(Please enjoy this updated version of my weekly commentary published August 15th, 2022 from the POWR Growth newsletter).

As usual, we will start by reviewing the past week…

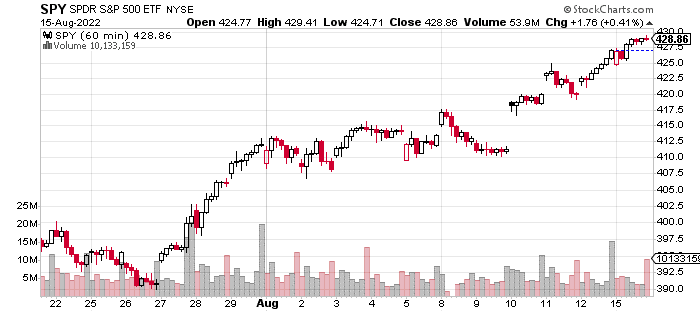

Here is an hourly, 3-week chart of the S&P 500:

Last week was another big week for the market as the S&P 500 (SPY - Get Rating) tacked on another 4% and has now retraced 50% of its decline from the top in January of this year.

We also firmly made higher highs after exceeding the previous high in March, dispelling the possibility that we could see a selloff with a new, marginal high as has happened in the past.

What we discussed last week, regarding this advance still stands. This is a short squeeze and a very, momentum-fueled move where applying logic is a fool’s errand. So instead of doing our usual coverage of different parts of the market, let’s just go straight to the main topic.

A New Bull Market

Instead, I think a more fruitful exercise would be some vibe-ology, where we try to determine how different market factions are feeling and positioned.

Fund managers are underinvested and now underperforming the market. This is a very uncomfortable position for them as they have to battle competing risks of portfolio risk vs career risk.

They are underinvested because they are understandably nervous about the market and see lower prices in the future. This is the portfolio risk component.

But, ultimately their job security depends on outperforming the market. And, consistent underperformance means, they will lose their high-status, high-paying jobs. This is the career risk component.

So, this is the psychology of fund managers and why many who were sellers a month ago may now be buyers even if they are still bearish on the market.

In fact, this dynamic has been present at the start of many new bull markets. Some technicians call it a lockout rally..

This is when both bulls and bears are uncomfortable.

Bears are rooting for lower prices and dismayed at the bullish price action which is undermining their thesis of an economy rolling over into a recession and a stock market (SPY - Get Rating) facing the prospects of plunging earnings.

Bulls are underinvested and hoping for a dip. Most of our dips have been quite quick and shallow. Even bad news has failed to dent the advance as evidenced by today’s bad Empire Fed report and even worse NAHB which is clearly showing manufacturing and housing turning lower and falling more.

While bad news has been quickly absorbed by the market, good news sends it higher. Like it did, following the employment report and CPI.

This dynamic and behavior are also seen at the beginning of many bull markets since they happen at capitulation points with investors willing to look past near-term economic pain.

Ultimately, these are necessary conditions for a bull market but not sufficient.

Therefore, while, we are positioned long and plan to ride out this rally, we are prepared for another leg lower – whether its a lower low or a higher low – that still seems likely given that the economic slowdown is just starting, while there is no reason to expect the Fed to pivot anytime soon.

Commentary + Trade Alerts

I do want to follow up on a thought from last week’s commentary when I discussed what would make me more bullish – peaking and plunging inflation – without the economy tilting into a bad recession.

This would be a Fed pivot for all intents and purposes, and it would also remove 2 of the biggest headwinds for the economy – rates and inflation.

It’s still not likely but the odds continue to slightly increase as evidenced by today’s drop in oil prices while stocks moved higher.

It’s weird but I feel like I’m more bullish in the short-term, while being more bearish in the intermediate-term. This is why I even got to 100% long in the portfolio because these types of momentum-driven moves can go past any reasonable target on the upside just like they can on the downside.

That being said, if/when it turns, I’m willing to quickly get back to neutral.

What To Do Next?

The POWR Growth portfolio was launched in April last year and since then has greatly outperformed just about every comparable index…including the 500, Russell 2000 and Cathie Wood’s Ark Innovation ETF.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +49.10% annual returns. I then take the very best stocks from this strategy and tell you exactly what to buy & when to sell, so you can maximize your gains.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

Want More Great Investing Ideas?

SPY shares were trading at $430.29 per share on Tuesday afternoon, up $1.43 (+0.33%). Year-to-date, SPY has declined -8.73%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |