- A US works project could provide the New Deal of the roaring 2020s

- Raw materials are critical construction building blocks

- A diversified approach is always best

- The PICK ETF offers exposure to the companies that extract commodities from the earth’s crust

Metals, minerals, and other industrial commodities are the building blocks of infrastructure. A house, building, road, bridge, tunnel, airport, or any other part of the infrastructure that provides shelter and utility for people worldwide contains the raw construction materials.

In 2020, the technology sector was the stock market’s growth area. Very often, the best performing sector during one period takes a backseat to another the next. At the beginning of 2021, investors and traders looking for the next booming area should put industrial commodities on their radar.

China is the world’s leading commodities consumer. With approximately 1.4 billion people and the world’s second-leading economy, the demand for infrastructure continues to grow each year. The world’s leading economy, the United States, will soon emerge from the global pandemic. The US leads the world with infections and COVID-19 fatalities. Unemployment levels are at high levels.

The Federal Reserve and the US government have pulled out all the stops to stabilize economic conditions via monetary and fiscal stimulus. When vaccines achieve herd immunity, it will be time for many to return to work. The construction sector is one of the prime candidates for new jobs over the coming months and years.

The iShares MSCI Global Metals & Mining Producers ETF product (PICK - Get Rating) holds a portfolio of the world’s leading industrial raw material producing companies.

A US works project could provide the New Deal of the roaring 2020s

The US economy will limp out of the global pandemic over the coming months if vaccines limit or erase the infection risks. Meanwhile, the financial costs on the federal and state levels are staggering. After the Great Depression in the 1930s, President Franklin Delano Roosevelt rolled out a New Deal with job-creating works projects.

The last upgrade to US infrastructure was in the 1950s when President Eisenhower built the interstate road system. In the 2020s, the world’s wealthiest nation’s infrastructure is in dire need of repairs and upgrades. The roads, bridges, tunnels, government and school buildings, airports are crumbling.

Politicians have been talking about an infrastructure rebuilding program for years, and there is bipartisan agreement on the issue. However, the legislators and administrations in Washington DC have not rolled out a plan. The post-pandemic economy could be the perfect time for the US government to agree and authorize the funds for the initiative that would put many unemployed people back to work.

Meanwhile, increased economic activity in the construction sector and other related industries services increase tax revenues when deficits are running rampant.

A commitment to rebuilding the US’s infrastructure could jumpstart the economy. It would also increase the demand for the commodities that are construction building blocks.

Raw materials are critical construction building blocks

Aside from labor, construction requires a host of raw materials. Metals, minerals, ores, lumber, and energy are the ingredients that will rebuild the United States. Meanwhile, we have already seen commodity prices move higher over the past months. This week, crude oil moved to the highest price since early 2020. Lumber is not far from a record high. Copper, steel, and other metal prices have been steadily rising for months.

China is the demand side of the fundamental equation for most commodities. Economic growth and infrastructure building have supported commodity prices. A US building program would only increase the demand.

Meanwhile, commodity prices are rising as fiat currency prices are falling. A tidal wave of central bank liquidity and a tsunami of trillion-dollar fiscal stimulus programs weigh on currency values. Deficits are rising, and inflationary pressures are mounting. Commodities could get a bullish double shot in the arm from inflationary pressures and a new demand vertical when the US begins rebuilding.

The future landscape for industrial commodities could become nothing short of a perfect bullish storm. The companies that extract commodities from the earth’s crust stand to be significant winners over the coming years as inflation and demand combine to push prices higher.

A diversified approach is always best

Successful investors rarely put all of their eggs in one basket. Even if a sector experiences a bullish renaissance, there is no guaranty that individual companies will participate. In the world of commodities, even the world’s leading producers carry idiosyncratic risks, including management, specific mining properties, and political risk in the countries that lease or grant rights to extract raw materials from within their borders.

Therefore, a diversified portfolio of mining companies offers the best chances of success. The iShares MSCI Global Metals & Mining Producers ETF product (PICK) is a product that provides diversified exposure to the leading global mining companies.

The PICK ETF offers exposure to the companies that extract commodities from the earth’s crust

PICK’s top holdings and fund summary include:

Source: Yahoo Finance

PICK has net assets of $538.9 million, trades an average of 297,080 shares each day, and charges a 0.39% expense ratio. PICK offers holders a blended dividend yield of 2.27%. The dividend yield covers the expense ratio for longer-term holders of the ETF in under three months.

Meanwhile, PICK posted a 23.95% gain in 2020.

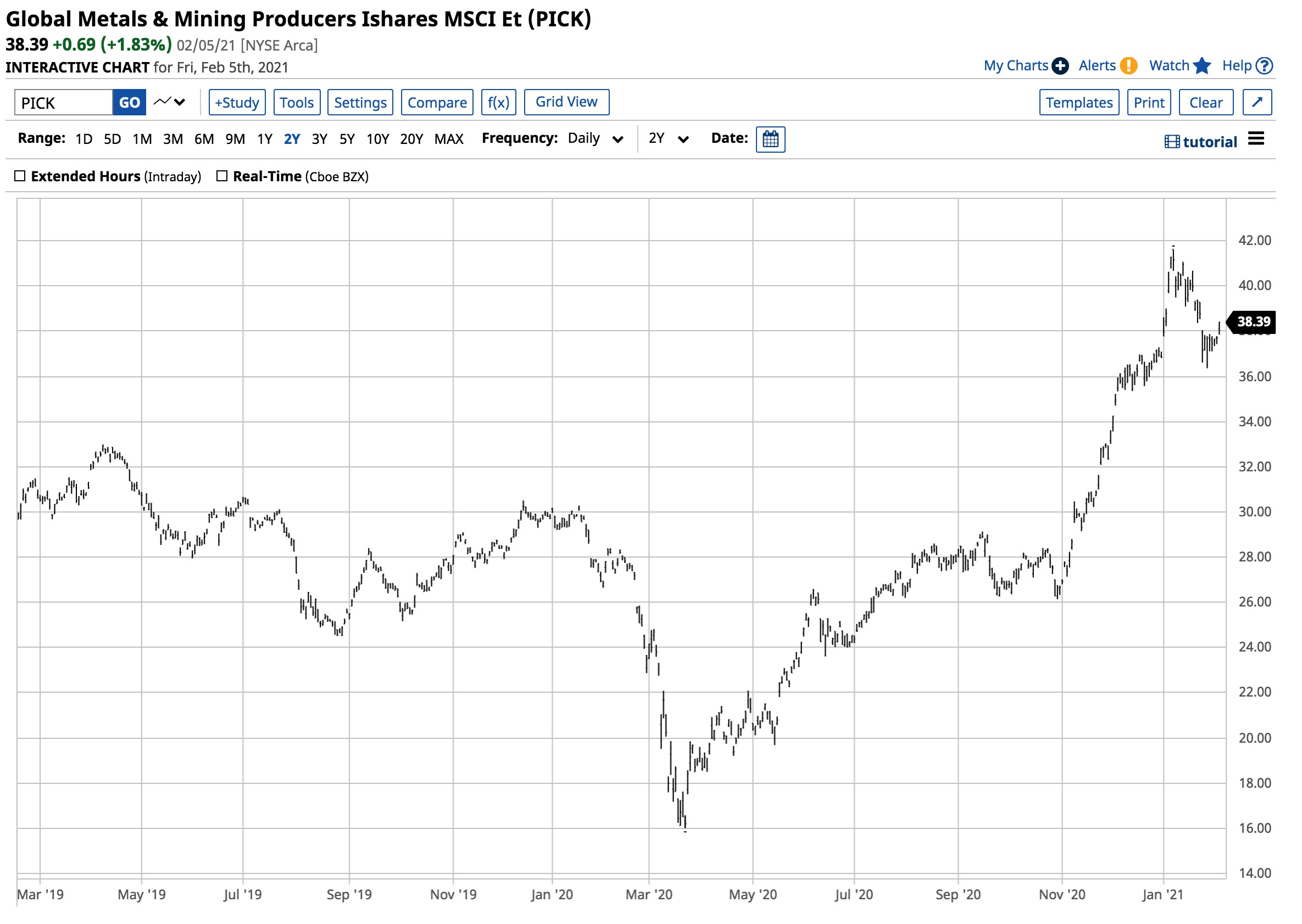

Source: Barchart

Source: Barchart

The chart shows that the ETF rose from $29.73 at the end of 2019 to $36.85 at the end of 2020. After trading to a high of $41.60 on January 8, PICK pulled back to $38.39 on February 5.

I view commodity producers as a growth sector for 2021. An infrastructure project in the US would only push an already bullish sector even higher. In 2012, PICK traded at a record high of $56 when the ETF began trading. I expect it to make a higher high over the coming months and years. Meanwhile, after covering the expense ratio, the dividend yield is attractive and is likely to rise with commodity prices as the leading producers deliver more earnings in an inflationary environment.

Commodities tend to do well when inflation rises. PICK holds the companies that dominate the industrial raw materials sector.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

February Stock Outlook & Trading Plan

7 Best ETFs for the NEXT Bull Market

5 WINNING Stocks Chart Patterns

PICK shares were trading at $39.35 per share on Monday morning, up $0.96 (+2.50%). Year-to-date, PICK has gained 6.78%, versus a 4.17% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| PICK | Get Rating | Get Rating | Get Rating |