We enjoyed a tremendous turnout for this live event Thursday afternoon, where I shared our most profitable solution for investors. This includes details on our 100 best stocks for July…and the rest of the year.

The revolutionary trading system shared in the presentation actually consists of 10 different “black box” trading strategies each with precisely 10 stocks each. Thus, coming out with the 100 best stocks at any time.

To create these strategies, we turned to the same Data Scientist who created our coveted POWR Ratings. We had 3 key requests for this project:

- 10 unique stock picking strategies. Something for every investor

- 10 stocks per strategy updated daily

- MOST IMPORTANT: Provide stellar performance

And boy did he ever deliver!

10 strategies x 10 stocks each = 100 best stocks.

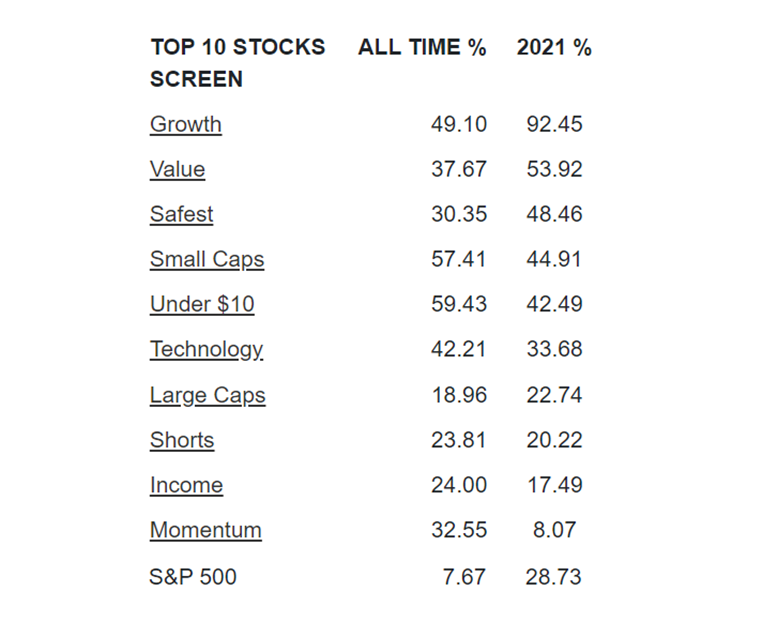

And as you will see in the table below these strategies did exceptionally well in 2021 including +92.45% for our Growth strategy.

It is also good to know that they have consistently topped the market over time. This comes in loud and clear in the All Time % column showing the impressive average annual returns going back to 1999.

Proof positive that these “black box” trading strategies work well now…and have consistently worked well over time.

Truly this is a game changing investment tool that continues to outperform even in the rough and tumble 2022 stock market.

For example we have a strategy up +45.12% year to date even as the S&P 500 (SPY) dropped -20.57% through 6/30/22.

You owe it to yourself to get on the right foot for the rest of the year by watching this valuable presentation now, so you can use these winning strategies to outperform in the weeks and months ahead.

Simply click below to get immediate access to this timely investment presentation:

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com

Want More Great Investing Ideas?

SPY shares were trading at $383.03 per share on Friday morning, up $5.12 (+1.35%). Year-to-date, SPY has declined -18.76%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |