Blink Charging Co. (BLNK): Price and Financial Metrics

BLNK Price/Volume Stats

| Current price | $3.41 | 52-week high | $7.25 |

| Prev. close | $3.26 | 52-week low | $2.18 |

| Day low | $3.25 | Volume | 2,567,580 |

| Day high | $3.44 | Avg. volume | 6,123,264 |

| 50-day MA | $3.10 | Dividend yield | N/A |

| 200-day MA | $2.95 | Market Cap | 344.61M |

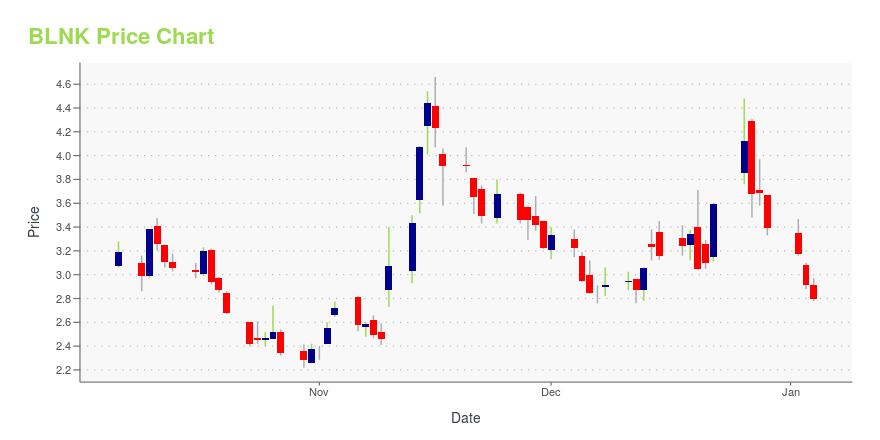

BLNK Stock Price Chart Interactive Chart >

Blink Charging Co. (BLNK) Company Bio

Blink Charging Co. engages in the operation and provision of electric vehicle, charging equipment, and networked EV charging services. Its product line and services include Blink EV charging network, charging equipment, also known as electric vehicle supply equipment, and EV charging services. The company was founded by Michael D. Farkas on October 3, 2006 and is headquartered in Hollywood, FL.

Latest BLNK News From Around the Web

Below are the latest news stories about BLINK CHARGING CO that investors may wish to consider to help them evaluate BLNK as an investment opportunity.

Reality Check: AI Predicts These 3 Stocks Can 10x in 5 Years. Here’s Why They Won’t.Investors shouldn't blindly use AI stock predictions because it is not infallible and can miss important facts about a business. |

Electric Avenue: 3 EV Stocks to Watch for Max Growth in 2024These are the EV stocks to watch as they represent companies that are poised for healthy growth and value creation. |

AI Predictions: 3 Penny Stocks That Google Gemini Says Will Surge by 1,000% Next YearGoogle's newest and best AI 'Gemini' spotlights three penny stocks with explosive growth potential next year. |

7 Electric Vehicle Stocks Worth Holding Until 2030These are the electric vehicle stocks to buy and hold until 2030 as they represent companies where growth is backed by innovation. |

Investors Sour on EV Charging CompaniesEV charging companies have fallen from lofty valuations amid concerns mount about their profitability. |

BLNK Price Returns

| 1-mo | 26.77% |

| 3-mo | 40.91% |

| 6-mo | 38.06% |

| 1-year | -41.81% |

| 3-year | -89.65% |

| 5-year | 28.20% |

| YTD | 0.59% |

| 2023 | -69.10% |

| 2022 | -58.62% |

| 2021 | -37.99% |

| 2020 | 2,198.39% |

| 2019 | 8.14% |

Continue Researching BLNK

Want to do more research on Blink Charging Co's stock and its price? Try the links below:Blink Charging Co (BLNK) Stock Price | Nasdaq

Blink Charging Co (BLNK) Stock Quote, History and News - Yahoo Finance

Blink Charging Co (BLNK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...