEO Kevin Helash accentuated the positive in announcing the Q3 results, stressing that “the second half of the year is typically a smaller period for us in terms of revenue” while forecasting better fortunes ahead.

“While we anticipate that our 2020 full-year revenues will be in the range of our historical growth rate, we continue to believe that our sales mix will continue on the historical trend of being stronger in the first half of the year than the second, and will continue to do so as we move forward,” he said.

Peer Grade: D

MBII is ranked #49 out of 91 stocks in the Chemicals category. As a relatively smaller company compared to the category’s leaders, MBII is not yet in the financial position to muscle its way up the rankings.

Industry Rank: B

The Chemicals category ranks #33 out of 123 stock categories and has a POWR Ratings average of “B.”

Overall POWR Rating: B

Despite recent problems, MBII’s POWR Ratings component grades add up to a “Buy” recommendation.

Bottom Line

The company is cognizant of its problems and is pursuing stronger results. In a recent letter to shareholders, Helash said he was working on that situation, admitting that while “revenues and gross profit are growing at a faster rate than operating expenses, there is room for improvement. Our team has been revisiting all aspects of the business to identify the areas that deserve investment because they drive growth with considerable returns.”

We are optimistic that Helash will succeed in his goals and therefore we believe that MBII is a stock worth putting on your watchlist in 2021.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

Should Investors Beware January 6?

7 Best ETFs for the NEXT Bull Market

MBII shares were trading at $1.30 per share on Friday morning, up $0.02 (+1.56%). Year-to-date, MBII has gained 4.00%, versus a 1.54% rise in the benchmark S&P 500 index during the same period.

About the Author: Phil Hall

Phil is an experienced financial journalist responsible for generating original content on the weekly Fairfield County Business Journal and Westchester County Business Journal, plus their respective daily online news sites, podcasts and video interview series. He is the winner of 2018, 2019 and 2020 Connecticut Press Club Awards and 2019 and 2020 Connecticut Society of Professional Journalists Award for editorial output. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| MBII | Get Rating | Get Rating | Get Rating |