Paypal is the victim of a recent cyberattack, resulting in the personal information of over 35,000 of its users having their names and social security numbers exposed. This scandal, coupled with the backlash the company has received for refusing (before overturning the decision) to process payments based on political views of certain groups of its customers, is tarnishing its brand. Any downturns in consumer spending, which may continue further into 2023, may hinder its revenue potential as well. In this article, we take a deeper look at Paypal’s revenue, profitablity, and balance sheet in comparison to its recent price action.

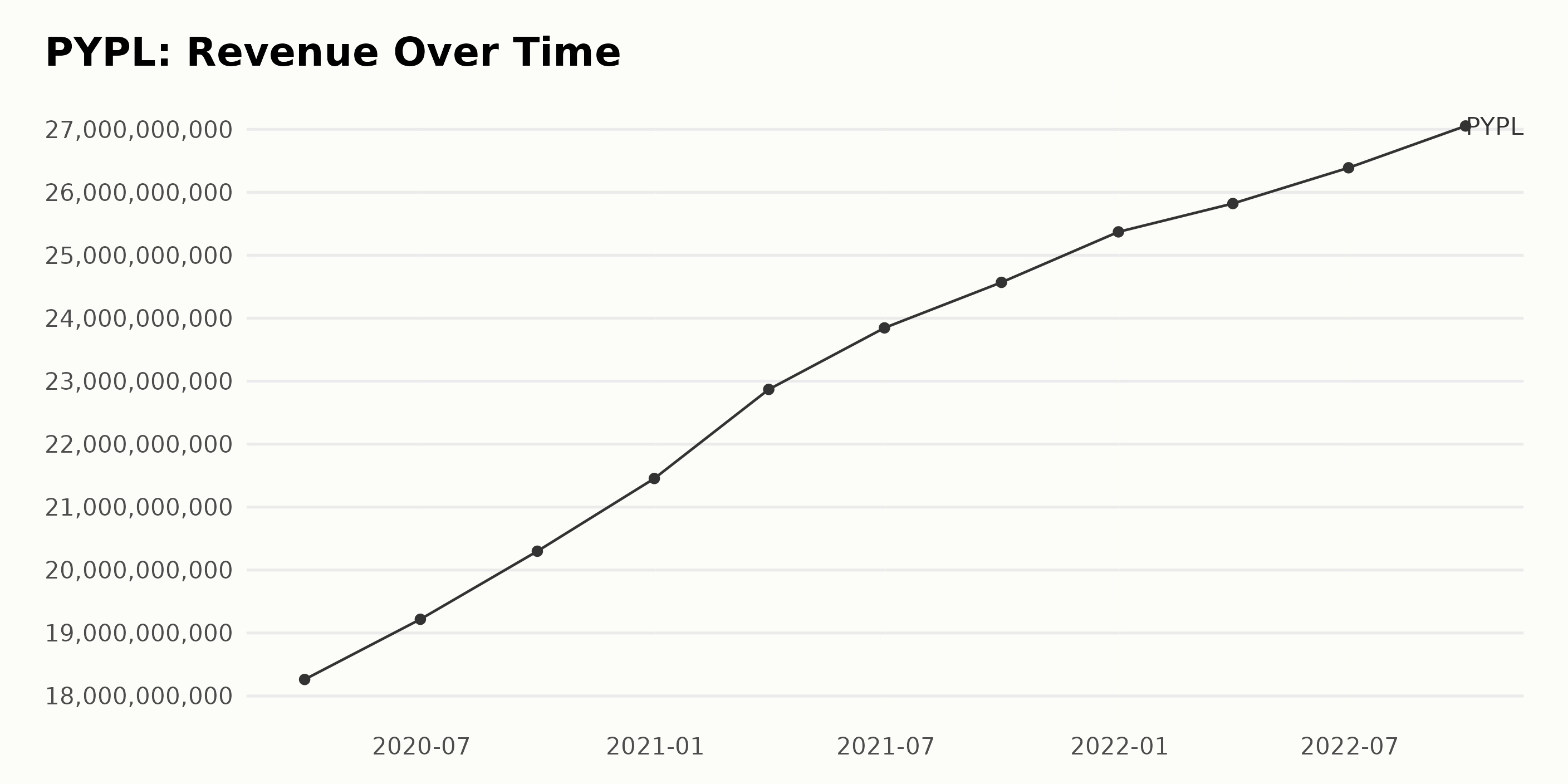

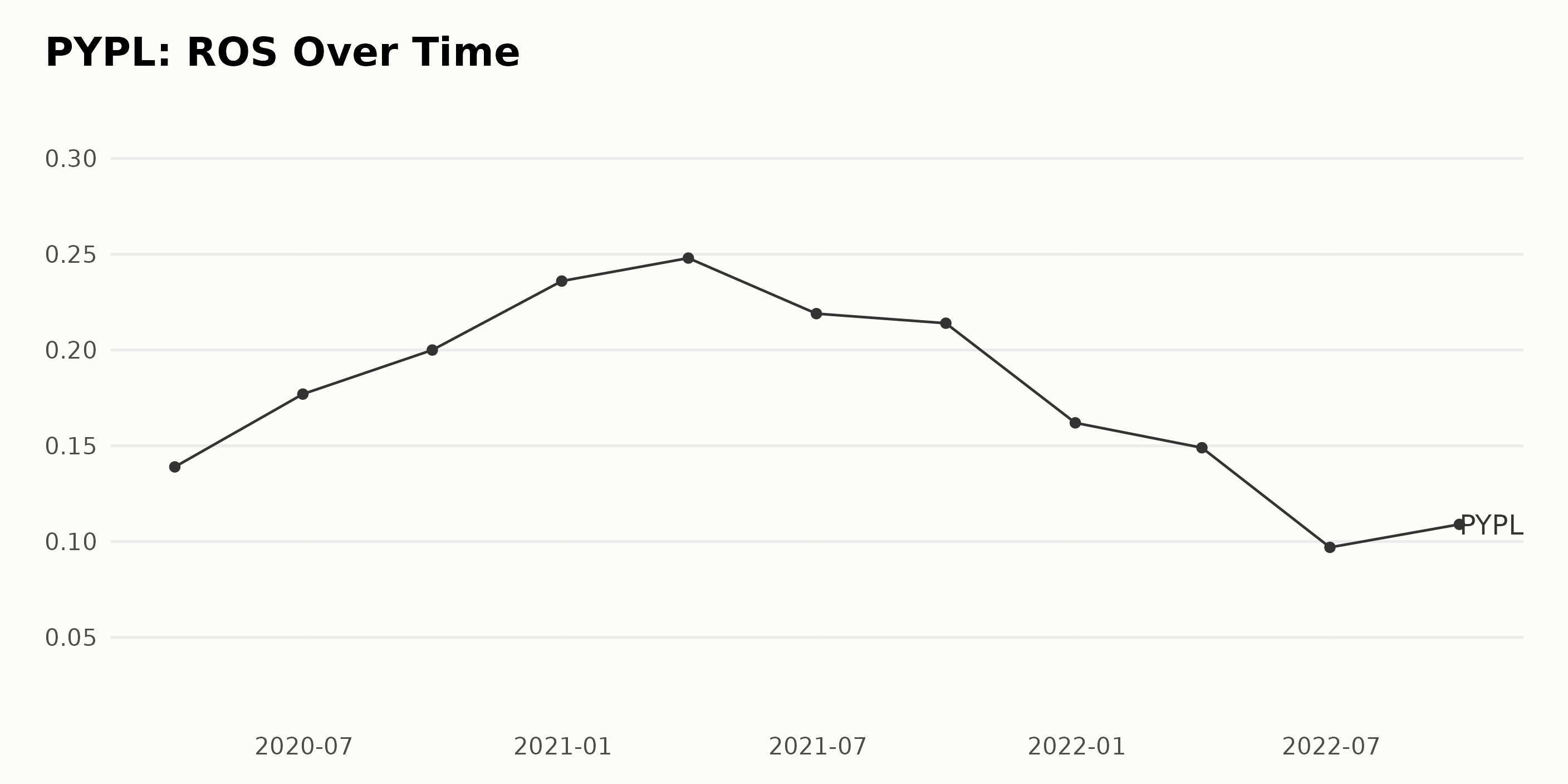

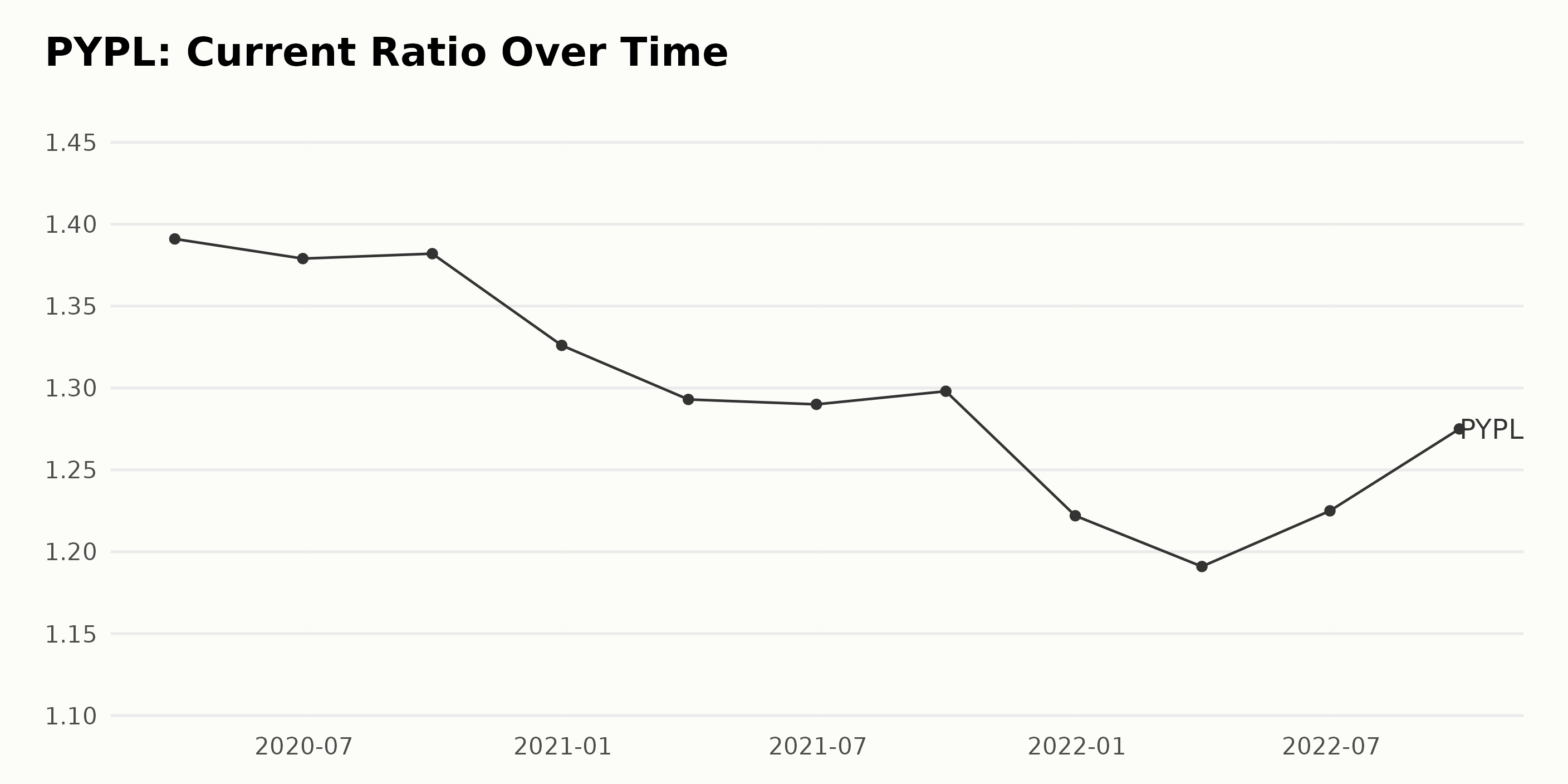

PYPL’s Revenue, Return on Sales (ROS), and Current Ratio from March 2020 to September 2022

PYPL’s Revenue has had a generally increasing trend, with fluctuations at certain times. From March 2020 to September 2022, the Revenue grew from 18.2 billion to 27.1 billion, an increase of nearly 50%. The largest jump was from March 2021 to June 2021, when revenue increased 8.6%. The most recent reported Revenue was 27.1 billion as of September 2022.

The return on sales (ROS) of PYPL has seen a generally downward trend with fluctuations over the past few years. The ROS started at 13.9% in March 2021, but fell to 10.9% in September 2022, a fall of 21.6%. There has been a slight increase in the final quarter of 2022 — it will be interesting to see if Paypal can make this a trend going forward, and prove its commitment to efficiency in doing so.

The Current Ratio of Paypal fluctuated over the nine quarters between March 2020 and September 2022. The first recorded ratio was 1.39, at the end of March 2020. It decreased to 1.22 in December 2021, before partially rebounding to 1.27 in September 2022, the last reported value. Overall, there has been a 5.2% decrease in the Current Ratio of PYPL since March 2020. In sum, Paypal’s short-term balance sheet remains sufficiently strong, and should not be an area of concern.

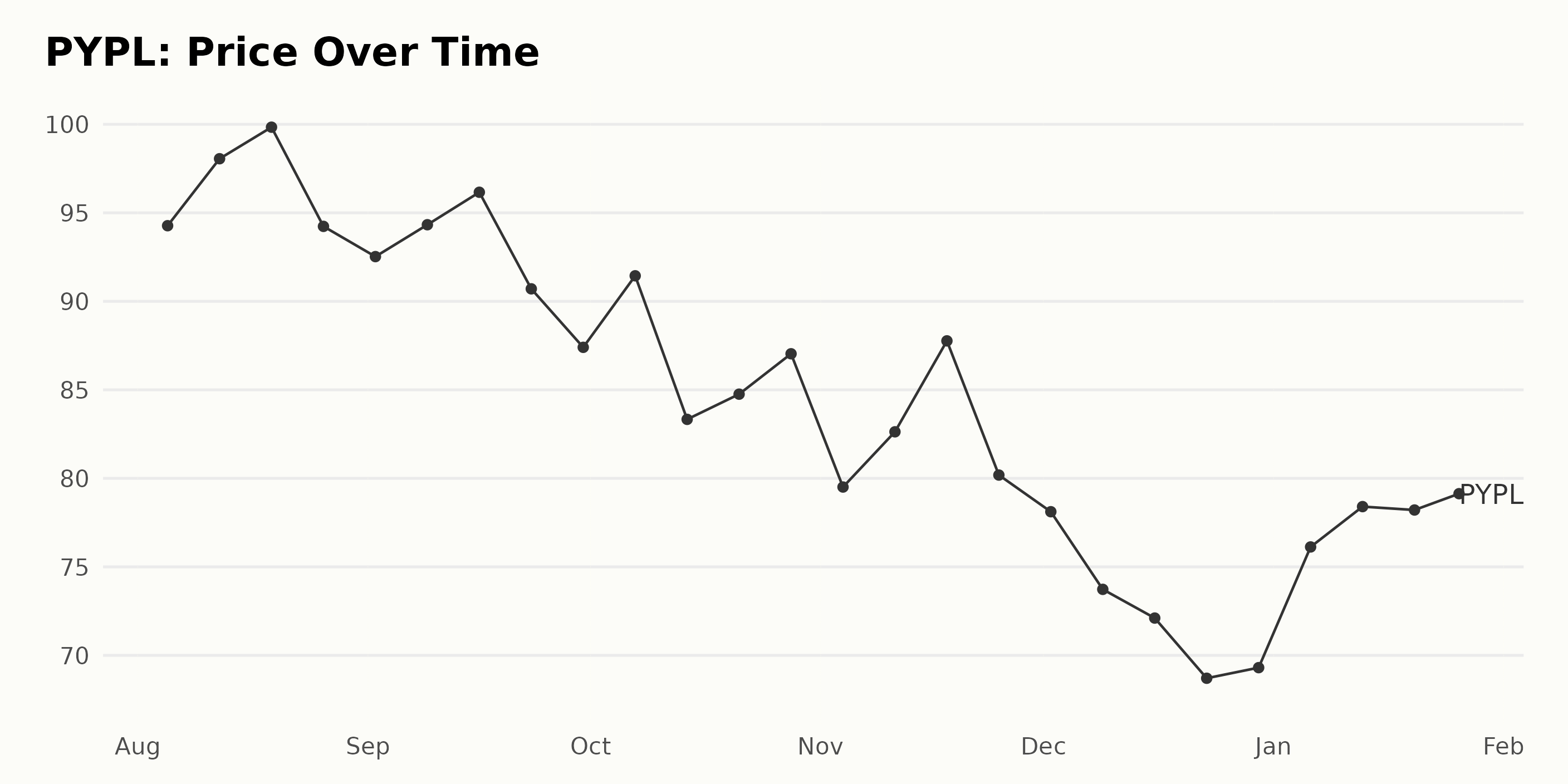

PYPL Share Price Sees Significant Increase of 16.2% Over Six Months

Overall, Paypal’s share price has been growing of late. Specifically, the share price of PYPL increased from under $70 to nearly $80 on January 26, 2023 — an increase of over 14%. Here is a chart of PYPL’s price over the past 180 days; it’s worth noting that the recent rally in price is set against a backdrop of a downtrend going back to at least August of 2022.

Want More Great Investing Ideas?

shares were trading at $403.97 per share on Thursday afternoon, up $3.62 (+0.90%). Year-to-date, has gained 5.63%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Simit Patel

Simit Patel has 2 decades of investing experience applying a top-down approach starting with macroeconomics followed by price action technical analysis to find more winning trades. More...