(Please enjoy this updated version of my weekly commentary published November 22th, 2021 from the POWR Growth newsletter).

First, let’s take a look at the past week:

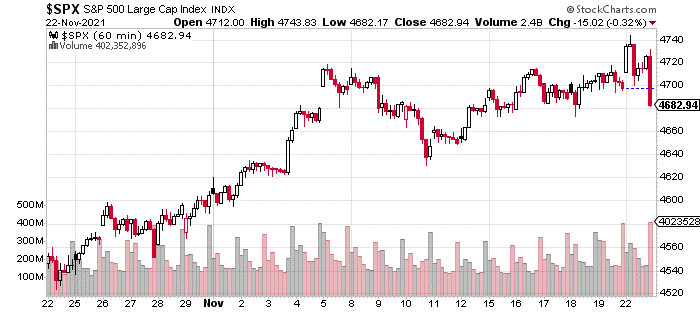

The past week’s price action also exemplifies the change in market conditions. Over the past week, the S&P 500 gradually made its way before breaking out to new highs today morning on the news that Fed Chair Powell would be renominated by President Biden.

These gains were wiped out in a couple of hours and we are basically back at last Monday’s low. Of course, this masks the damage and distribution experienced in other parts of the market over the past week. For instance, the Russell 2000 is down 3%, the energy stock ETF, XLE, is down 4%, and the Nasdaq 100, QQQ, is actually up 1% from last Monday but down 2% from today’s high.

Gameplan

Given this change in market conditions, it’s appropriate to adjust our strategy and portfolio.

I still see no change in the market’s bullish intermediate-trend. BUT what is different is that we seem to be in a narrower advance that requires more judicious stock selection and aggressive risk-management. It’s a market to go for singles and doubles rather than home runs.

In some ways, it’ll be less fun than the last six weeks when we had an environment that was conducive to going for homeruns.

We will continue to stay long and fully invested and ride the market’s primary trend higher. But, I don’t think the same sectors that outperformed in the last six weeks will necessarily do so.

I have some stocks that are on my watchlist that I believe are very well suited for the market environment.

I also remain fascinated by energy. Crude is down 10%. A few weeks ago, I would have been salivating at such an opportunity. BUT, I do think that crude deserves to go down considering the potential global, coordinated release from the SPR, signs that production is increasing, and an uptick in coronavirus cases.

My short-term solution is to not try to catch the falling knife despite potential for a big bounce given how oversold it is. Instead, I will wait for a low-risk entry point.

I still see crude oil going higher over the next twelve to eighteen months given long-term depletion in reserves and capex while demand only increases.

2 bearish items

Last week, I talked about 2 bearish developments that bear watching – coronavirus case counts and supply chain issues.

Well, there is good and bad news.

The coronavirus situation is getting worse as the 7 day average of case counts are now at 91,000 from a low of 71,000 at the end of October. I expect this to get worse given what we know about the virus’ ability to transmit during the winter and the fact that there don’t seem to be many limits on gatherings.

Of course, the situation now is much better than last year due to vaccines and better treatments. And, I’m open to the possibility that it has no effect on stock prices even those in the travel sector. So far, our hotel stock – CHH – has shown little impact. But, some are attributing weakness in oil to this development.

The second item is about supply chain issues, and this is good news. Over the last week, I noticed a number of positive developments related to supply chain issues in terms of autos, port backlogs improving, and semiconductor chips becoming available. It remains a problem, but I am open to the possibility that things are now marginally improving.

Market Commentary Summary

We enjoyed the market melt-up but now it’s a different game and we will adjust accordingly.

Expect more profit-taking into strength and vigilance in terms of cutting losers.

What To Do Next?

The POWR Growth portfolio was launched in early April and is off to a fantastic start.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +46.42% annual returns.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

Want More Great Investing Ideas?

SPY shares were trading at $466.47 per share on Tuesday morning, down $1.10 (-0.24%). Year-to-date, SPY has gained 25.99%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |