When you see a chart like this and experience the pain of watching your portfolio fall day after day, sometimes by double digits, it’s understandable why you might wish the market would just close.

The stock market has closed twice in history, during WWI and after 9/11.

Whether you look at the Dow or the S&P 500, you might think just closing the stock market for a few months might be a good idea. After all, this is an unprecedented crisis, so why not guarantee that stocks can’t go down any more until the crisis has passed?

Closing the Stock Market Is How a Bear Market Can Turn Into a Financial Crisis

Here’s Barron’s Alex Friedman, explaining the biggest reason that closing the market is a potentially disastrous idea.

People tend to panic when they don’t have access to their assets. Closing markets is how a “run on the bank” mentality starts. Given the complexity of various modern markets, governments around the world would have to guarantee the value of existing frozen assets to avoid leverage and margin calls leading to ruinous dynamics by creditors. Such guarantees could potentially undermine the government bond markets.

Government stimulus, to the tune of nearly $4 trillion announced so far (globally), is how we avoid a temporary economic contraction (though the biggest in history by far) turning into a full-blown depression.

The ability of global governments to borrow enough money to minimize the risks of permanent economic damage depends on low-interest rates.

Imagine you’re an institution like a pension fund. You have to make payments each month, with cash. You have various assets, including stocks, bonds and alternative assets (private equity funds under 5 to 10-year lockups you can’t touch).

What if the stock market is closed and you have no ability to sell them to raise cash to make your pension payments? Then you are forced to sell other assets, such as government bonds, causing their prices to fall, and yields to rise.

Closing the stock market is a great way to turn a global liquidity crunch into the kind of financial panic that can prevent the very stimulus that is our only hope of averting a depression.

Secretary of the Treasury Mnuchin told Congress recently that without direct stimulus unemployment would hit 20%. He likely understated the risk because

- Morgan Stanley expects 17 million job losses in May alone (more than double the total of the Great Recession in a single month)

- Moody’s estimates that 80 million jobs, 50% of the total, including 14 million in travel/leisure are at risk in this crisis

- St. Louis Fed President Bullard estimates unemployment could peak at 30%, representing nearly 50 million job losses, due to Q2 growth of -50%

The only reason Bullard isn’t worried about a depression, is because $2 trillion in stimulus in a single quarter is sufficient to replace about 80% of the economic damage in Q2.

Take away the government’s ability to do that stimulus, by tanking the bond market, and you have the potential for 50 million job losses to become permanent.

THAT is something that America would indeed have a very tough time ever coming back from.

Here’s another reason closing the market is likely a terrible idea.

Markets are so intertwined that any freeze would have to apply to all major markets around the world, in all major asset classes, and in derivatives and private markets as well, which would be impossible to enforce. Certain goods and services would have to continue trading to assure critical food and medical supplies, which would result in uneven rules being applied. Black markets would increase, leading to additional fraud and crime.” – Barron’s

On Thursday, March 16th, the stock market suffered its 3rd worst day in history, plunging a frightening 12%. “Safe haven” assets like gold and long-duration US treasuries, supposedly “risk-free”, fell along with stocks.

That day virtually every asset class on earth fell, in unison, as asset correlations began to approach zero.

What explains that kind of frightening pricing action in normally safe assets?

Simply put it was a global margin call.

$1 trillion in corporate credit lines were being drawn down by companies big and small, who wanted the maximum amount of cash “just in case”.

Banks were forced to sell bonds, which make up most of their capital reserves, to meet the demand for cash.

Hedge funds and private equity funds similarly faced margin calls. If you own gold and are facing financial ruin, you sell your gold because it’s the only asset you might have to sell at a profit (or the smallest loss).

The reason that global margin calls are bad is it signal tightening credit conditions.

Corporate borrowing costs have virtually doubled in the past three weeks. If a BBB rated company like Altria (MO) needs to refinance its maturing bonds? Well, then its 4% average borrowing costs are going to rise when it has to pay 5% interest on new bonds.

That’s not a big problem for a stable business like MO, whose demand stays relatively stable during recessions. But now imagine that you’re a cyclical company like Ford (F) who is now junk bond rated? Junk bond yields during the Financial Crisis went as high as 15% or more, depending on how speculative they were rated.

If we close the stock market, then the global margin call gets worse, credit markets likely tighten further and we risk a wave of large scale bankruptcies that could throw even more people out of work.

The unintended consequences would almost invariably cause a cascade of black swan events that would likely be worse than the “cure.” Spooky action. True crisis times call for draconian measures and wild ideas that might be considered crazy in normal times. But freezing markets is not the answer. Their wild fluctuations are symptoms of the crisis, not the cause.” -Barron’s

The point is that investors have to rely on prudent risk management, not a stock market closing to see them through this crisis.

Prudent risk management begins with the right asset allocation for your needs.

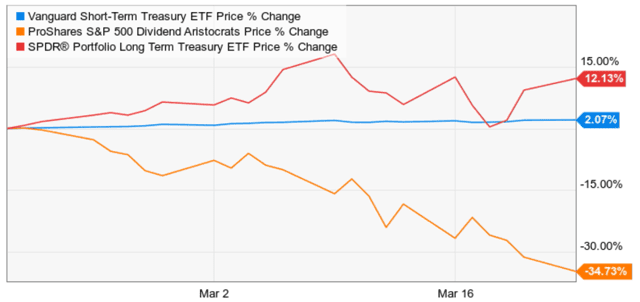

(Source: Ycharts)

For example, the dividend aristocrats are some of the bluest of the blue chips, large companies (all in S&P 500) and 25+ year dividend growth streaks. That includes two or three recessions.

Yet just like the broader market, they are down about 35%. If you were 100% in aristocrats and needed to pay an unexpected bill (or merely fund retirement expenses)? Well, you’re screwed.

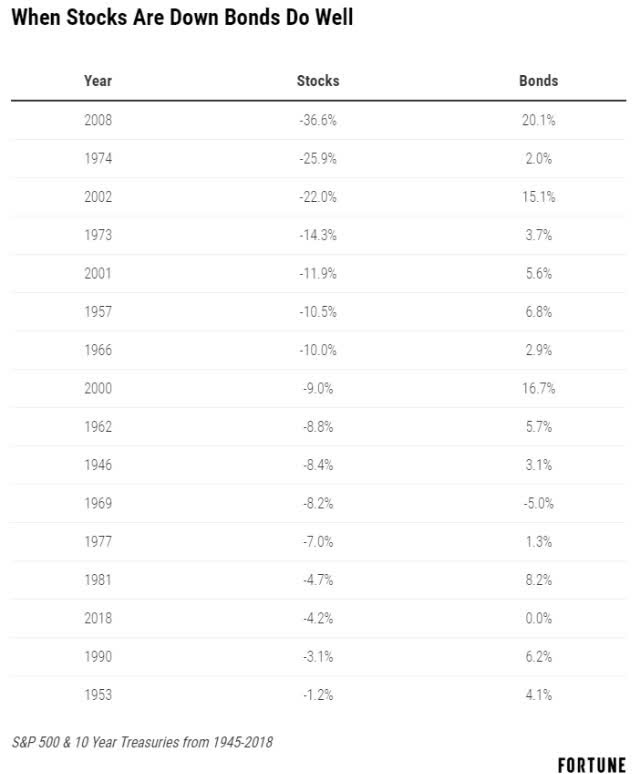

But note how long bonds (SPTL) and cash equivalents (VSGH, t-bills) have done what bonds normally do when stocks fall.

- 92% of years when stocks fall, bonds are stable or go up.

- 100% dividend aristocrat portfolio (diversified into high-quality blue chips): -35%

- 60% aristocrats, 30% bonds, 10% cash: -17% HALF AS MUCH OF A DECLINE

A balanced aristocrat portfolio would be down half as much during this bear market.

No matter how good your long-term plan is unless you can stick to it while sleeping well at night it will be useless.

(Source: imgflip)

Here’s the real key to sleeping well at night and remaining disciplined when other investors are losing their mind in panic.

The 10% cash in this balanced portfolio is stable…even during a global margin call/liquidity crunch. That allows you to fund expenses or emergency costs (like from losing your job) without selling any asset at a loss.

When the bond market stabilizes? Like after the Fed injects trillions of liquidity into it via QE and other emergency measures? Then once you run out of cash, you have a lot of bonds to sell at a profit.

Your stocks? The blue chips down 35% and counting? You never have to touch those, not until stocks recover back to all-time highs.

There is a reason that stocks are called a “risk asset” even the safest and highest quality ones on earth (like AAA rated JNJ).

In a bear market, almost all stocks fall, which is why the notion of a dividend stock “bond alternative” is pure folly.

(Source: Guggenheim Partners, Ned Davis Research)

No money you’ll need for 3 years (and preferably five years) should EVER be invested in stocks, no matter how high-quality.

The average bear market lasts three years, measured from peak to peak. The average market crash (which we are 5% away from right now), lasts about five years.

If you have five years’ worth of cash/bonds (when supplemented with pension/SS or dividends)? Then you have the time required for stocks to likely recover.

That’s how you follow Buffett’s cardinal rules of prudent long-term investing.

(Source: imgflip)

THIS is what I am talking about when I recommend companies as part of a “well-diversified and properly risk-managed portfolio”.

A portfolio that lets you sleep well at night no matter what the economy/market or individual company prices might be doing.

There is no question that over the long-term stocks are the best income/wealth compounders you can own.

But as the saying goes “stocks let us eat well, bonds let us sleep well.”

If you can’t remain disciplined during a bear market? Well, I’ll leave you with one final quote from the Oracle of Omaha.

(Source: imgflip)

Want more great investing ideas?

How the Federal Reserve Is Preventing a Bond Calamity

Reitmeister Total Return portfolio – Discover the portfolio strategy that Steve Reitmeister used to produce a +5.13% gain while the S&P 500 fell by -14.97%.

Free Access Pass to Wealth365 Online Summit– join many of the world’s top investors to learn strategies to not just survive, but actually thrive in the midst of this bear market.

SPY shares were trading at $254.78 per share on Friday morning, down $6.42 (-2.46%). Year-to-date, SPY has declined -20.38%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| Get Rating | Get Rating | Get Rating | |

| Get Rating | Get Rating | Get Rating |

(Source: Ycharts)

(Source: Ycharts)