The coronavirus pandemic has brought much of the world to a screeching halt. For the first time in history, much of the world is voluntarily shutting down its economy in an all-out war to beat a virus.

The result is likely to be the most severe recession in history, as I’ve explained here.

However, the real reason that the stock market dived almost 35% in a mere month, isn’t due to tens of thousands of deaths, or even economic reports so bad they seem literally the stuff of nightmares.

Fastest Bear Market in History…And It Might Not Be Over Just Yet

(Source: Ycharts)

In just over a month the S&P 500 dived 34%, the fastest bear market in history.

The sharp hit to corporate earnings created by many companies literally having to shut down for an indeterminate amount of time is what sent Wall Street into a selling frenzy.

So let’s take a look at what the current consensus is for how bad earnings are going to get, as well as how horrible they actually might prove, and what you can do to protect yourself from what’s likely to be the earnings season from hell.

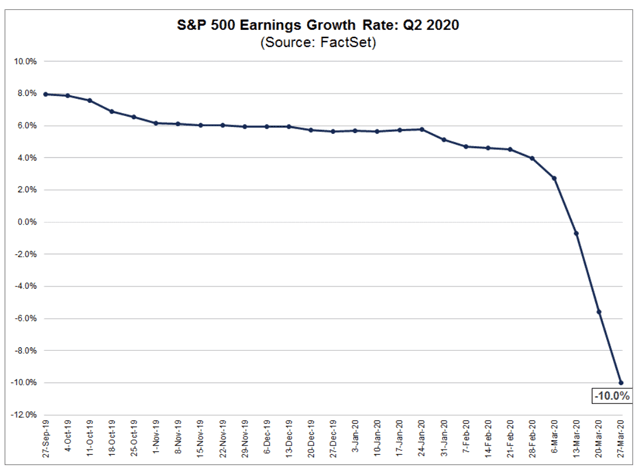

Consensus Estimates Are Pretty Bleak…

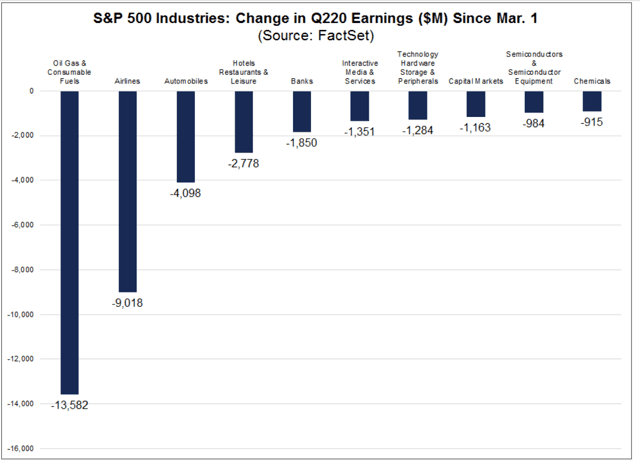

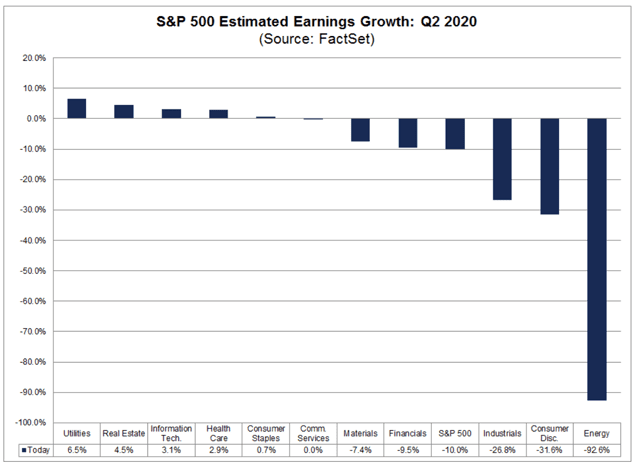

Here are the downward revisions for Q2 earnings (which start rolling out in July en mass) for certain hard-hit industries.

These numbers aren’t surprising but the effect on the total earnings of corporate America is expected to be severe.

Not every sector is expected to suffer negative growth, but the most economically sensitive ones are expected to see YoY growth that is impressive in its bearishness.

Keep in mind that oil prices might crash as low as $5 due to what the International Energy Agency is estimating might be a 20 million bpd oil glut. For context, the 2016 oil crash was the result of a mere 400,000 bpd glut.

The OPEC + Russia price war, combined with an unprecedented global recession, could result in an oversupply of oil that’s 50 times as large. It could be so massive that within 2.5 months all the world’s storage capacity will be maxed out.

At which point, should Saudi Arabia and Russia continue their dangerous game of chicken, crude could crash even faster, as some suppliers might literally have to pay customers to take their oil.

In 2016 North Dakota oil traded at -$0.50 per barrel, and in Canada bitumen-based crude is already at close to zero.

In other words, current consensus estimates, of a 10% decline in Q2 earnings and -1.4% 2020 EPS growth (-1.2% from Lipper Financial) might prove too conservative.

…BUT Might Prove Far Too Conservative

How bad could an earnings crash be in 2020 but especially in Q2?

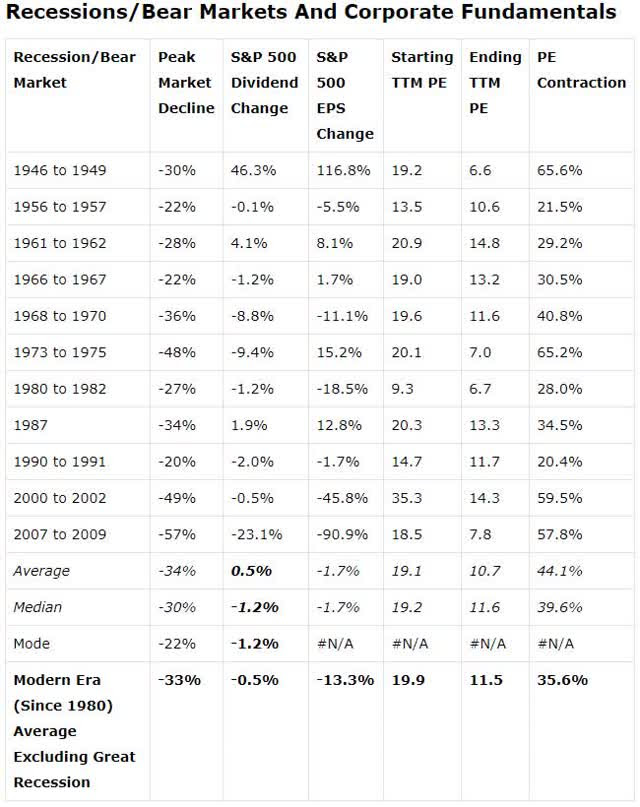

(Sources: Moon Capital Management, NBER, Multipl.com)

The average recession sees EPS decline by 13%. But there is nothing average about this recession.

- Bank of New York Mellon initially forecast -13% EPS growth for 2020, now forecasting -25%

- Goldman initially estimated zero EPS growth, then -5%, then -13%, now -33%

- Goldman expects Q2 earnings growth to be more than -100% (for the S&P 500 to post billions in losses)

But there is good news as well. Both in terms of how to protect your portfolio from this potential earnings devastation, and how to even profit from it.

How You Can Prepare for an Earnings Season From Hell

First, we need to remember that proper investing always focused on the long-term, including for black swan events like this.

Proper asset allocation, that allows you to ride out economic/market storms is step 1 in winning by not losing.

If you can avoid selling stocks in a bear market, either psychologically or financially, then you’re halfway to achieving your long-term financial goals.

Second, you want a diversified portfolio of top-quality companies, with balance sheets that can weather what’s likely coming later this year.

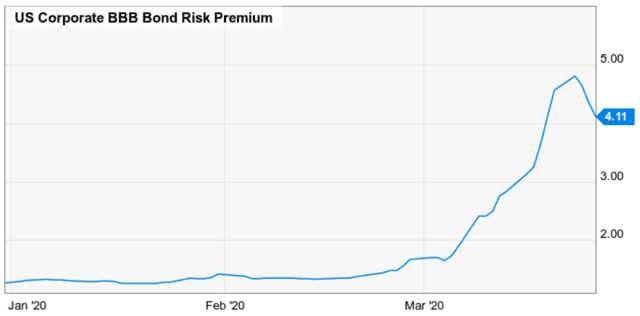

(Source: Ycharts)

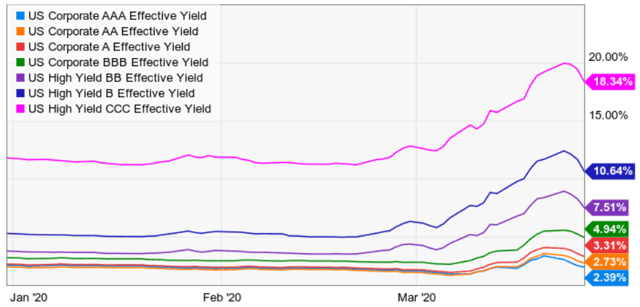

The Fed’s recent corporate bond-buying has slightly eased corporate credit conditions, as you can see from average corporate borrowing costs.

(Source: Ycharts)

The higher a companies credit rating the lower its borrowing costs are, and the more low-cost capital it can access just in case this pandemic turns out to be longer than currently expected.

The US government is planning for a worst-case scenario in which the nation might have to effectively be shut down for as long as 18 months. Goldman’s -33% EPS growth 2020 forecast is based on just one-quarter of losses.

The firm expects +55% EPS growth next year, a bonanza of growth created by very easy comps.

But imagine what would happen to 2020 earnings if America and many of its companies had to remain shut down for both Q2 and Q3? Or even the rest of the year?

An “A” credit rating, which is the average of the 60 companies in the Dividend Kings Phoenix Portfolio (most likely to rise from the ashes and soar to new heights) is an invaluable safety net when we still don’t know how bad this pandemic will get or how long it will last.

For example, Alphabet (GOOG) is a Phoenix stock with an AA+ credit rating, literally as good as the US treasury (according to S&P).

How strong is Alphabet’s balance sheet? Its average borrowing cost is just 0.5%, about five times less than the US Treasuries’ because it borrows overseas where rates are near zero or even negative.

What’s more, GOOG has $120 billion in cash vs $4 billion in long-term debt. That means that GOOG, whose ad-based business is expected to take a modest hit in this recession, could ride out not just lower earnings, but massive losses, for several years.

No company is “risk-free”. Even Alphabet, with a mountain of cash and a wide moat, can theoretically go bust (Sears used to be the largest retailer in the world and seemed invincible).

However, for GOOG to actually go bankrupt? That would require such economic devastation, that persists for so long, that realistically it would likely mean a total collapse of the world economy and possibly civilization itself.

If that happens? Well, what you own in your portfolio isn’t going to matter and we’ll likely be too dead to care about stocks.

Want more great investing ideas?

The Fake Rally is Over! – Why the bear is still in charge. Along with the right investment strategy to generate profits while stock prices head lower.

How to Make Money in a Bear Market – Learn more about this vital webinar with famed investor Marc Chaikin.

Reitmeister Total Return portfolio – Discover the portfolio strategy that Steve Reitmeister used to produce a +5.13% gain while the S&P 500 fell by -14.97%.

SPY shares were trading at $251.04 per share on Thursday afternoon, up $4.89 (+1.99%). Year-to-date, SPY has declined -21.54%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |