(Please enjoy this updated version of my weekly commentary from the POWR Growth newsletter).

As usual, we will start by reviewing the past week…

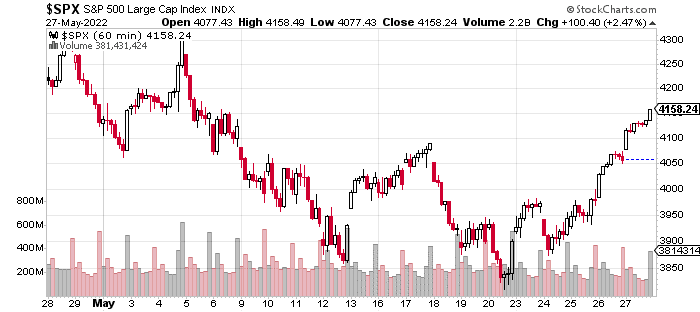

Here is an hourly, 3-week chart of the S&P 500:

Over the last week, the S&P 500 is up by 4.7%, but its 8.3% gain from last Thursday’s low is even more impressive. And, the strength has been broad-based as the Nasdaq and Russell 2000 had similar moves with gains of 8.8% and 8.1%, respectively.

It’s definitely a fair question to ponder how the market will handle these gains. Recent history has shown that any 2-4 day bounce is met with aggressive selling, and the macro risks, facing the economy, are nowhere close to being sorted out.

But, there are also some reasons to think that these gains could stick or even accelerate. In the next section, I will argue the bullish and bearish cases and then share my conclusion.

Bearish Perspective

The bearish narrative has dominated, and it’s pretty well understood. We have high inflation, a hawkish Fed, and an economy that seems to be rolling over.

Economic weakness doesn’t necessarily mean a long bear market, but it usually does when it becomes endemic and systematically starts hitting different parts of the economy. This is basically what happened in 2001 and is happening now.

Think about the weakness in e-commerce that was starting to be apparent in Q3 and Q4 of last year which is now impacting the revenues of digital ad companies. In turn, these companies may cut back on spending and hiring which creates its own ripple effects.

Something similar is also happening in retail with inflation eating into Walmart and Target’s bottom line.

Bullish Perspective

I think the best bullish argument is to note that all of these negatives are priced into the market… that’s exactly why the last 6 months have been so bearish.

And, now there are subtle signs of improvement and upcoming developments that indicate modestly lower inflation and higher growth over the next few months. Let’s count them up:

Forward-looking inflation measures have broken lower which has resulted in bonds finding a bid. As noted last week, this is a necessary but not sufficient precondition for a meaningful rally.

We’re starting to see a bid in the riskiest parts of the market.

Credit spreads have compressed which is indicative of a lack of systemic risk.

China’s economy is reopening. This can double as growth and deflationary pulse. In fact, it’s fair to speculate that some (but not all) of the sharp deceleration in economic data has to do with China.

Risks are now skewed to the upside as positioning and sentiment show an extreme number of shorts and cash on the sideline.

Based on the last commentary and recent moves in our portfolio, it’s clear that my bias is on the long side. This was, even more, the case last week as we were just above the 3,800 level.

In our previous commentary, I laid out a rough roadmap to try to make sense of the economy. We certainly have weakness in tech and the goods part of the economy. But, this weakness is on a YoY basis. On a 2Y basis, growth is exceptional.

Even if we do get weakness and a contraction in these categories, there will continue to be strong in categories like autos, CAPEX, housing, defense, and energy.

And, the strength in these areas is due to issues that transcend the economic cycle like demographics, the re-shoring of supply chains, geopolitics, etc. Therefore, this is not going to be a normal recession when most parts of the economy are simultaneously contracting.

But, I do think it could be a situation where the economic pain is not as bad as the stock market pain since tech and the goods part of the economy make up a large portion of stock market capitalization.

Another way to say this is ‘soft landing’. And, I think the odds of this more benign outcome will increase in the coming weeks especially if China’s economy comes back online.

What To Do Next?

The POWR Growth portfolio was launched in April last year and since then has greatly outperformed just about every comparable index…including the S&P 500, Russell 2000 and Cathie Wood’s Ark Innovation ETF.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +49.10% annual returns. I then take the very best stocks from this strategy and tell you exactly what to buy & when to sell, so you can maximize your gains.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

Want More Great Investing Ideas?

SPY shares rose $0.22 (+0.05%) in after-hours trading Tuesday. Year-to-date, SPY has declined -12.79%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |