Most folks think retiring on $527K is a dream—but most folks haven’t heard of high-yield closed end funds (CEFs). With yields as high as 22%, these unsung income plays can fast-track your race to financial independence.

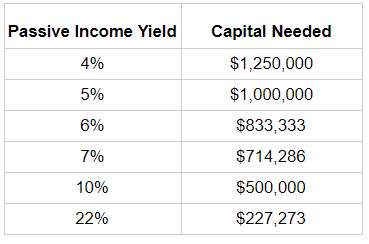

Here’s how: let’s say you’re looking to clock out and use your portfolio to replace $50,000 in yearly employment income. Many financial advisors will tell you that the most you can withdraw out of a conservative stock portfolio is 4% a year (this is known as the 4% safe withdrawal rate). Simple math tells us that this means you will need $1,250,000 to retire.

High-yield investments like CEFs turbocharge that because we’ll need less capital to get that $50,000 annual income stream. If we can find an investment giving us a 5% yield, we only need a million, so we could reduce the amount we’d need to save by $250,000. And if we can get higher yields, we can cut it down even more.

The Bigger the Yield, the Less Needed to Save

So it follows that a retiree who finds a 7% passive income stream needs half a million dollars less than a retiree blindly following their financial advisor.

But is a safe 7% dividend stream possible? With CEFs, the answer is a resounding yes.

CEFs are designed to invest in familiar assets—stocks, bonds and real estate investment trusts (REITs), for example—but are professionally managed to buy and sell assets at the best possible time to hand out a high income stream to investors. The best CEFs yield 7% or more and have done so for over a decade without cutting their payouts.

A Massive Income Boost

Source: CEF Insider

As you can see above, the average CEF yields 7.4% today, nearly four times more than the S&P 500’s average payout. Plus, CEFs are diversified across many different asset classes, including municipal bonds, corporate bonds and stocks in various sectors and countries, so you can build a portfolio of several different funds and get a diverse mix of assets while still getting a retirement-level income stream.

And we can do better than 7.4%. With many high-quality CEFs paying more than that, we can boost our dividends up to over 9% without breaking a sweat.

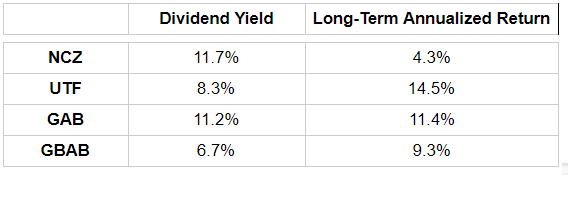

A Diversified 4-CEF Portfolio Yielding 9.5%

Take, for instance, this 4-fund portfolio: the AllianzGI Convertible & Income Fund (NCZ) for corporate bonds, the Duff & Phelps Utility and Infrastructure Fund (DPW), for utilities, the Gabelli Equity Trust (GAB), for stocks and the Guggenheim Taxable Municipal Managed Duration Trust (GBAB), for municipal bonds.

Combined, that gets us a portfolio with a 9.5% dividend yield and an annualized return of 9.9% per year.

High Income, Steady Returns

So, with just these four funds, we’ve created a high-yield CEF portfolio that can get us into retirement with $50,000 in annual income on just a $527K investment.

And these aren’t even the best CEFs out there! There are plenty of others you can combine into a diversified portfolio that pays a massive yield. This is one reason why these little-known funds are the income investor’s short cut to a worry-free retirement.

Free Report: 5 Bargain Funds with Safe 11% Dividends

A “1-Click” Way to Grab Safe 8% Dividends

The $43,000 “dividend secret” Wall Street hides from you

SPY shares rose $0.48 (+0.16%) in after-hours trading Friday. Year-to-date, SPY has declined -5.82%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Michael Foster

Michael Foster has worked as an equity analyst for a decade, focusing on fundamental analysis of businesses and portfolio allocation strategies. His reports are widely read by analysts and portfolio managers at some of the largest hedge funds and investment banks in the world, with trillions of dollars in assets under management. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |