Micron Technology, Inc. engages in the provision of innovative memory and storage solutions. It operates through the following segments: Compute and Networking Business Unit; Mobile Business Unit; Storage Business Unit; and Embedded Business Unit.

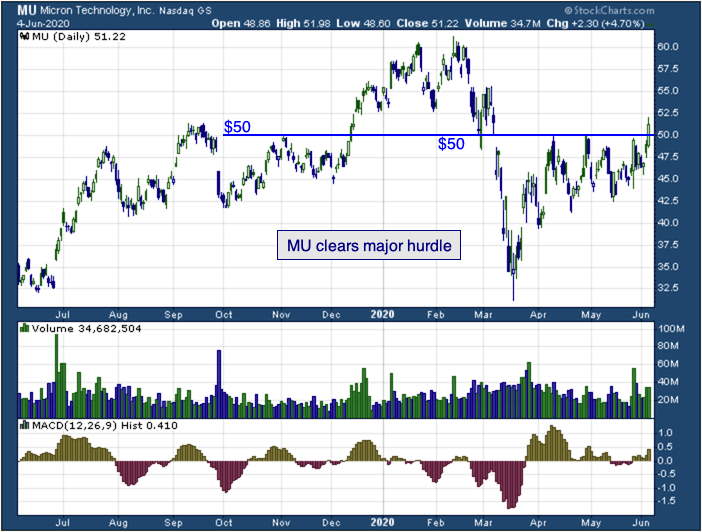

Take a look at the 1-year chart of Micron (MU - Get Rating) below with the added notations:

Over the course of the past 7 months, MU has formed an important level to watch at the $50 (blue) mark. That level was resistance back in November, brief support at the end of February, and then it became resistance again in April and May. MU just broke back above $50 yesterday, which could mean another support bounce is coming.

The Tale of the Tape: MU has a key level at $50. A trader could enter a long position on a pullback down to that level with a stop placed under it. However, if traders are bearish on the stock, a short trade could be made on a break back below the $50 mark.

Before making any trading decision, decide which side of the trade you believe gives you the highest probability of success. Do you prefer the short side of the market, long side, or do you want to be in the market at all? If you haven’t thought about it, review the overall indices themselves. For example, take a look at the S&P 500. Is it trending higher or lower? Has it recently broken through a key resistance or support level? Making these decisions ahead of time will help you decide which side of the trade you believe gives you the best opportunities.

No matter what your strategy or when you decide to enter, always remember to use protective stops and you’ll be around for the next trade. Capital preservation is always key!

Good luck!

Christian Tharp, CMT

Want More Great Investing Ideas?

9 “BUY THE DIP” Growth Stocks for 2020

Bull Market or Bull S#*t? How to trade today’s stock market bubble and prepare for the return of the bear market.

7 “Safe-Haven” Dividend Stocks for Turbulent Times

MU shares were trading at $53.51 per share on Friday morning, up $2.29 (+4.47%). Year-to-date, MU has declined -0.50%, versus a -0.55% rise in the benchmark S&P 500 index during the same period.

About the Author: christian

Christian is an expert stock market coach at the Adam Mesh Trading Group who has mentored more than 4,000 traders and investors. He is a professional technical analyst that is a certified Chartered Market Technician (CMT), which is a designation awarded by the CMT Association. Christian is also the author of the daily online newsletter Todays Big Stock. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| MU | Get Rating | Get Rating | Get Rating |