Nuvve Holding Corp. (NVVE - Get Rating) and Blink Charging Co. (BLNK - Get Rating) are two US based electric vehicle charging (EV) stocks. Recently both stocks have experienced steep declines, similar to many other stocks within the EV industry.

This pullback could offer buying opportunities to investors looking to add EV stocks to their portfolio. That’s why we’re going to take a look at both these stocks today to see which is the better buy right now.

Nuvve Holding Corp. (NVVE):

NVVE is a green energy technology company deploying innovative solutions for electric vehicles and grid infrastructure. The company provides commercial bi-directional vehicle-to-grid (V2G) services, allowing EV batteries to store energy when prices a low and resell unused electricity back to grid operators, when demand is high.

The customers of NVVE are essentially EV fleets and deliver all the services required to optimize and reduce the cost of EV ownership while supporting the integration of renewable energy sources. It generates revenue from bidding on energy markets and creates energy savings for its customers.

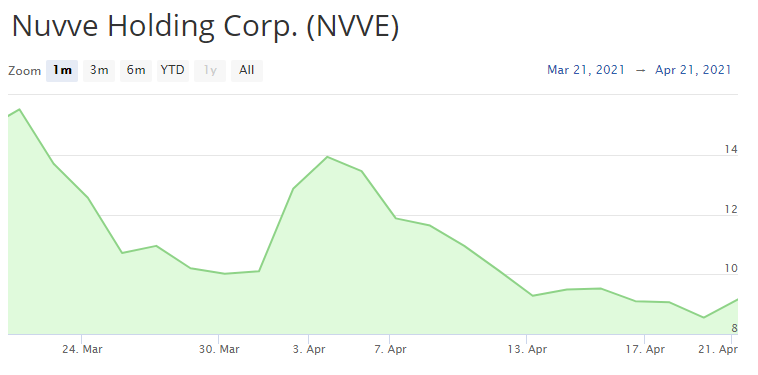

After NVVE began being traded publicly via a SPAC with Newborn Acquisition Corp. (NBACU) in the beginning of April 2021, its stock price plunged about 40% and is currently trading at about $9 per share.

NVVE’s forward guidance looks extravagant at first sight. Though the company plans to boost its revenue fivefold in 2021 to $32 million and to triple it in 2022 to $93 million, it’s current market cap is $182 million.

Nevertheless, the company is leading the V2G market and there is room to grow in this market that is expected to grow to $17 billion by 2027, according to industry analysts. With its proprietary technology, key patents and established position in global markets, NVVE’s provides a different solution to benefit from the transition to greener energy.

However, compared to its peers NVVE currently looks undervalued. The company has a robust 2020 – 2022E revenue CAGR of 312%, one of the highest in the industry, and NVVE’s 2021e P/S is very cheap, with a ratio of only 10.7x.

Blink (BLNK):

BLNK is a pure player in the EV charging sector. The company operates, owns, designs, and manufactures charging equipment and provides EV-related services for commercial and residential customers. The stock dropped 17% to about $35.50 per share year-to-date, attaining a market capitalization of $1.44 billion.

The company deployed over 23,000 charging stations worldwide, with nearly half on the Blink Network, representing a market share of nearly 10% in the U.S. However, these stations are based on a revenue-sharing model, implying that the company has to monetize energy sales to recoup upfront installation costs. Yet, this solution is less attractive for customers, making charging prices relatively high compared to peers.

In 2020, BLNK lifted product sales in the 4Q2020 by 227% quarter-on-quarter to $1.8 million. Nevertheless, BLNK is still cash flow negative and it had just $22.3 million cash on hand at the end of December 2020. Building new charging stations is cash intensive and the company is fueling its expansion through public offerings, which is dilutive for existing shareholders.

In terms of valuation, BLNK trades at a huge premium compared to NVVE, with a 2021e P/S ratio of 126x.

Conclusion

While BLNK is more mature than NVVE, the latter seems to have more potential in the long-term, given its undervalued metrics. Furthermore, NVVE is one of the leaders of the V2G market and with its global footprint, the company provides a geographical diversification that will enable it to better cope with any slowdown in the US EV market.

NVVE shares were unchanged in premarket trading Thursday. Year-to-date, NVVE has declined -46.81%, versus a 11.65% rise in the benchmark S&P 500 index during the same period.

About the Author: Cristian Docan

Cristian is an experienced investment analyst and financial writer. Prior to StockNews.com, Cristian spent three years as a consultant providing investment research and content to financial services companies and online publications on the Oil & Gas sector. Cristian enjoys researching and writing about stocks and the markets. He takes a fundamental, technical and quantitative approach in evaluating stocks for readers. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| NVVE | Get Rating | Get Rating | Get Rating |

| BLNK | Get Rating | Get Rating | Get Rating |