(Please enjoy this updated version of my weekly commentary from the Reitmeister Total Return newsletter).

There were some very short lived flare ups last week with very little staying power. The first one I previewed above. That being the shift to defensive investing last week as worldwide Coronavirus cases spiked to a new high. And yes, there were modest signs of an increase in the States.

This had some investors moving towards a Risk Off investing approach with the most conservative names doing well. And the most aggressive names doing the worst. (And many of the names that benefit from the Coronavirus fading away also took it on the chin like restaurants, airlines, cruise lines et).

Gladly a week later we see signs of improvement on the Coronavirus. Especially if we take India out of the equation. (Check out the stats here.)

Later in the week we got a scare out of DC with plans of sharply higher capital gains rate for Americans making over $1 million per year. And yes, 80% of the stock market is owned by this very group of investors which gave grounds for some pause and reflection.

We covered this topic a bit in last Friday’s end of the week note. Indeed investors have quickly moved past this as the DC sausage making process could take a long time with final results being much more benign in the end. In fact, quite possible that no tax change ever gets pushed through given what will certainly be heavy opposition.

So this gets us back to viewing the market from more of a traditional standpoint. That being a focus on the fundamentals such as the economy and the results of Q1 earnings season.

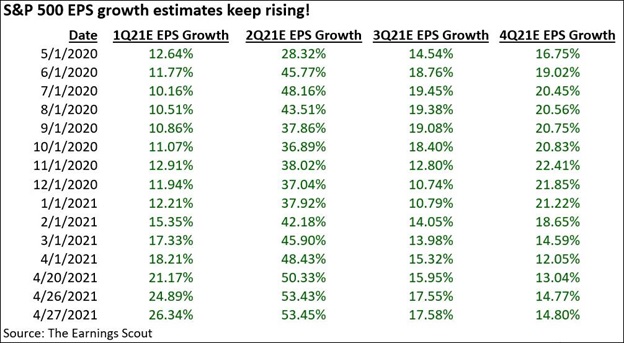

We are now entering the heart of earnings season, yet the early results already tell us we have another strong one on our hands. Below is a copy and paste from Nick Raich who used to be Director of Research at Zacks when I was there. Now he heads his own shop EarningsScout.com which has their own beneficial views on earnings trends. Here is what you need to know from this morning’s comments:

- In total, 153 companies in the index have now released results classified as 1Q 2021.

- 88% of those companies have exceeded their EPS estimates, on average, by +17.24%. This is significantly larger than normal beat rate.

- Actual 1Q 2021 vs. 1Q 2020 EPS growth for these 153 companies has been +41.57% with top-line sales rising +6.77%. Excellent results justifying the rally in stocks over the past year.

Learn more about earnings insights from EarningsScout.com.

The main point is that the earnings trend has been rolling higher for quite some time. And since the early earnings reports are so strong, then the growth prospects for the entire market are on the rise. This is very bullish fuel.

Now onto a discussion of the economic data this week, which was also quite bullish. First up being the tremendous 150,000 drop in Jobless Claims last Thursday showing how quickly the economy is healing.

Then on Friday the PMI Markit Flash rose from 59.7 to 62.2 showing broad based gains in both manufacturing (60.6) and Services (63.1). Sorry for repeating myself so much. But for those who are not aware, anything above 50 is a sign of economic expansion. And above 55 is considered a strong reading. And thus 62.2 is VERY, VERY impressive.

Beyond the strong manufacturing read above we also got two stellar regional manufacturing reports. That started on Monday as the Dallas Fed Manufacturing index climbed from an already impressive 28.9 to a shockingly good 37.3.

Today we find that the Richmond Fed Manufacturing Index held firm at a solid 17. For these reports anything above 0 is expansionary. And anything about 10 is impressive. So yes…please be impressed by this 17. And uber impressed by the 37.3 for Dallas.

Lastly is today’s announcement that Consumer Confidence exploded higher from 109 to 121.7. This means consumers are downright giddy, which is strong foreshadowing of higher spending activity ahead.

So not only do these economic reports speak highly of the current situation, but the forward looking aspects look even better. This should give investors pretty good confidence that they should continue expecting this bull market to push even higher.

Reity, does that mean we will be up to 4,500 or 5,000 soon?

Slow your roll buddy

Indeed those are very attainable heights this year given a still low rate environment that makes stocks so much more attractive to cash and bonds by comparison. Then lop on top the better than expected economic/earnings data and you have fertile soil for more stock gains.

However, with as much gains that are already in hand, I suspect the market will be a case of 2 steps forward and 1 back. And even at some point we may take 2-3 steps back in a real correction that wrings out excess allowing the market to progress higher in healthier fashion.

The timing of these events is unknown and unknowable. So in general we should have a bullish posture with a healthy mix of growing companies owned at attractive prices.

What To Do Next?

The Reitmeister Total Return portfolio has outperformed the market by a wide margin this year.

+25.83% for Reitmeister Total Return

+11.47% for S&P 500

Why such a strong outperformance? Because we know that the 2021 stock market is playing by very different rules than last year. And thus a different breed of stocks will lead the way higher.

If you would like to see the current portfolio of 11 stocks and 3 ETFs, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About Reitmeister Total Return newsletter & 30 Day Trial

Wishing you a world of investment success!

Steve Reitmeister

…but everyone calls me Reity (pronounced “Righty”)

CEO, Stock News Network and Editor, Reitmeister Total Return

Want More Great Investing Ideas?

SPY shares . Year-to-date, SPY has gained 12.01%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |