Much ink has been spilled over how Robinhood traders, which has become short-hand for Millennium age or younger, who’ve enjoyed their first rush into investing, or shall we call it trading, by buying the dip at the depth of COVID-19 created sell-off. I, too have been guilty of glomming onto to Dave Portnoy and his band of merry traders because not only does it make for great content but the fact is they have been making a mockery of the market as a whole and targeting investment legends like Warren Buffet specifically, claiming he’s washed up 90 year man.

Millennials have been blamed for the ‘killing’ of a wide variety of products and industries. But, they may have just saved Wall Street, or at least given it a boost into the next iteration. In recent weeks, the old guard, from Bill Gross, Sam Zell, Jeremy Grantham, Carl Icahn, and Stan Druckenmiller have all made high profile media appearances stating their bearish case.

Meanwhile, Portnoy and his cohort are starting to get equal time on-air, show nothing but exuberance, often describing their process and experience with stocks as simply “fun’ and prices always go up.

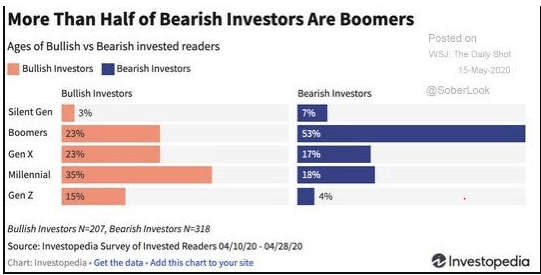

As a peacemaker, I think both parties can be right. The elders may have simply succumbed to the fact as you get older your risk tolerance decreases, it simply makes sense to go into preservation mode as your life draws to a close. But more impactful in the decision making of becoming negative is the inability to keep up with technological changes in which to develop a new ‘blue sky’ vision within the investment landscape.

Whether it be in music or in sports or in markets, the prior generation never thinks “kids” will ever measure up. Basically, the old guard has become old. Yes, they’ve all had brilliant careers and made gobs of money being active investors in the financial markets. But now they are gloomy.

As Benjamin Graham- the man who basically invented value investing, they’ve fallen victim to the “get off my lawn syndrome.” Meanwhile, the young guns are embracing the market, whether it be active trading or learning about long-term investing like never before. This pivot makes sense because the economic challenges of the millennial generation, now in its 20s and 30s, is in some ways the opposite of what baby boomers faced at the same age. Rather than struggling with high inflation and interest rates, the challenges have been low wage growth and a labor market that too often is far from full employment.

They simply cannot afford to have a ‘balanced portfolio” in which 20%-30% is allocated to bonds that yield nothing. Investors under the age of 35-40, even if they came late due to the scar tissue left by the 2009 financial crisis, can and must focus on growth.

For the younger cohort, who didn’t get burned during the dot.com, this a full fresh greenfield opportunity in which to begin learning and building both trading and investing skills. This market has been wild. It offers something for everyone. I think we could all use some of the younger people’s unbridled enthusiasm.

To learn more about Steve Smith’s approach to trading and access to his Option360 click here.

Want More Great Investing Ideas?

9 “BUY THE DIP” Growth Stocks for 2020

Top 3 Investing Strategies for the Year Ahead

7 “Safe-Haven” Dividend Stocks for Turbulent Times

SPY shares were trading at $313.82 per share on Tuesday afternoon, up $3.20 (+1.03%). Year-to-date, SPY has declined -1.92%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |