(Please enjoy this updated version of my weekly commentary from the Reitmeister Total Return newsletter).

Last Thursday the market action was becoming FAR TOO reminiscent of the runaway stock market bubble of the summer. Especially given how it was the same old tech stocks leading the way. This led us to add 3 fresh stocks into the Reitmeister Total Return portfolio. This scenario is what is behind door #1.

On the other hand, the historical pre-election pattern shows several rallies falling just short of the all time highs and then the market tumbling in the final weeks into the election. This lies behind door #2.

Which version of history will repeat itself…the summer bubble or the pre-election sell off?

Let’s peak behind both doors to determine which to walk through.

Market Commentary

The action the last few weeks sure feels like “The 2020 Bubble Part 2”. Let me explain it with the following three storylines.

Storyline #1: Tech Stocks Leading the Way

OK, this is an old story line that worked all summer long. So in the midst of a bubble investors don’t think “Hey its times to change course and let a new group take the lead”.

No a bubble is that whatever worked in the past will work again in the future. That is why I often refer it to pressing the “Easy Button”.

But the real oddity here is that this is taking place all the why the government is talking about breaking up the seeming monopoly powers of the big tech companies. So for tech to rally as the risk of this story picks up is stupefying odd to the rational thinker. And the loss of reason is another hallmark of a bubble.

Just to reinforce the absurdity of the returns. Please check out these results from Monday.

+0.63% for Mid caps

+0.67% for Small caps

+1.64% for S&P 500 which is top heavy with tech stocks

+2.56% for Tech Heavy Nasdaq

+3.56% Alphabet/Google

+4.27% Facebook

+4.75% Amazon

+6.35% Apple

Storyline #2: Likelihood of Delayed Election or Contested Election Growing Stronger

We have talked ad nauseum about the historical pattern of the market falling into an election. Indeed that took place a little in September. But it is only supposed to get uglier in October. And yes…this still could happen.

However, right now the market is gaining steam to the upside. And in all the usual suspects of the past (Tech, FAANG, Tesla etc). This is completely ignoring the likely damage that would be caused to the market from the uncertainty surrounding a delayed or contested election. And the evidence is mounting by the day that both of these are strong possibilities.

So once again, ignoring clear and present danger is a sign of a bubble.

Storyline #3: Market is Rallying Because of Stimulus Talks

That is kind of funny when you consider that the market is rallying because economy is so bad that we need a 3rd round of stimulus. But no one cares about government debt (yet) and it does improve the prospects for the economy. So yes, it is true that stimulus is a positive for the stock market.

But now consider the following: Did you ever think for a second that there wouldn’t be more stimulus?

Of course we all know it is coming sooner or later and that any delay is just the typical “sausage making process” of government negotiations.

Simply stated, more stimulus was a given. So to rally on this news as if it was a SURPRISING positive is kind of odd. Like the kind of activity that happens in a bubble market when the market rallies for any and all reasons even things that are as obvious as the nose on my face (yes, I have a large nose…that’s the point

Adding the 3 points above sure feels a lot like the second coming of the summer bubble rally led by tech stocks. Yet this seeming runaway rally is still did run out of steam about 40 points below the all time highs set in early September at 3,588.

Maybe that is because the historical pre-election pattern IS playing out after all. We have talked about very often in recent commentary. So if a picture is worth a thousand words, then let these 2 pictures of price action in the previous 2 election years speak volumes:

2016 Election: Trump vs. Clinton

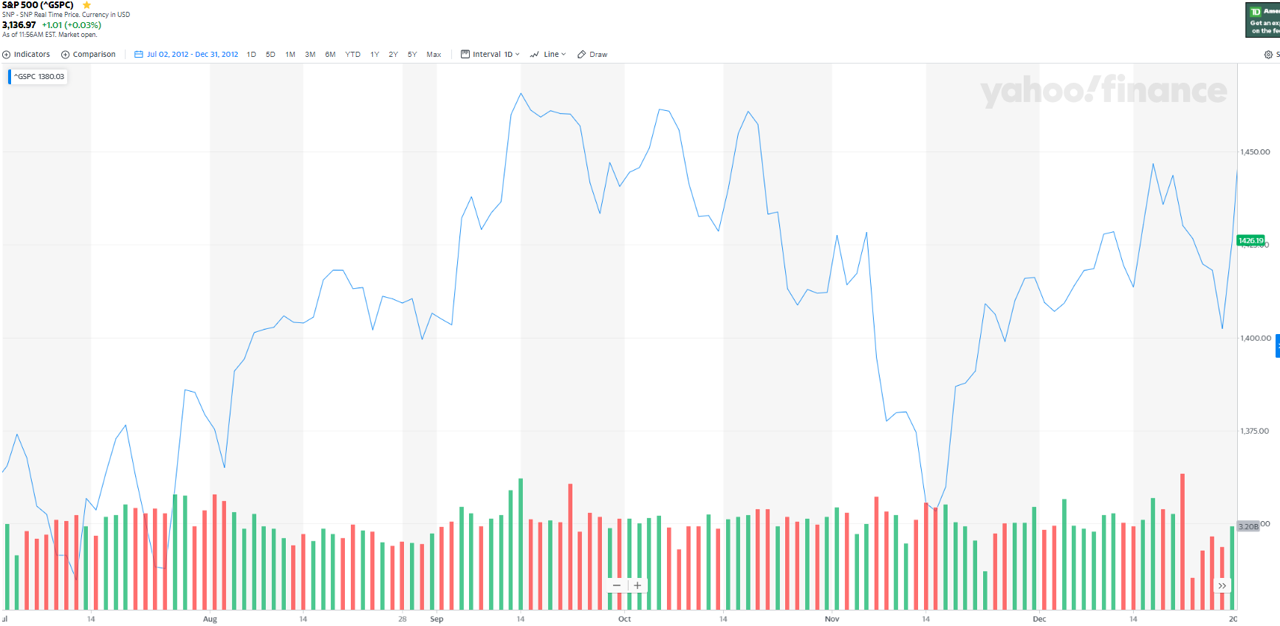

2012 Election: Obama vs. Romney

The similarities should be clear. Stocks rally up to September. Then a series of falls followed by bounces back to ALMOST the previous high only to falter again. And then in the last few weeks leading up to November election stocks tumble into voting day.

So the sell off Tuesday may be step one of several whereby the pre-election pattern does come to fruition. I still like the odds for this to come true. But realize that the irrationality of the summer bubble may win the day.

Because of that my game plan works as follows. We plan to keep our portfolio in a defensive shell until the election. And that defensive shell is constructed as follows:

48% Long attractive growth stocks at a reasonable price

26% Inverse ETFs

12% Precious Metals

14% Cash

(Discover all 6 stocks and 5 ETFs inside the Reitmeister Total Return portfolio by clicking here).

IF stocks do break above the previous highs would be a sign that the historically negative pattern is not going to repeat for which we would trim our Inverse ETF positions and add more longs. Meaning we would ride the bubble as well to new heights.

But if things play out as expected, with lower stock prices ahead into the election, then we will take our profits on the inverse ETFs after the election is finalized and get ready to rally again.

And just for 110% clarity, “finalized” means that the loser of the election actually concedes removing any uncertainty from the equation. Because with all the write in ballots the possibility of either side contested results and delaying the finalization of the election is much higher than any of us should like. And that would certainly be a negative for the market.

So we are prepared for any and all outcomes. Now let the chips fall where they may and we will react in timely fashion.

What To Do Next?

Right now my Reitmeister Total Return portfolio has already taken steps to protect against the pre-election sell off that seems quite likely to take place.

All in all we have 11 positions that are just right for the times:

6 stocks that are uniquely built to excel during the Coronavirus recession.

3 inverse ETFs that rise as the market falls. This has been our saving grace in September as the market tumbled from recent highs. And likely will continue to rise in value if it is true that this correction has not yet run its course.

2 precious metals ETFs because when the US government and Fed throw money out of a helicopter it devalues the dollar and makes precious metals all the more valuable.

But let’s be honest with ourselves. Its crazy out there!

That’s why I am trying my best to help investors make sense of it all and profit from whatever scenario comes our way. The best way for me to do that is give you 30 days access to the Reitmeister Total Return.

This is my newsletter service where I share more frequent commentaries on the market outlook, trading strategy, and yes, a portfolio of hand selected stocks and ETFs to produce profits whether we have a bull…a bear…or anywhere in between.

Now is a tricky time for the market as we have competing factors at play. Either a return of the summer bubble or quite the opposite action if stocks fall into the historically negative trend of tumbling into election day.

So if you want to stay on the right side of the action, you might want to see what we are doing in the Reitmeister Total Return portfolio.

Just click the link below to see all 11 stocks and ETFs in this uniquely successful portfolio. Plus get ongoing commentary and trades to adjust your strategy as 2020 continues to be the wildest market in history. Gladly it can be tamed.

About Reitmeister Total Return newsletter & 30 Day Trial

Wishing you a world of investment success!

Steve Reitmeister

…but everyone calls me Reity (pronounced “Righty”)

CEO, Stock News Network and Editor, Reitmeister Total Return

SPY shares rose $0.26 (+0.07%) in premarket trading Wednesday. Year-to-date, SPY has gained 10.34%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |