“At the end of the day, all price action comes down to earnings.”

The above is a quote from Ben Zacks…the famed money manager over at Zacks Investment Management that I worked for over twenty years ago.

Indeed that quote is 100% true. In particular as it refers to expectations for future earnings. That is why we are going to dive into the latest earnings season to see what it tells us about the future for stock prices.

Market Commentary

While the investment world was focused on inflation and the Fed a very interesting earnings season took place. The details of which tell us about recent price action and what may lay ahead.

In short, I would say it was a bad earnings season because earnings estimates continue to come lower for the year ahead. However, expectations were so low that it created an easy hurdle to climb over giving some logic behind the early 2023 rally.

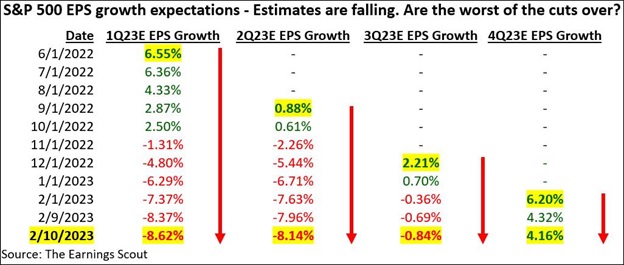

There is no shortage of data one could analyze. However, I believe the following chart is the best way to assess how Wall Street feels about this earnings season.

Let me add some color commentary to make sense of these trends.

What you see here is the change of future earnings growth expectations for the S&P 500 in each quarter for 2023. Clearly things have been moving in the wrong direction for quite some time and only got worse as earnings reports rolled out over the last several weeks. Most notable is how the next 3 quarters are showing negative earnings growth when +10% earnings growth is the norm during bullish times.

The most optimistic view is to say that Q1 earnings estimates ONLY slipped from -6.29% to -8.62%. Because the average recession comes with 20% earnings declines then it could be said that the modest revisions keep the hopes alive for a soft landing. That would say the worst is behind us and new bull market emerging.

The more pessimistic view is to appreciate that Wall Street is usually behind the curve at the onset of a new recession. And thus estimates being cut by 20% or more may still be on the way. That negative outcome is most certainly not priced into stocks at this time and points to the potential for much more serious downside ahead.

Boiling it all down…the earnings outlook depends on the economic outlook…which depends a good deal on the Fed.

On that front Powell was decidedly more hawkish after last Friday’s strong employment report which showed far too much wage inflation. He was quite candid in his Economic Forum interview that this may lead the Fed to raising rates higher than previously expected…or for longer than expected.

This flies in the face of the bullishness experienced to start 2023. Which likely explains the haircut we have taken this past week.

Let’s dial into that price action for a moment.

The initial sell off from a recent high of 4,200 just seemed like your typical digestion after eating up a lot of gains. However, Friday we saw a very clear sector rotation away from Risk On assets and back towards Risk Off.

The poster child for Risk On is Cathie Wood’s ARK Innovation Fund (ARKK - Get Rating) which dropped a whopping -3.33% on the session even when the S&P closed in positive territory.

On the other end of the spectrum we saw defensive Risk Off groups like healthcare, utilities and consumer staples were STRONGLY in positive territory on the day.

If this defensive rotation continues, then it means that more investors appreciate the false start of the 2023 rally and why there are still many reasons to be bearish. That includes the declining earnings picture as shared today coupled with a increasingly hawkish Fed.

The key for price action in the near future is the possibility to break out of the current range of 4,000 to 4,200 for the S&P 500 (SPY - Get Rating). In particular, being mindful of a break below 4,000 and right after the very important 200 day moving average at 3,945.

A break below that would start a likely stampede back to the bearish side. Let’s remember that 3,491 was the previous low. And the average bear market decline of 34% would have us retreating to 3,180.

Here are some upcoming events that could serve as catalysts for future price action:

2/14 Consumer Price Index

2/15 Retail Sales

2/16 Producer Price Index

Indeed anything is possible when it comes to the economy and how investors react. But given the facts in hand, I still believe that extension of the bear market is 2X more likely than emerging into a new bull market at this time.

Trade accordingly.

What To Do Next?

Watch my brand new presentation: “Stock Trading Plan for 2023” that will help you assess the full bull vs. bear case to create the right trading strategy. It covers vital topics such as…

- Why 2023 is a “Jekyll & Hyde” year for stocks

- How the Bear Market Could Come Back with a Vengeance

- 9 Trades to Profit Now

- 2 Trades with 100%+ Upside Potential as New Bull Emerges

- And Much More!

Watch “Stock Trading Plan for 2023” Now >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

Want More Great Investing Ideas?

SPY shares were trading at $408.01 per share on Friday afternoon, up $0.92 (+0.23%). Year-to-date, SPY has gained 6.69%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| ARKK | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |