Last year we saw earnings crashes that had to be seen to be believed.

And this year, we’re seeing the opposite, which is why the S&P 500 just smashed the record for the fastest doubling from bear market lows.

But of course, the easiest profits have already been made. This is why it’s important to know three things about the 2nd best earnings season in history.

Both to keep enjoying strong long-term profits in late 2021 and 2022, but also to avoid painful and costly mistakes in the coming months and years.

Fact 1: This Was A Historically Glorious Earnings Season

Q2 2021 represents the 2nd best earnings season in recorded history, at least as far as FactSet is concerned.

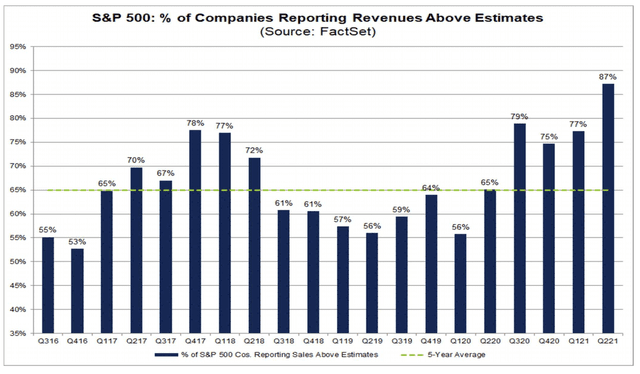

With 91% of companies reporting, 87% have beaten sales expectations, the highest ever recorded.

And those beats were despite incredibly high expectations.

The revenue surprise percentage for Q2 2021 of 4.9% is also above the trailing 1-year average (+2.8%) and the trailing 5-year average (1.2%). In fact, the second quarter will mark the highest revenue surprise percentage since FactSet began tracking this metric in 2008.” – FactSet Research

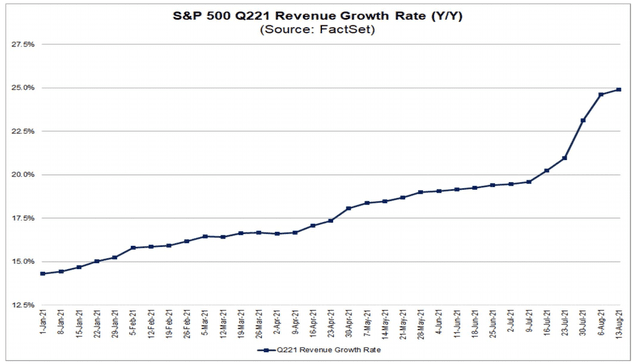

Just how great was sales growth in the last year?

Try 24.9%.

For Q2 2021, the blended earnings growth rate for the S&P 500 is 89.3%. If 89.3% is the actual growth rate for the quarter, it will mark the highest year-over-year earnings growth rate reported by the index since Q4 2009 (109.1%).” – FactSet Research

Earnings growth has been explosive, and analysts still haven’t caught up. Every week estimates are rising and every quarter companies continue to beat them by impressive amounts.

(Source: FactSet Research)

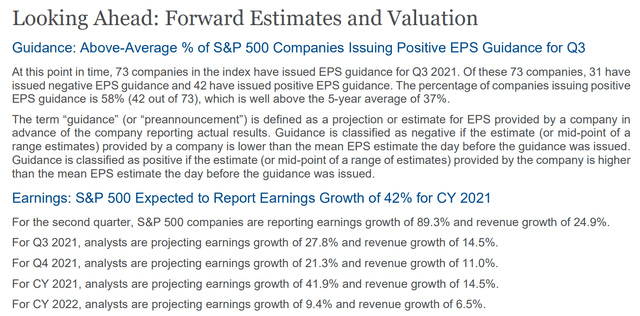

Despite the incredible growth in 2021, next year’s growth, for both the top and bottom line is expected to also be above-average.

Net margins, currently at 13.0%, an all-time high, are expected to get even better.

Fact 2: Here Are The Best Sectors For 2022

The bottom-up 12-month consensus for the S&P 500, using the 12-month price targets for all 500 companies in the index, is forecasting an 11% gain.

Mind you that’s an educated guesstimate because just 6% of 12-month returns are a function of fundamentals and valuation.

It’s historically true that stocks deliver 8% to 13% gains in 80% of years, so history is on the side of the bullish analyst forecast.

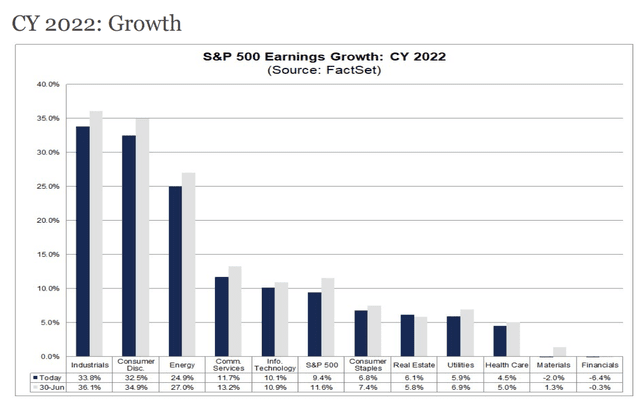

However, some sectors are potentially poised for a far better year in 2022 thanks to very impressive earnings growth.

Industrials are expected to potentially benefit from a perfect storm of positive tailwinds, such as infrastructure spending and the best economy in 40 years.

Consumer discretionary benefit immensely from nearly $3 trillion in excess savings created by stimulus during the pandemic, along with 10.2 million job openings, an all-time record.

And energy potentially could profit from what many analysts (such as Bank of America) think could be oil’s return to $80 to $100 per barrel.

In part two of this series, we’ll look at what companies, in particular, could be set for market-smashing returns in 2022 and beyond.

SPY shares were trading at $446.71 per share on Thursday morning, down $2.20 (-0.49%). Year-to-date, SPY has gained 20.26%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |