POWR Options just closed out a bearish put position in MicroStrategy (MSTR) Wednesday for a $30 gain, or a little over 6% in the 9 days we held the trade.

While this might seem like just a small profit (which it was), the fact that it was not a substantial loss is a testament to the use of options in place of stock to take a shorter-term directional stance.

The MSTR bearish purchase was initially recommended on Monday, November 11. POWR Options chose the December $200 puts which were trading just under $5.00 at the time. The actual alert is shown below:

Action To Take

- Buy to open MSTR 12/20/2024 $200 puts for $4.90 w/.10 discretion

Each option will cost roughly $490 per contract

A look at the chart below shows the entry and exit days of the trade highlighted along with the corresponding IV chart (which is general in nature).

Our close out alert from November 20 is shown below:

Close out

- Sell to close MSTR 12/20/2024 $200 puts for $5.20 w/.10 discretion

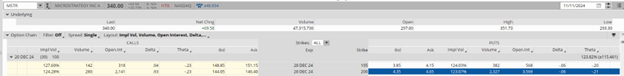

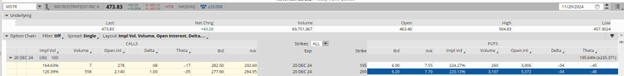

A comparative look at the December $200 puts from November 11 (entry) and November 20 (exit) will help shed some light.

On 11/11/24 MSTR stock closed at $340. December $200 puts closed at about $4.50. Implied volatility was roughly 123. The puts had a delta of -.06 meaning you would expect the put price to lose 6 cents for a one-point rise in MSTR stock. The theta was negative 21 so each day that passes you would expect the option to drop 21 cents as a function of time decay.

On 11/20/24 MSTR stock closed at $473.83-or a gain of nearly 134 points (just under 40%) in that 9-day period. One would have certainly expected the price of these bearish puts to drop sharply given the massive rally in the share price along with 9 days of time decay.

Instead, we were able to exit the trade for a small gain. How is that even possible?

Two words-Implied Volatility.

The implied volatility (IV) of the December $200 puts was around 120 at trade inception. IV rocketed to just over 220 when we closed out the trade.

Increases in implied volatility cause option prices to rise. Huge increases in IV such as the one we are witnessing in MSTR options cause option prices to go ballistic.

Eventually MSTR IV will revert to a much lower level-another reason to exit the trade for a small gain now.

Shorting MSTR stock would have resulted in a large 40% loss in 9 days. Buying bearish puts in MSTR puts ended up being a small winner.

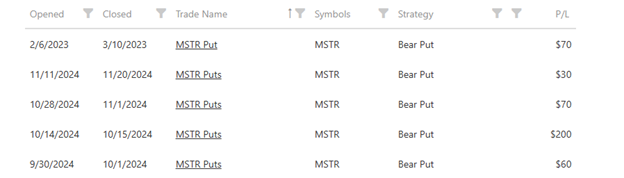

In fact, all our most recent trades in MSTR bearish put options have been winners as seen in the table below:

Note that the holding period on the trades is usually just a few days. The initial outlay is right around $500 on average.

Certainly not all trades will end up being profitable. Trading is all about probability and not certainty.

But traders looking for a way to have a low cost and defined risk way to play the market should give POWR Options a look.

POWR Options

What To Do Next?

If you’re looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

Want More Great Investing Ideas?

MSTR shares . Year-to-date, MSTR has gained 650.18%, versus a 25.41% rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| MSTR | Get Rating | Get Rating | Get Rating |