What really sticks out to me in 2022 is the myriad of investment strategies that can be employed during a bear market. Your financial advisor wants you to believe that it is IMPOSSIBLE to time the market. Then they can show you charts to prove that it always comes back at some point. In other words, they want you to “Stay Calm and Carry On”.

Sure there is some historical evidence pointing out the difficulty in timing the market. But this “ostrich in the sand” strategy led to about 50% losses for the average investor during the Financial Crisis and Great Recession back in 2008.

A lifetime of savings cut in half by doing nothing in the face of OBVIOUS difficulties. That should compel each of us to find a better, more proactive path when the bear comes to town.

Now let’s flash forward to 2022 where by the late Spring we could all fully appreciate this was more than just a run of the mill correction. Clearly a bear market was forming given the very high correlation between raging inflation and future recessions. And indeed, inflation was RAGING!

As you know I run 2 newsletters (Reitmeister Total Return and POWR Value) and thus I embarked on 2 different strategies to not be asleep at the wheel as the bear market came to town. Thus, we should review the pros and cons of these unique approaches in the hopes of that it will help us be more successful in future bear markets.

POWR Value = Half Cash & Half Safe Stocks

In a way, my hands were tied with POWR Value. Given the charter of the service it is there to find the best value stocks rain or shine. Meaning it is not meant to time the market. HOWEVER, when the bear is in the air the service is allowed to go up to 50% in cash which is what we did since evolving to a bearish outlook in May/June.

With that backdrop in place, let’s review the year to date picture including the steps that took place as we got more cautious in late May, then downright bearish by mid June where we stand today.

(I started tracking performance for the POWR Value portfolio on 12/1/21 when I took over as Editor of the service. At that time, I set the starting value at $100,000 which means it rose $6,330 into year end. This higher value also marks the starting point for our 2022 performance review).

No…I will not be winning the Nobel Economics prize for losing only -3.94%. But compared to the -19.82% loss for the S&P 500 or the much, much steeper losses heaped on small cap and growth oriented investors this year, then it shows a great advantage that does compel one to consider if it is worth timing the market as that is not a cup of tea as we shall explore below.

The main reason for these market beating results has to be given to the POWR Ratings. Rain or shine this proven model continuously finds the best stocks ready to outperform. The bear market of 2022 proves that point once again.

More thoughts on the POWR Value results in the Conclusion section further below. Now let’s switch our focus to the strategy employed by the…

Reitmeister Total Return = Bearish Hedge Anchored by Inverse ETFs

This service is meant to have great flexibility. To do whatever it takes to find profit regardless of market direction. That notion is kind of built into the name “Total Return”.

At first I did not see the bear clouds forming. Just looked like a good ole fashioned correction because the early signs of inflation seemed “transitory” as the Fed was fond of saying. Like a hangover from Covid in the supply chain that would soon be cured (take 2 aspirin and call me in the morning

But that was not the case. Indeed inflation was persistent…and the Fed was behind the curve…and the combination of which got investors to increase odds of recession which begat the bear market.

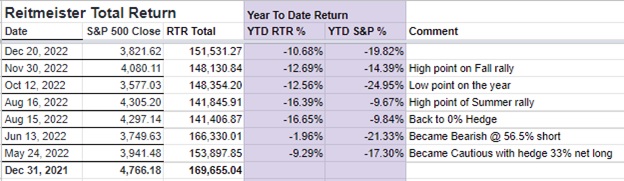

Now let’s review the Reitmeister Total Return portfolio results followed by discussion:

(I started tracking performance for the Reitmeister Total Return portfolio on 6/11/20 using a starting value of $100,000. At the end of 2021 the portfolio had swelled to $169,655.04 which also marks the starting point for our 2022 performance review).

In a way there really was 4 phases to what we did in Reitmeister Total Return in 2022 and thus good to review them in isolation.

Phase 1- Start of year til 5/24/22

I was fully long the stock market expecting a bounce back to a bull market. The modest -9.29% loss on the year was actually half of the pain experienced by the S&P 500. Yet a small fraction of the pain endured by most growth oriented investors. (Just ask Cathie Wood).

Once again this points to the benefit of the POWR Ratings finding more stocks ready to outperform…and help avoiding the picks most likely to languish. Also we benefited greatly from a timely trade on TBT to short the Treasury bond market as rates were flying higher.

Phase 2- 5/24/22 to 6/13/22

More and more signs this could be more than a correction. So became increasingly cautious on market outlook which led me to reduce the portfolio to just 33% long stocks. The market only moved -4% lower in that time…but our outperformance over the market grew nicely.

Phase 3- 6/13/22 to 8/15/22:

Stocks tripped the bear market wire at 3,855 pushing us to become “gung ho bears” shorting the market with both fists. This was great for a week as stocks headed lower. And then a 18% suckers rally ensued over the next two months that defied logic. This was a painful death by a thousand lashes process where we saw our once sizeable lead fritter away day by day. The pain endured by this aggressive bearish strategy led to a much more sensible approach in the next phase.

Phase 4- 8/15/22 to the Present

The summer rally had tricked many investors to join the bull party. However, I could not find the logic in that approach given the ever darkening recessionary storm clouds that would point to lower prices ahead. Yet on the other hand, just couldn’t stay put with a fully loaded short stock portfolio any longer.

The solution was a bearish hedge. This was constructed with an equal percentage weighting to inverse ETFs as it was to conservative long stocks. The purpose was to rise as the market sank, but would have less risk if market did keep climbing higher.

From beginning to end we turned a 6.81% deficit versus the market into a +9.14% outperformance as of the close this evening. The majority of that gain came in December when yet another ill fated suckers rally came to an end. That is where we stand today.

Conclusion

In summary, both of the proactive investing approaches discussed today proved far superior to sticking our heads in the sand when the bear market came to town.

As for the more aggressive approach employed in the Reitmeister Total Return portfolio, it has certainly worked…but not without EXTREME volatility and a poor night’s sleep. Trying to time the market really does have you question your sanity at times

To be fair, the final score cannot really be measured until the new bull market has emerged and we see the final tally. If indeed my “2023 Stock Market Outlook” is correct, and market bottom come as I expect in the first half of the new year closer to 3,000 to 3,200…and we make the moves to take our profits at that time and bottom fish for next bull…then this proactive bearish hedge inside Reitmeister Total Return will be crowned victorious.

On the other hand, if I am wrong about that…and the movement of the stock market continues to elude and confound us…then it would appear that the more balanced POWR Value approach is the preferred path.

HOWEVER, selecting the best strategy may have nothing to do with performance. It might be more about each investor’s temperament.

Meaning if you cannot stomach the extra emotional turmoil that comes with the EXTREME volatility of a bear market, then probably best to take the smoother path employed by POWR Value.

Long story short, the lessons learned from 2022 is still a work in progress. So, I will be sure to share the final tally when we finally get to bear market bottom.

For now, please move ahead with the strategy that makes the most sense for you. Given that they are both outperforming by a wide margin should give you great comfort going forward into the new year.

What To Do Next?

Watch my brand new presentation: “2023 Stock Market Outlook” covering:

- Why 2023 is a “Jekyll & Hyde” year for stocks

- 5 Warnings Signs the Bear Returns in Early 2023

- 8 Trades to Profit on the Way Down

- Plan to Bottom Fish @ Market Bottom

- 2 Trades with 100%+ Upside Potential as New Bull Emerges

- And Much More!

Watch Now: “2023 Stock Market Outlook” >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, Stock News Network and Editor, Reitmeister Total Return

Want More Great Investing Ideas?

SPY shares rose $0.51 (+0.13%) in after-hours trading Tuesday. Year-to-date, SPY has declined -18.95%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |