Arjun Murthi’s latest piece is a must-read, thought-provoking piece that investors may wish to consider regarding the future of energy – which in turn will impact every other investment market. One particular quote from the piece stands out:

There will be growing recognition in 2023 that a 100% EV future is a pipe dream, no matter how many decades in the future one looks.

If Murthi is correct, what does this mean for electric vehicle (EV) stocks? In this article, we’ll take a look at two of the foremost EV stocks: Tesla (TSLA) and Rivian (RIVN).

Tesla and Rivian: Vertically Integrated EV Companies

As most know, Tesla is a publicly traded company that designs, manufactures, and sells electric cars and other electric vehicles. It is one of the most popular stocks in the US, and its share price has seen huge gains in recent years. TSLA stock is an opportunity for investors who wish to get into the growing technologies revolving around electric vehicles and the potential impact they have on the automotive industry and beyond, as well as those who wish to have a position in mega cap stocks with momentum potential.

Rivian takes a page out of the Tesla’s book and covers a multitude of areas in-house, such as designing, building, financing, and selling its electric trucks and SUVs through its own dealerships. Additionally, they are collaborating with major insurers to provide their own special auto insurance coverage. By consolidating all these activities and having them under one roof, Rivian could potentially realize greater profits.

In sum, both Tesla and Rivian are vertically integrated EV companies. The similarities of their industries and their operating methods may make them highly correlated in the long-run.

Tesla vs Rivian: Revenue Examined

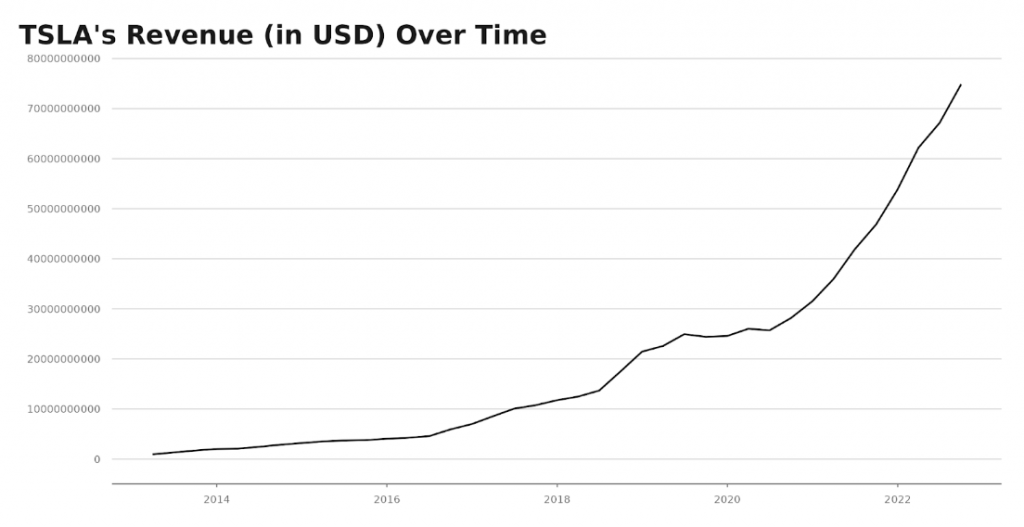

The biggest difference between TSLA and RIVN is that Rivian is much younger; its IPO was in 2021, while TSLA had its initial public offering back in 2010. As a result, Tesla is much larger, and has had much more time to grow its revenue; the company’s revenue has been steadily growing since 2013, with the latest reported figures indicating an impressive 7.48 billion USD in trailing twelve month revenue. Over the past nine years, TSLA’s revenue has grown threefold. The chart of TSLA’s revenue (in USD) over time illustrates.

As Rivian only IPO’d in late 2021, a direct comparison is not quite possible. Still, though, it is worth noting that RIVN crossed the $1 billion threshold in trailing twelve month revenue in its September 2022 SEC filing – an impressive jump from the $55 million in revenue recorded in all of 2021.

Momentum is Clearly Bearish

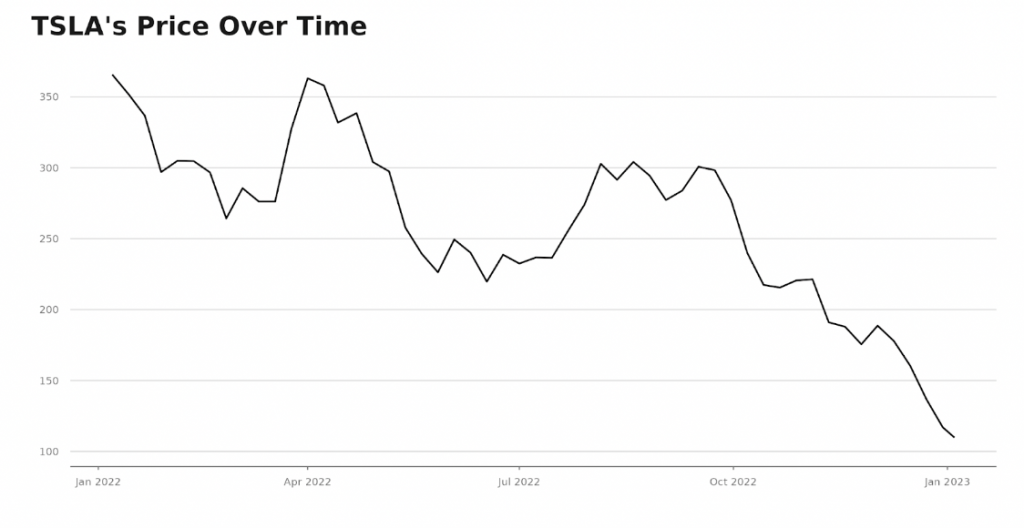

While the revenue numbers are impressive, the trend in the share price of TSLA over the past year is clearly bearish. The share price started last year (2022) near $365 and has steadily decreased until its current price of near $110 – a steady, uniform decline of nearly 70%. The price chart of TSLA illustrates.

Rivian has a similar story, going from around $91 to near $17 in the past year – a decline of nearly 80%.

Is it Time to Buy?

With prices so low and sentiment so bearish, it may be worth asking if it is time to buy. And indeed, contrarians are likely intrigued by this idea. However, it’s worth noting that price has not not shown any signs of bottoming, so momentum/price action traders may wish to wait for evidence that price has found its bottom before going long.

Want More Great Investing Ideas?

shares fell $2.36 (-0.61%) in premarket trading Thursday. Year-to-date, has declined -0.16%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Simit Patel

Simit Patel has 2 decades of investing experience applying a top-down approach starting with macroeconomics followed by price action technical analysis to find more winning trades. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| Get Rating | Get Rating | Get Rating | |

| Get Rating | Get Rating | Get Rating |