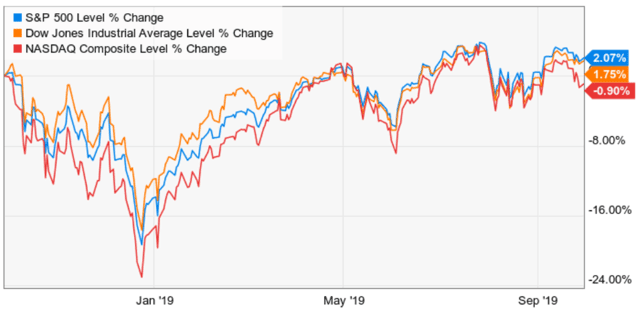

The stock market, whether you’re looking at the S&P 500, the Dow Jones Industrial Average, or tech-heavy Nasdaq, has gone nowhere in a hurry over the past year.

(Source: Ycharts)

Since 1945 (as well as 2009) we’ve averaged a 5% to 19.9% pullback/correction every six months. Thanks to endless political/trade war chaos, we’ve had three such declines over the past 12 months.

Now we’re facing the prospects of Trump being impeached, which is likely to crank up the DC chaos meter up to 11. To help you avoid making costly mistakes with your portfolio here are three facts to know, about what’s likely to happen with impeachment, what it means for the economy and how to protect your portfolio.

Trump Is Likely to Be Impeached…BUT Isn’t Going Anywhere

In a recent poll, 62% of Democrats said they favor impeaching Trump over is alleged attempts to pressure Ukraine’s president into launching a corruption investigation against Joe Biden (over a natural gas deal he and his son invested in).

House Speaker Nancy Pelosi had previously refused to launch an impeachment inquiry, the first step in the impeachment process because she viewed it as a distracting circus. Now, however, several vulnerable Texas House Democrats have begged her to do it, as a political strategy to help preserve the Dem’s small majority in the House.

Given that her base supports this move, it now appears as if impeachment is slightly more likely than not. At the very least the House is going to spend a lot of time investigating this matter, which is sure to cause a lot of dramatic headlines.

However, even though the Democrats likely have the votes to impeach Trump, there is virtually zero chance he will be removed from office. Per the Constitution, the House must vote for articles of impeachment and the Senate, in a 67 vote supermajority, must remove him/her.

It would take all 47 Democrats and 20 Republican Senators to come together to remove Trump, and there is no indication that the Senate GOP caucus is fractured enough to allow for this.

Basically, all that’s likely to happen is a lot of political grandstanding and talks about “witch hunts” from the right, and “restoring the dignity of the office” from the left. How will this affect the stock market? Most likely not at all.

Stocks Are Likely to Ignore This

There have been two impeachments in the past 100 years so we can’t say with certainty how this process will affect equity markets. However, I agree with Ken Fisher, founder of Fisher Investments that most likely the market will ignore this political noise, as it does almost all political noise.

There is nothing that’s going on now that isn’t in my opinion pre-priced and that would stop a bull market…This is kind of a circus…And circuses in the longer term don’t make or kill bull markets or bear markets. Will we have more circus? We’re going to have circus all the way through the November 2020 elections. If you don’t expect the elections to have drama, you’re missing what elections are all about.” – Ken Fisher (emphasis added)

The stock market cares about fundamentals, both economic and corporate earnings. Impeachment almost never has an effect on either, which is why how stocks trade during times of impeachment comes down to macroeconomic factors.

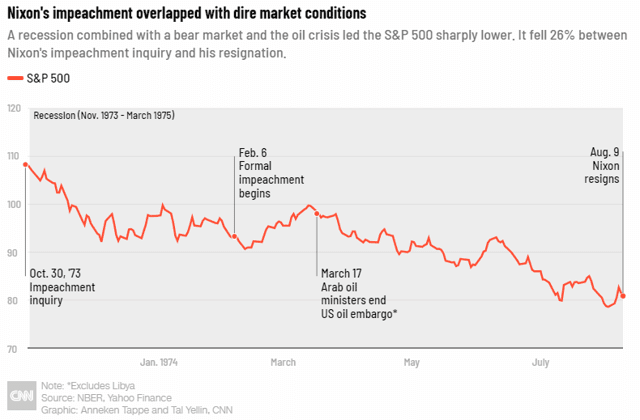

The Clinton impeachment saw the market rally 40%, thanks to a roaring economy and the tech bubble.

The Nixon impeachment occurred during a recession and the Arab Oil Embargo which kicked off a decade of rising inflation that was horrible for both bond and stock returns.

But wait a second? What about how this might affect important policy decisions? Might not a President Trump who is already known for volatile swings in policy, become even more erratic? And since trade talks are scheduled for October 10th, ahead of major tariff increases on October 15th and December 15th, might potentially escalate the trade war to look tough during impeachment proceedings?

That is a valid risk so let’s take a look at how the political circus of impeachment might affect the actual economy.

Economic Risks Are Elevated But This Likely Won’t Harm US Fundamentals

First, I’m going to forgo speculation about how impeachment might affect the trade talks. It’s just as likely that a President Trump gearing up for political war with the House might want to end the trade war entirely to avoid a two-front political conflict.

BUT there is one other major policy concern coming soon, a potential government shutdown on November 21st.

Here’s Moody’s Analytics with their take on impeachment and its potential implications.

Since the outcome of the 2018 midterms, Moody’s Analytics never expected the relationship between the president and House Democrats to be harmonious. The academic literature finds that a shift from unified to divided government tends to produce a five fold increase in the number of congressional hearings and quadruple their duration. However, the emergence of the impeachment inquiry, prompted by Trump’s phone call with his Ukrainian counterpart, does add more fuel than expected to tension between the president and House Democrats, with some implications for the U.S. economy…Our baseline assumption is that Pelosi’s announcement won’t impact the Senate’s vote on the stopgap spending bill, nor the president’s willingness to sign it. However, we’re eyeing the November 21 deadline with a bit more caution than before…The inquiry is set to absorb Capitol Hill’s attention, which will likely stymie progress on the 12 appropriations bills needed to fully fund the federal government through September 2020. This could force lawmakers to kick the can down the road once again, leading to another stopgap bill in November. Though short-term funding resolutions are preferable to a shutdown, they still represent a failure of fiscal policymaking. Short-term spending bills create uncertainty for agencies, which have to restrict their spending and hiring cycles to the close confines of the stopgap measure. This often leads to lost productivity, since agencies are forced to make repetitive, inefficient, short-term contracts. Government contractors are not immune to these effects as well.” – Moody’s (emphasis added)

While the debt ceiling has now been eliminated for two years, thus taking the doomsday scenario of a US debt default off the table, we haven’t actually passed a budget for 2020. Congress is working on 12 spending bills that need to be completed by November 21st in order to avoid a government shutdown.

The last shutdown, which was the longest in history (35 days over Mexican wall funding) significantly hurt consumer sentiment per Bank of America’s monthly rolling survey.

Should we get another shutdown, right before Christmas, then retailers who are already facing 15% tariffs on apparel, could see a hit to the most important shopping season of the year. One that historically delivers 50% of annual profits for them.

The good news is that Moody’s doesn’t expect the impeachment inquiry to turn into a full-blown political brawl that results in another shutdown. But the bad news is that the House spending most of its time on impeachment investigations could force ongoing one to three-month continuing resolutions to be passed over and over again.

Normally that wouldn’t be a big deal, except when US businesses are already facing a lot of trade uncertainty which Moody’s estimates has just a 15% probability of being resolved by the end of next year.

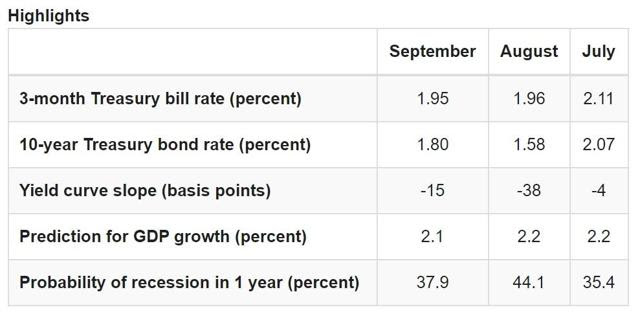

But guess what? Just because there is a lot of economic uncertainty doesn’t mean the wheels are falling off the US economy. For example, here’s the Cleveland Fed’s most recent economic growth/recession risk model, updated on September 26th.

(Source: Cleveland Federal Reserve)

Based on the -15 basis point average yield curve inversion in September the Cleveland Fed estimates the US economy is growing 2.1% right now and there is a 38% probability of a recession by late 2020.

As I write this the yield curve is 17 bp inverted, meaning that, based on the 0.25% risk/bp slope of the curve over the past three months, recession risk is about 38.5% right now, according to the bond market.

Or another way to put that is that if nothing changes (good or bad) there is a 61.5% probability of no recession coming by the end of next year.

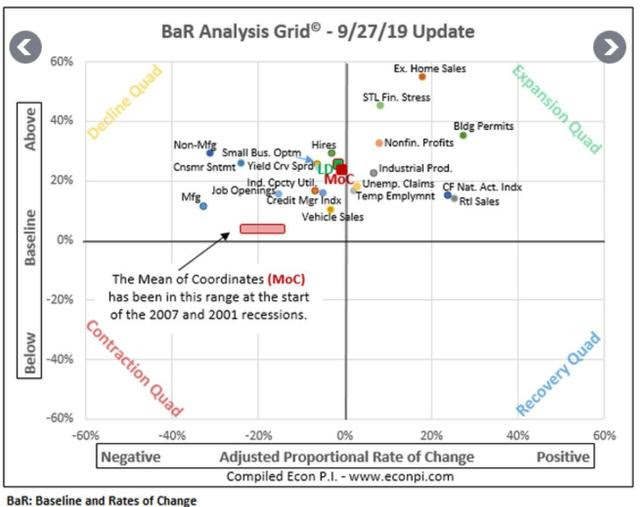

That’s confirmed by the actual economic data, specifically 19 leading indicators tracked by David Rice’s Baseline and Rate of Change or BaR economic grid. This looks at 19 economic surveys/reports that collectively predicted the last 4 recessions with 12+ month lead time.

In the past two weeks, despite all the craziness that’s gone on, the average of all 19 indicators rose from 23.9% above historical baseline to 24.5%. The monthly rate of change has improved from about -5% month over month to -2% and the eight most sensitive indicators have gone from 25.7% above baseline to 26.1%.

Basically this means that if nothing changes over the next few months the US economy will get stronger, not weaker and there is virtually no chance of a recession over the next 12 months. According to Mr. Rice, and based on the last three recessions, any reading of 20+% above baseline for the average of all 19 indicators means a recession is all but impossible.

And since 1945 we’ve had just two mild non-recessionary bear markets. Which means that any future pullback/correction in the stock market is likely to be a run-of-the-mill decline, short-lived and mild. Not the start of the next great market collapse as so many fear.

Bottom Line: Political Chaos Might Create Good Buying Opportunities So Be Ready

I run four model portfolios for The Dividend Kings as well as my retirement portfolio based on a long-term approach driven by facts, not fear.

- I am aware of risks (what might go wrong with fundamentals) to the economy, corporate earnings and the stock market

- But I only make decisions based on facts (actual data) which almost always proves worst-case scenario doomsday prophets wrong

Don’t get me wrong, political headline risk is a real thing that can wreak havoc on certain stocks, especially in the tobacco and healthcare sectors. But as Joshua Brown, aka “The Reformed Broker” likes to say “volatility isn’t risk, it’s the source of future returns”.

Recently I’ve been backing up the truck on Altria during the great “vapocalypse” scare of 2019. Morningstar estimates the worst case, US vaping is banned forever outcome would reduce Altria’s long-term growth rate by 1% per year (3% to 8% instead of 4% to 9%). From today’s insanely great valuation (lowest PE in 10 years) that’s still good enough to likely generate 20+% long-term annualized returns while enjoying a safe and growing 8.4% yield from this dividend king (50-year dividend growth streak).

I’m also buying UnitedHealth Group, which is in a bear market due to 2020 campaign regulatory risk fears (Democrats promising to nationalize health insurance). Without 60 votes in the Senate those proposals (wish list ideas really) are DOA and thus this is a great opportunity to buy a 10% to 15% growing Super SWAN stock at a 10% discount to 2020’s fair value and lock in 10% to 17% CAGR long-term return potential.

SPY shares were trading at $295.81 per share on Tuesday morning, down $0.96 (-0.32%). Year-to-date, SPY has gained 20.01%, versus a 20.01% rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |