(Please enjoy this updated version of my weekly commentary published September 13th, 2022 from the POWR Growth newsletter).

As usual, we will start by reviewing the past week…

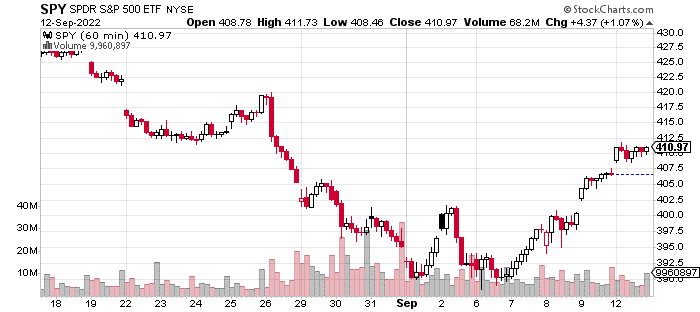

Here is an hourly, 3-week chart of the S&P 500 (SPY - Get Rating):

Over the last 2 weeks, the S&P 500 is up by 2%. Of course, this belies the volatility as it was down by nearly 5% at one point before reversing early last week. From these lows, the S&P 500 is up more than 6%.

And, tomorrow morning, we have the August CPI report which could be another market-mover. Currently, analysts are looking for 7.9%, and the market also expects a soft number as evidenced by this recent bout of strength.

So, we could see all or a chunk of these gains quickly given back or this advance accelerate with a very soft reading.

Next week, we have an FOMC meeting which also will add to volatility. It will be interesting to see if the FOMC will acknowledge any weakening in the economy or erosion in inflationary pressures or if it remains steadfastly hawkish.

And sandwiched between these 2 major market-moving events is a quarterly options expiration day which tends to add to volatility.

Bullish vs Bearish Paths

The market is encountering an interesting mix of bullish and bearish forces.

On the bullish side, the economy continues to be resilient. This is evident as Q2 earnings season saw earnings growth of 6% with another 4% expected in Q3.

If anything, there are signs of improvements in the economy with jobless claims plunging and consumer spending perking up as gas prices move lower.

Additionally, it seems likely that we could have our second straight month of lower inflation. Gas prices are down 12% over the last month, while used car prices are down 4%. These are leading indicators of inflation and support the notion that it’s losing momentum.

And, it’s certainly encouraging that inflation seems to be cooling fast, while the economy has remained resilient, especially in terms of employment.

These are the biggest factors in equity strength, while the biggest headwind is the Fed.

The Fed is determined to keep financial conditions tight to ensure that inflation keeps coming in lower.

A booming stock market is inconsistent with tight financial conditions, so any equity strength could be met with hawkish Fedtalk which is what we saw in early August when the S&P 500 (SPY - Get Rating) approached 4,300 last time.

Adjustments to Trading Strategy

As noted above, the odds of a soft landing have continued to increase. This is especially true as economic growth seems to be firming, even while inflationary pressures continue to abate.

Given this development, it’s prudent to increase the risk we are taking in the portfolio by increasing our allocation to high-beta positions.

What To Do Next?

The POWR Growth portfolio was launched in April last year and since then has greatly outperformed just about every comparable index…including the S&P 500, Russell 2000 and Cathie Wood’s Ark Innovation ETF.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +49.10% annual returns. I then take the very best stocks from this strategy and tell you exactly what to buy & when to sell, so you can maximize your gains.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

Want More Great Investing Ideas?

SPY shares fell $9.27 (-2.26%) in premarket trading Tuesday. Year-to-date, SPY has declined -14.62%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |