- Base metals prices surge

- The producers are making huge profits—PICK holds the leaders

- More than a triple over the past year

- Copper is the leader of the pack—Goldman Sachs sees the price 50% higher by 2025

- Bull markets rarely move in a straight line—Buy on weakness

In March 2020, copper fell to a low of $2.0595 per pound, the lowest price since June 2016. The red metal fell as the global pandemic spread worldwide, causing businesses to grind to a halt and all asset prices to plunge.

From April 2020 through May 2021, copper has made a remarkable recovery, as the price of nearby COMEX futures rose in 12 of the past 14 months. Furthermore, the red metal that is a building block of infrastructure, a critical component in green technology and many semiconductors and a bellwether commodity for the global economy hit an all-time high on Friday, May 7. The price surpassed the 2011 all-time peak on COME futures at $4.6495 per pound.

Copper is the leader of the base metals that trade on the world’s leading nonferrous metals forward market, the London Metals Exchange. Aluminum, nickel, lead, zinc, and tin prices have also rocketed higher, following copper’s lead.

The companies that extract the ores and metals from the earth’s crust are experiencing an earning boom not seen since 2011. The iShares MSCI Global Metals & Mining Producers ETF product (PICK - Get Rating) holds shares of the world’s top base metals producers. PICK has risen to the highest price level since 2012. The trend remains bullish, and the trend in markets is always your best friend.

Base metals prices surge

Nonferrous metals are critical inputs for industry and infrastructure building. As central banks inject massive levels of liquidity into the world’s financial system and governments stimulate economic growth in the aftermath of the global pandemic, inflationary pressures are rising.

We have witnessed an almost perfect bullish storm in the base metal sector as monetary and fiscal policies and increasing demand have lit a bullish fuse under the metals. Nearby COMEX copper futures closed at the $3.52 per pound level at the end of 2020. On May 7, they made a new all-time high.

Source: CQG

As the chart highlights, COMEX copper futures traded to a high of $4.8985, surpassing the 2011 $4.6495 peak earlier this month.

Copper is the leader of the base metals that trade in the forward market on the London Metals Exchange.

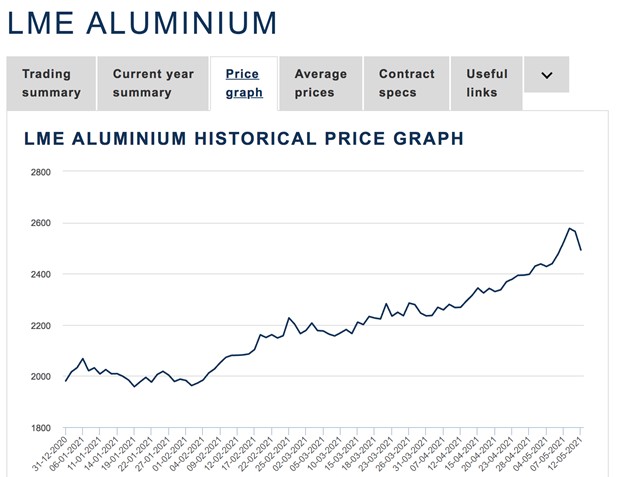

Source: LME

Three-month LME aluminum prices moved from $1,980.50 per ton on December 31, 2020, and advanced to $2,577 on May 10, a 30.1% in 2021 at the most recent high.

Source: LME

Zinc forwards for three-month delivery on the LME rose from $2,745.00 to $3,052.50 per ton this month or 11.2% since the end of 2020.

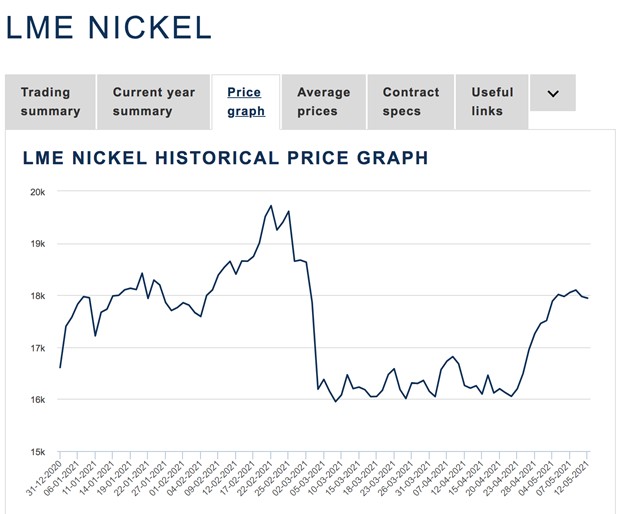

Source: LME

Nickel forwards rallied from $16,607 to $17,942 per ton on May 12 or 8.0% since the end of last year. Nickel hit a high of $19,722 in late February, 18.8% above the December 31 closing level.

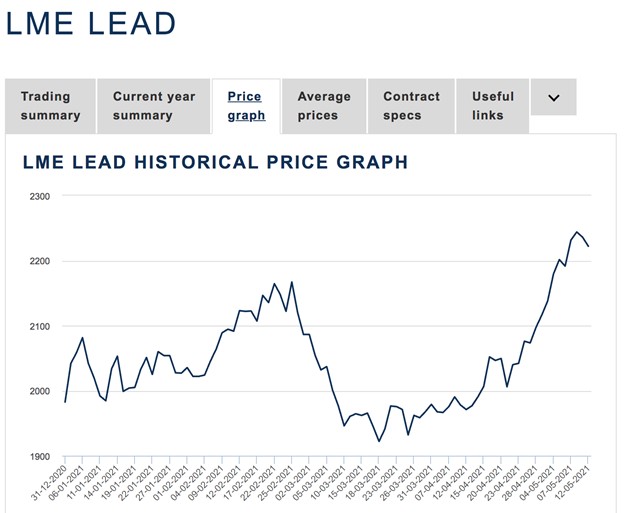

Source: LME

Over the same period, three-month LME lead metal prices increased from $1,982.50 to $2,244 per ton on May 10 or 13.2%.

Source: LME

LME tin exploded from $20,290 on December 31 to $30,325 per ton or 49.5% on May 6.

Source: Barchart

Meanwhile, iron ore, the primary ingredient in steel, moved from $158.15 at the end of 2020 to $218.38 per ton as of May 13, a 38.1% increase.

The producers are making huge profits—PICK holds the leaders

While input prices are rising along with base metals prices, producers are cashing in on the rally in the commodities they extract from the earth’s crust. The iShares MSCI Global Metals & Mining Producers ETF product (PICK) holds a diversified portfolio of the world’s top industrial metal producing companies. The portfolio approach mitigates the idiosyncratic risks of management and specific mining properties in countries worldwide. PICK’s most recent top holding and fund summary include:

Source: Yahoo Finance

PICK has $1.373 billion in assets under management, trades an average of 549,473 shares each day, and charges a 0.39% management fee.

Mining companies often outperform the commodities they produce on the upside, offering investors leverage.

More than a triple over the past year

The PICK ETF has exploded higher since the March 2020 lows.

Source: Barchart

As the chart highlights, PICK moved from a low of $16.01 in March 2020 to $52.39 on May 10, more than three times the price at the low. PICK closed at $36.85 at the end of 2020 and was 42.2% higher at the most recent high.

Copper is the leader of the pack—Goldman Sachs sees the price 50% higher by 2025

Copper remains the leader of the industrial metals pack. Goldman Sachs recently called copper “the new crude oil.” Goldman’s price target is $11,000 per ton over the coming twelve months.

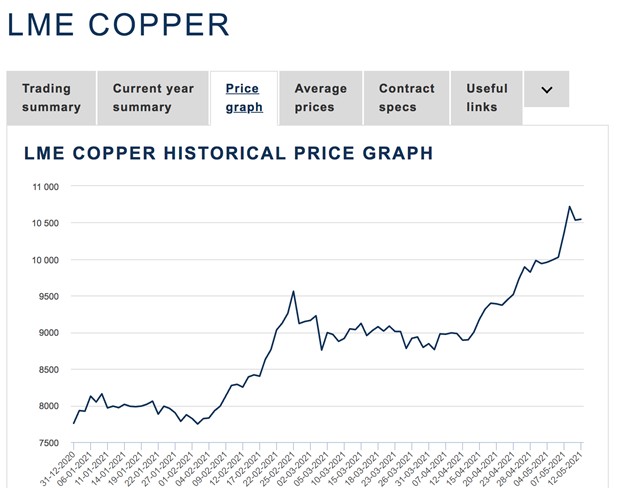

Source: LME

The chart shows that LME three-month copper forwards were recently trading at $10,720 per ton after closing 2020 at $7,757. Even though copper rallied over 38% at the most recent high on May 10, Goldman expects the price to reach at least $14,000 per ton by 2025, and other analysts are forecasting even higher price levels for the base metal.

Bull markets rarely move in a straight line–Buy on weakness

Bull markets tend to move far beyond levels that even the most aggressive analysts believe possible. Commodities can be highly volatile assets, which makes forecasting market bottoms or tops a challenge. The risk of price corrections rises with prices, and bull market selloffs can appear out of the blue and are often brutal.

Rising inflationary pressures on the back of central bank liquidity and government stimulus, a falling US dollar, increasing demand for worldwide infrastructure building, green technology, and other industrial applications create an almost perfect bullish storm for the ferrous and nonferrous metals. The producing companies are looking to increase output to meet the growing demand and fill their pockets with profits.

The trend is always your best friend in markets. The bull market in metals is firmly in place and could continue over the coming months and years. Buying on price weakness will likely be the optimal approach for investors and traders. The PICK ETF continues to be a “pick-and-shovel” play in the metals arena as it holds a portfolio of growth stocks for the coming years. As of the end of last week, PICK paid shareholders an 84.0 cents per share or 1.73% annual dividend at $48.50 per share. The yield on the stock pays for the 0.39% management fee in a little under three months.

Want More Great Investing Ideas?

PICK shares were trading at $47.87 per share on Friday afternoon, down $0.47 (-0.97%). Year-to-date, PICK has gained 29.91%, versus a 11.74% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| PICK | Get Rating | Get Rating | Get Rating |