(Please enjoy this updated version of my weekly commentary from the POWR Growth newsletter).

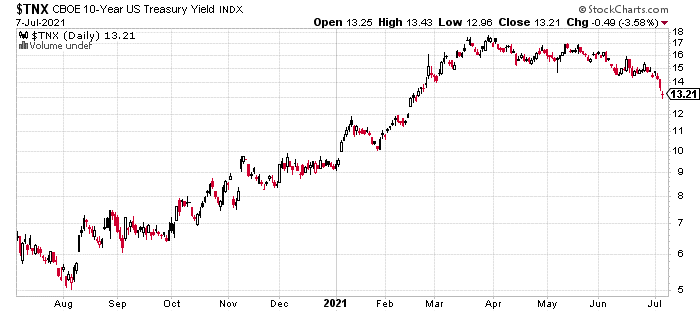

One of the major forces impacting the market is the decline in longer-term rates.

From April, the yield on the 10-year has dropped from 1.75% to 1.32%. The 30-year Treasury had an even bigger drop – from 2.45% to 1.94%. At the same time, short-term rates have slightly risen as the 2-year yield went from 0.15% to 0.25%.

This development is contrary to a lot of the narratives that have developed over the past year, especially around inflation. The bond market is a believer that “inflation is transitory” as yields would be significantly higher otherwise, and its recent weakness only confirms it.

For equity markets, this development tends to lead to inflows into certain sectors like megacap tech, consumer staples, utilities, and dividend-paying stocks.

On a longer-term basis, it tends to elongate bull markets – a commonality among bull markets that last for more than 5 years is strength in bonds, while bull markets that lead to higher rates tend to last between 2-3 years, before the higher rates start to compete with stocks for inflows.

In the short-term, strength in bonds tends to correlate with weakness in mid-caps and small caps. As noted above, the Russell 2000 has been underperforming and is down 4% since the end of June, while the S&P 500 is 2.5% higher. When money is moving into bonds, investors’ risk appetites and growth outlook are receding which makes it a more difficult environment for growth investing.

Not impossible just more challenging.

This market environment continues to reward a more patient and conservative strategy. If anything, the market’s polarization has only intensified over the past week.

In last week’s commentary, we talked about current market conditions continuing to persist, the possibility of a deeper pullback, and the possibility that market conditions improve and become more consistent with growth stock outperformance.

There’s still no firm answer to this question. However, we are positioned and ready to take advantage of any direction the market goes.

There are good arguments and evidence on all sides. On the bullish side, we have rock-bottom interest rates and steady earnings growth which are the two most important factors for stock prices. On the bearish side, sentiment and positioning are at high levels, and the market hasn’t experienced a meaningful pullback in quite some time.

Summary

It’s likely that earnings season will be the next major driver for stock prices. Last quarter featured a strong earnings season with 70% of companies beating earnings and 80% of companies topping revenue expectations.

What To Do Next?

The POWR Growth portfolio was launched in early April and is off to a fantastic start.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +46.42% annual returns.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

Want More Great Investing Ideas?

SPY shares were trading at $431.11 per share on Thursday afternoon, down $3.35 (-0.77%). Year-to-date, SPY has gained 16.06%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |