(Please enjoy this updated version of my weekly commentary published July 18, 2022 from the POWR Growth newsletter).

As usual, we will start by reviewing the past week…

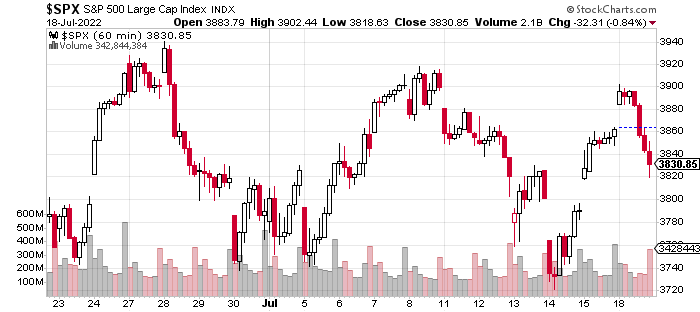

Here is an hourly, 3-week chart of the S&P 500 (SPY - Get Rating):

From last week, we are down by a little less than 1%. Of course, that doesn’t quite capture all the action.

Between last Monday’s close and Thursday AM, the S&P 500 dropped by about 140 points with the major reason being the CPI report coming in hotter than expected.

However, these losses were reversed by today’s open and we were actually up 1% from last Monday’s close. Some reasons for the sharp move higher (~5%) were a drop in inflation expectations and dovish Fed chatter. Of course, the market never makes it easy.

Just like bears were disappointed that the market failed to break down on the ‘hot’ CPI number, bulls were disappointed that the S&P 500 was met with heavy resistance at 3,900, falling nearly 2% from the intraday high.

Overall, this continues to be a choppy market.

What is the Bull Case?

It’s also fair to say that the market has been in a bear market for all of 2022. And, I would argue that certain parts of the market have been in a bear market since early to mid-2021.

For a whale, bulls could credulously argue that a ‘soft landing’ was possible. The odds of this have dropped, most notably according to the Fed which is now debating hikes of 75 or 100 basis points.

We have seen the effects in so many parts of the stock market (SPY - Get Rating), and they are now showing up for the economy. Just like the inflation that continues well after the Fed started hiking.

The point of this is to make clear that I believe the economy is slowing and will continue slowing for many months. But, I’ve made the case so many times in past commentaries.

Today, I want to put on a bull hat and argue the other side. First, I don’t think another bull market, beginning from here, is possible. Instead, I do think a bear market rally could happen and is something that we should consider a possibility. Although, it does require a series of positive catalysts.

First of all, sentiment is extremely bearish. This means that any positive news could spark a big rally. As noted, inflation falling is a bullish force that has been providing support to long-duration assets. China is easing. Earnings haven’t been as bad as expected.

If we look back at previous bear market episodes, we find powerful bear market rallies between 15 and 25% that lead to sentiment becoming bullish or at least neutral. We haven’t had one yet, which means that we are due.

Now, let’s throw some harsh reality on that pretty picture…

A lot of ifs are necessary for a big bear market rally to come to fruition. And, each of the bullish catalysts could fizzle as they have for much of this year. Let’s go through it:

Bearish sentiment in a bear market is a useless indicator. Inflation has failed to decline despite many forecasts of it declining. Anyways, it’s not falling because we added new capacity to the economy, it’s going down due to an impending recession.

Chinese stimulus hasn’t flowed into the economy because of Zero-COVID policies. And, earnings season is only beginning, and analysts continue to forecast positive EPS growth in Q3 and Q4.

Final Thoughts

To sum up my thinking: We are in a bear market. The economy is slowing which means more pain is coming. However, I believe that the ‘window is open’ for a bear market rally.

In terms of the portfolio, we have marginally increased exposure but are ready to get back to a more neutral position if we break below the mid-June lows.

What To Do Next?

The POWR Growth portfolio was launched in April last year and since then has greatly outperformed just about every comparable index…including the S&P 500, Russell 2000 and Cathie Wood’s Ark Innovation ETF.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +49.10% annual returns. I then take the very best stocks from this strategy and tell you exactly what to buy & when to sell, so you can maximize your gains.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

Want More Great Investing Ideas?

SPY shares were trading at $388.88 per share on Tuesday morning, up $6.93 (+1.81%). Year-to-date, SPY has declined -17.51%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |