Every turn of the calendar brings new predictions, promises, and platitudes on how to be a better or more successful investor in the coming year.

Lucky for us, most of these ideas or rules haven’t changed over time so there is no need to learn any new “tricks” or skills. Just being reminded of some simple concepts and basic behaviors should be sufficient enough to allow most investors to navigate whatever the market throws at them.

1. There Is No Reward Without Risk

Many people operate under the assumption or are led to believe, that through practices such as diversification, portfolio protection, hedging, etc. that risk can be eliminated.

But there’s an old saying, “Risk can be quantified, assumed, bought, sold, transferred, created, subordinated, reassigned, split, delayed, diluted, fragmented, hedged against, and laid off. Risk can respond to some methods, but it is still a risk, and is near impossible to eliminate.”

Enticingly high yields. Smooth returns. Sophisticated ‘black box” systems. These are just a few of the siren songs that can lead investors astray.

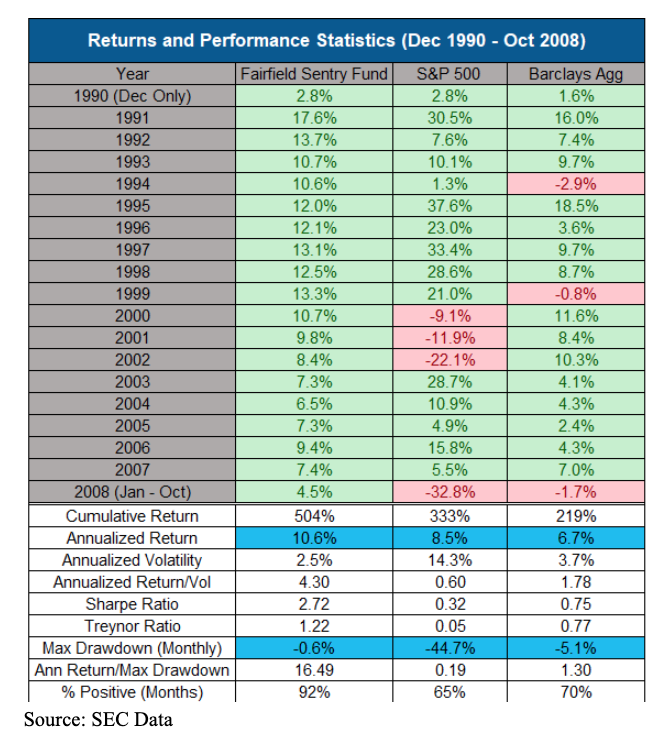

Take a look at the second column in the table below:

No one single down years from 1990 to 2008 with a 10.6% annualized return with less volatility than bonds. The maximum drawdown was a mere 1%.

Does that seem too good to be true?

It was. The above was the false returns Bernie Madoff fawned off on both individuals and supposedly sophisticated hedge funds while perpetrating one of the largest Ponzi Schemes in history.

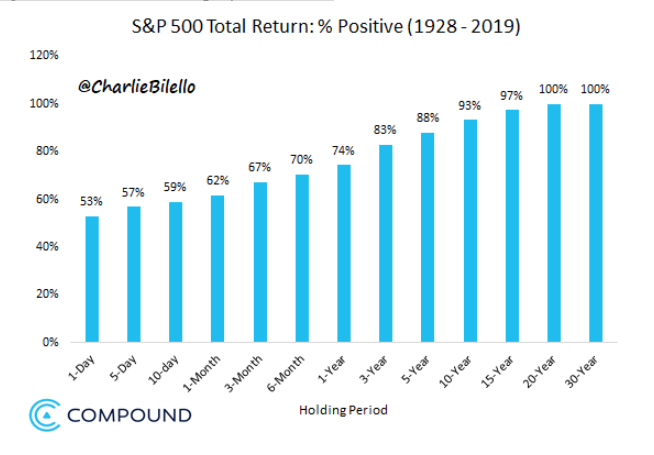

2.The Longer Your Holding Period, the Higher Your Odds of Success

On any given day in the stock market, your odds of a positive return are just 53%, little better than a coin flip. Increase your holding period to a year, and your odds of success jump to 74%. At a 20-year holding period, there has never been a negative return for U.S. equity investors.

3. Plans Beat Prophecies. Evidence Overpowers Opinions

How many times in the recent past have knowledgeable experts said something along the lines, “if X occurs, Y will follow.”

It happened after the initial Brexit vote in which stocks were expected to tank but instead rallied. Same with the Trump election as the consensus among hedge funds was stocks would “crash” if Donald Trump was elected.

Indeed, during earnings season most people think if they knew the company’s results beforehand they’d have a lock on making money. I beg to differ and can show numerous examples of a company blowing out and beating expectations by a large margin only to see the stock drop following the news.

Why would this ‘sell the news’ occur? Who knows?

What evidence did they have backing their cataclysmic prediction? None.

There are two other old sayings that come into play here, “Plan your work and work your plan” and When facts change so does my opinion.”

There is nothing wrong with having an opinion, in fact, one and the willingness to risk that you’ll be proved right, are necessary to success. Just don’t be dogmatic about it.

4. Concentration Is the Fastest Way to Build Wealth And Destroy It

Bezos. Gates. Buffett. Zuckerberg.

A list of the wealthiest Americans all have one thing in common: concentration in a single company’s stock that they founded.

It’s tempting to believe that is the model you should follow in your own investment portfolio, but for most, that would be a mistake.

Why? The odds of you picking a single stock and it becoming one of the big winners are not in your favor.

Most companies (72%) vastly underperform Treasury bills over the long term and more than half earn a negative lifetime return.

Any individual stock can go to $0. Remind yourself of this next time you’re tempted to go all-in on a single name.

5. Don’t Be Afraid to Say “I Don’t Know”

- Where is the S&P 500 going to be at the end of 2020?

- What about the 10-year Treasury yield?

- Who will win the election next year?

- Is Gold a good investment today?

- When will the trade war be resolved?

- Will the Fed cut continue to cut rates next year?

It’s tempting to believe that you must have the answer to such questions to succeed as an investor, but as discussed above, even if you had the answers it might not help you succeed.

In fact, the opposite is true. Thinking you know something and acting on that opinion can be far more harmful than admitting you just don’t know.

SPY shares were trading at $322.38 per share on Monday morning, down $0.03 (-0.01%). Year-to-date, SPY has gained 0.16%, versus a 0.16% rise in the benchmark S&P 500 index during the same period.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |