Last week the December Fed meeting was just one of the numerous important events that the market was watching like a hawk.

(Source: Advisor Perspectives)

The S&P 500 managed to finish the week up 0.7%, partially due to the Fed doing what was expected in terms of leaving the Fed Funds Rate or FFR unchanged.

However, there were actually three important bits of news from the Fed meeting that will have important long-term ramifications for the US economy and stock market, both in 2020 and long beyond.

The Fed Remains Optimistic About the State of the Economy

The FOMC’s long-term forecasting table is the most important thing released last Wednesday and includes a plethora of valuable data.

(Source: FOMC)

The first thing to note is that the FOMC (the group that actually determines rate policy) doesn’t see a recession coming through at least 2022.

Now economists are famous for missing recessions, and given how closely everyone watches the Fed you’d hardly expect Jerome Powell to ever say “we expect a recession in year X or Y”. However, the Fed’s optimism about the economy is backed up by the data we’re seeing come in now.

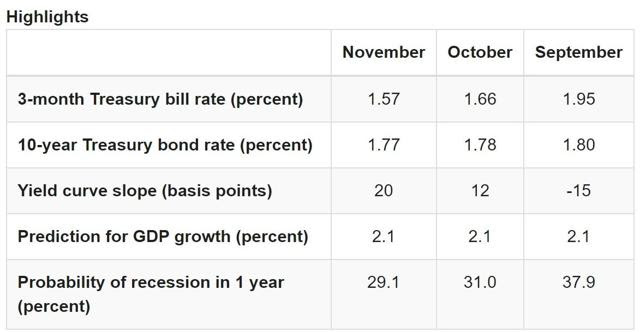

(Source: Cleveland Fed)

The Cleveland Fed/Haver Analytics recession/GDP growth model has a relatively good track record of estimating recession risk based on the 10y-3m yield curve, the single best recession predictor ever discovered.

Right now that model is saying that a 13-month recession risk (extrapolated from the above table using the slope of the curve vs recession risk) is about 26%. That’s down nearly 50% from the 48% risk we saw in early September.

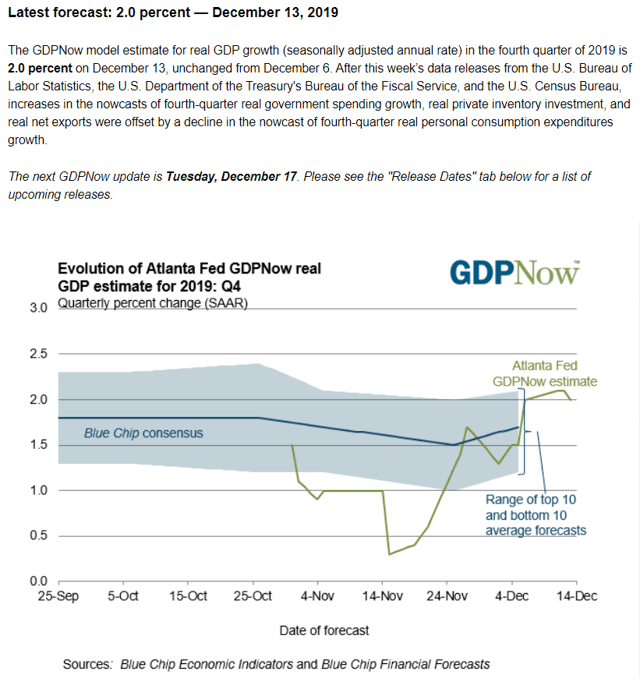

(Source: Atlanta Federal Reserve)

The Atlanta Fed’s real-time GDP growth model says that better than expected economic data last week means the US economy is likely growing 2% in Q4, similar to the 2.1% we saw in Q3.

It’s also in-line with the Cleveland Fed model’s 2.1% GDP growth forecast, and the FOMC’s 2% growth expected in 2020.

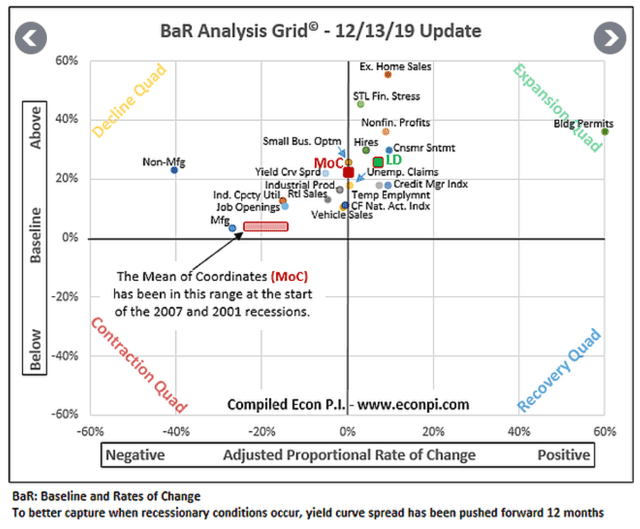

(Source: David Rice)

Finally, we have the aggregate economic data, looking at 19 leading indicators that collectively predicted the last four recessions.

The average of all 19 is currently about 23% above the historical recessionary baseline. More importantly, the 8 most sensitive leading indicators (like the yield curve, St. Louis Financial Stress Index, and consumer sentiment) are currently 25.5% above baseline and are improving at an accelerated pace month to month.

All of this means that the 2020 recession risk is all but zero, especially with the Phase 1 trade deal now official between the US and China.

That deal is expected to be signed the first week of January and includes

- September 1sts 15% tariffs on $120 billion worth of imports fall 50% to 7.5%

- 25% tariffs on $250 billion worth of intermediate goods stay the same

- December’s 15% tariffs on $160 billion worth of consumer-facing goods are canceled

- China has agreed to buy more US goods (amount to be determined by January)

- China has agreed to reforms on IP and protecting patents (details to be hammered out in phase two talks)

Phase two negotiations will begin immediately after that though cover much tougher issues and thus may not be completed by election day. But still, the fact that tariffs will be falling for the first time in 20 months is a major win for the economy and further reduces recession risk, both in 2020 and 2021.

Modest Long-Term Growth And Low Inflation = A Modest Pace of Future Rate Hikes

What really got the market excited about the December Fed meeting was the Fed’s dot plot which showed zero rate hikes in 2020 and just one each in 2021 and 2022.

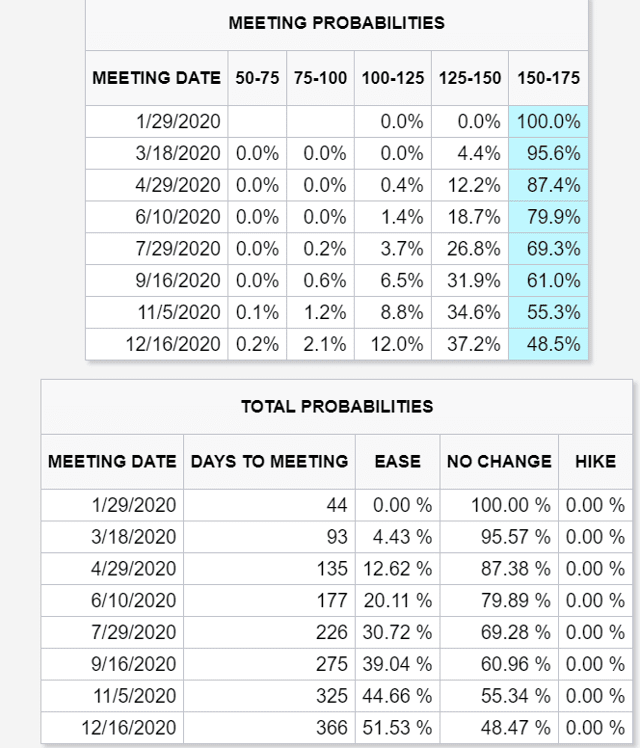

(Source: CME Group)

The bond market is still pricing in a 52% probability of one cut next year, but that’s down from two cuts as recession risks fall and trade talks make substantive progress.

What’s most important for investors is the fact that the Fed is NOT worried about rising inflation, despite unemployment being at the lowest level since 1969. The Philips Curve is a core economic model the Fed has used for decades that says that falling unemployment leads to rising inflation (due to higher wages) and back in January 2018 we had a correction triggered by unexpectedly high wage growth.

The Fed uses the core PCE inflation index and right now that’s running at 1.6%, below its long-term symmetrical 2.0% target. Not until 2021 does the Fed expect core PCE to hit 2.0% and the 25 bp hikes it expects in 2021 and 2022 are designed to prevent inflation running hot and requiring a faster pace of rate increases.

This is fundamentally great news for the jobs market which is by far the strongest reason we’ve avoided a recession despite the trade uncertainty we’ve faced this year.

Job Market Should Continue to Heal, Driving Sustained Growth in Wage Growth, Consumer Spending And Corporate Profit Growth

What gets me most excited about the Fed’s latest long-term forecast is the lack of a recession through at least 2022, which is supported by economic data we’ve seen over the last month.

Goldman Sachs is forecasting unemployment falling to 3.3% by the end of 2020 and 3.5% wage growth (up from 3.1% now).

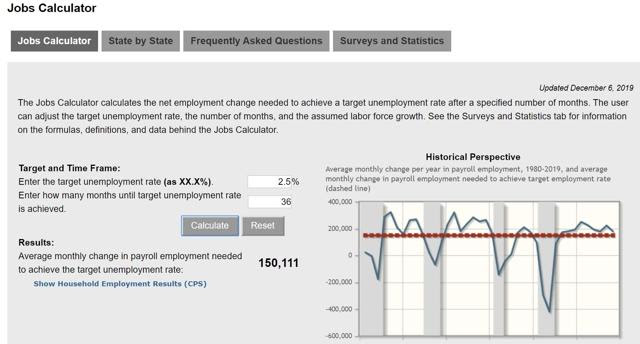

That may prove to be a conservative estimate because according to the Atlanta Fed Job calculator, it would take just 150,000 average net jobs per month over the next year to achieve the lowest unemployment rate in over 70 years.

For context we’ve

- averaged 180K jobs per month in 2019

- 205K per month over the last three months

- anything above 107K tightens the labor market even more and causes unemployment to keep falling and wage growth to steadily rise over time

(Source: Atlanta Federal Reserve)

(Source: Atlanta Federal Reserve)

If the labor participation rate of 63.2% were to remain unchanged (it’s been climbing in recent years) then 150,000 net jobs per month through the end of 2022 would get us to 2.5% unemployment. That would be the lowest since 1952 and tie the record low rate seen outside of WWII (1.2% unemployment in 1944).

In reality, a rising labor participation rate is likely to keep unemployment higher than these static forecasting tools show, but that’s a good thing. The more people renter the workforce the stronger the base for a healthy economy to grow.

Over time GDP growth is a function of labor force growth + productivity growth, and positive wage growth tends to bring people in off the sidelines.

What’s more, rising wages help fuel consumer spending (65% to 70% of our economy) and give companies a reason to invest in productivity-boosting capex, (like 5G based automation).

In the 2020s 5G is expected to really hit its stride (50% penetration by 2023) and productivity growth of 2% to 2.5% could allow for 4% to 4.5% wage growth while still hitting the Fed’s 2% inflation target.

That would mean both a stronger economy (and faster earnings growth helping stocks) plus slower rates of future rate hikes.

Bottom Line: The Fed Meeting Was 100% Positive for Economic Fundamentals And Bodes Well for the Best Bull Market in History to Continue

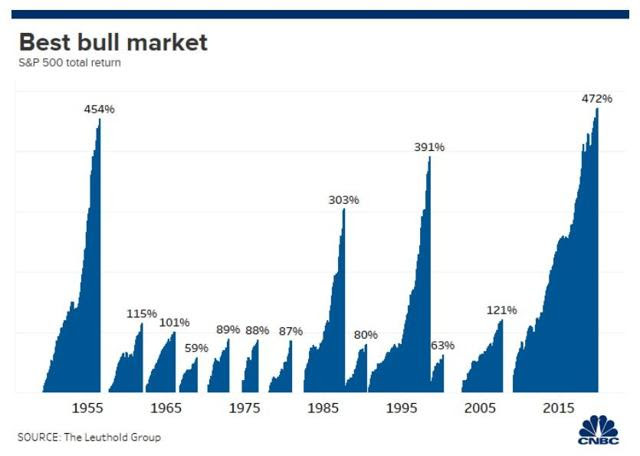

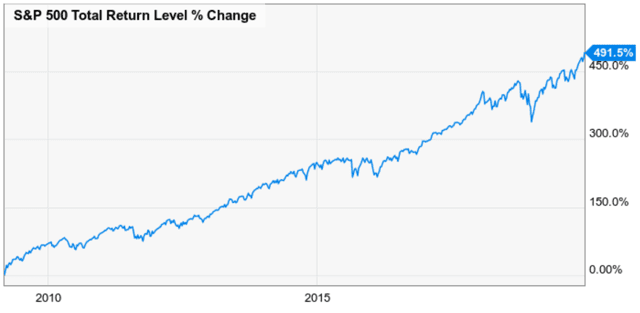

On Nov 11, the longest bull market in history became the most profitable one as well, and since then the market has climbed steadily higher.

(Source: Ycharts)

In order to avoid a bear market, we need to avoid a recession and keep corporate earnings growing. Fortunately, the December Fed meeting had nothing but good news for economic/market fundamentals including

- no recession expected through at least 2022 (backed up by actual economic data)

- a modest pace of future rate hikes (1 per year starting in 2021)

- the Fed forecasting significant expansion of the labor market (rising participation)

As long as the fundamentals of the US economy remain as robust as they are today, not just is no bear market likely, but the best bull market in history is likely to have many more years to run and set many more records along the way.

SPY shares were trading at $319.78 per share on Tuesday morning, up $0.28 (+0.09%). Year-to-date, SPY has gained 29.74%, versus a 29.74% rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |