(Please enjoy this updated version of my weekly commentary from the POWR Growth newsletter).

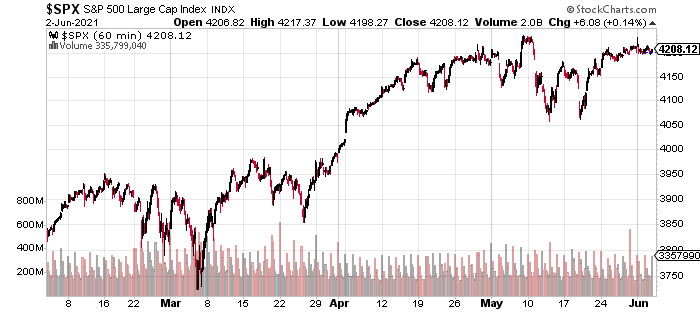

The S&P 500 (SPY) has essentially been locked in a range between 4,200 and 4,050 since early April.

In mid-May, we tested the lower end of the range and have steadily moved higher and are now consolidating under all-time highs set in early May around 4,230.

See the 4-month chart of the S&P 500 below:

There are many reasons to believe that we could breakout soon with Friday’s jobs report being the catalyst. Some of the most compelling include a strong earnings season, continued strength in economic data especially in terms of consumer spending, and the steady pace of vaccinations leading to a quicker than expected normalization of the economy.

So, I wouldn’t be surprised by a breakout, especially given that animal spirits are currently raging in the stock market and the possibility of a strong jobs report.

However, in yesterday’s Trade Alert, I gave some reasons why I’ve become a bit warier of chasing a breakout and more inclined to use it as an opportunity to take some profits. This could change if we start to see the rally broadening out with a wider swathe of sectors making new highs.

So far, there are no inklings of this happening, so I believe our current stance is correct – we remain exposed to strength in the market but have the firepower to add on weakness. Additionally, the slight downgrade in market outlook means that we will be slightly more conservative with our profit targets and less patient with underperformers.

Some Thoughts on AMC/Meme Stocks

Over the last couple of days, we’ve seen some incredible moves in stocks with high short-interest like AMC. AMC is up more than 500% in less than a month. Today’s move came on unfathomable volume – 761 million shares!

At an average price of $50, this equates to $38 billion!

AMC’s closing price of $62.55 gives it a value of $28 billion which is significantly more than its valuation anytime in its history. Even prior to the pandemic, it was struggling as fewer people were watching movies at theatres. In 2019, it lost more than $100 million.

Anyway, this will not end well especially for buyers who are late to the party. Yet, it’s impossible to say with certainty when the move will end especially given the emotional, retail-driven fervor.

Implications for Us

I don’t think this has too many major impacts on our portfolio, although there are some marginal, positive ones.

We’ve seen parabolic moves in stocks or pockets of the market that deflate with little impact to the broader market. Notable recent examples include GameStop, EV stocks, cryptocurrency miners, cannabis stocks, SPACs, etc.

So, I’m not concerned about this risk, although it would be a concern if we saw such parabolic action in stocks/sectors that make up a bigger share of the market.

Some marginal, positive secondary effects from the meme stock bubble are that stocks with high short-interest are being targeted. TUP and HOME have relatively high short interest at 8% of their float, so I wouldn’t be surprised to see some strength spillover into these names if these stocks continue to be targeted.

The spike in these stocks is also evidence of increasing animal spirits which bodes well for some our holdings such as ZIM (a recent IPO) and Chinese Internet stocks which tend to outperform when investors are in a risk-on mode.

Market Commentary Summary

Taking a step back, I want to reiterate that we remain in a very strong bull market with accelerating economic growth.

Within this bull market, we are in a market rotation. It will most likely resolve higher (possibly in the coming days or weeks) but there is a chance that the breakout could fail as it did earlier in May and lead to another test of the lower end.

We remain focused on navigating this circumstance and making adjustments as new data and information come in.

What To Do Next?

The POWR Growth portfolio was launched in early April and is off to a fantastic start.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stock strategy which has stellar +46.42% annual returns.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

Want More Great Investing Ideas?

SPY shares were trading at $418.87 per share on Thursday afternoon, down $1.46 (-0.35%). Year-to-date, SPY has gained 12.40%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |