Friday’s silver selloff had a lot of bulls sweating. And who wouldn’t, seeing a favorite trade suddenly drop out?

(credit Fidelity.com)

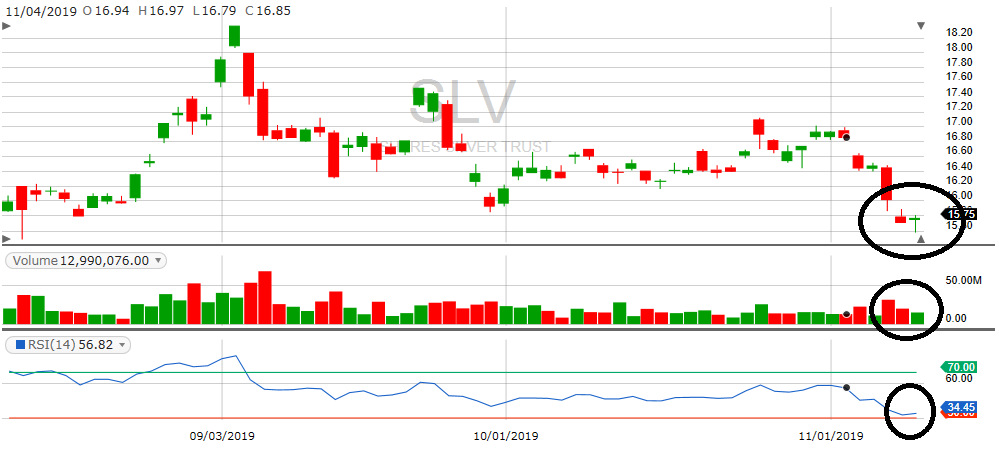

SLV, the unleveraged silver trading ETF popular among US traders, dropped from it’s 16.47 Wednesday close to end Thursday at 16-even. That’s almost a 3% drop in one day. Hardly the sort of move that makes one feel bullish.

The drop was due to a positive-news release about the US-China trade war. The Chinese Ministry of Commerce announced a phase one agreement which, if true, would mean a big step forward. Such news was always expected to drop precious metals and drop they did. Both silver and gold had big-down days, silver by far the worse.

We’ll learn more about the current state of the trade war from President Trump’s trade speech today. Silver is chopping sideways in premarket trading this morning, with no real conviction showing either way.

Technically the chart shows that the current move by silver is done unless there is a further big change in conditions. RSI fell from 60 to 34 in 3 days, a very drastic change. Volume in SLV dropped on Friday and Monday, trading ranges dropped, and on Monday SLV posted a hanging man candle pattern. In Japanese candlestick theory, a hanging man often signals a bottom, and US technicians would include a low RSI for confirmation.

We have both of those right now, but as this is a very news-driven market we’re not rushing out for new silver long trades. Two main reasons for that: One, President Trump’s speech could go either way; he might be concerned that the Chinese overstated agreement between the two sides, or he could announce more progress has been made. Being on the wrong side of that announcement could really hurt. Second, we’re not convinced there are enough people on the other side of either of those trades to give it any follow-through; traders seem to once again be focused on equities not precious metals or safe-havens.

So, for now, we’ll wait for silver to confirm that it’s stabilizing. Remember that trading is about risk-reward if you want to gamble go to Vegas baby!

Signed,

The Gold Enthusiast

DISCLAIMER: The author holds no position in any mentioned security. The author is long the silver sector via small positions in USLV, PAAS, and SVBL. He may daytrade around these positions but has no intention of trading out of these core positions in the next 48 hours.

SLV shares were trading at $15.60 per share on Tuesday morning, down $0.15 (-0.95%). Year-to-date, SLV has gained 7.44%, versus a 25.71% rise in the benchmark S&P 500 index during the same period.

About the Author: Mike Hammer

For 30-plus years, Mike Hammer has been an ardent follower, and often-times trader, of gold and silver. With his own money, he began trading in ‘86 and has seen the market at its highest highs and lowest lows, which includes the Black Monday Crash in ‘87, the Crash of ‘08, and the Flash Crash of 2010. Throughout all of this, he’s been on the great side of winning, and sometimes, the hard side of losing. For the past eight years, he’s mentored others about the fine art of trading stocks and ETFs at the Adam Mesh Trading Group More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SLV | Get Rating | Get Rating | Get Rating |