(Please enjoy this updated version of my weekly commentary published July 11, 2022 from the POWR Growth newsletter).

As usual, we will start by reviewing the past week…

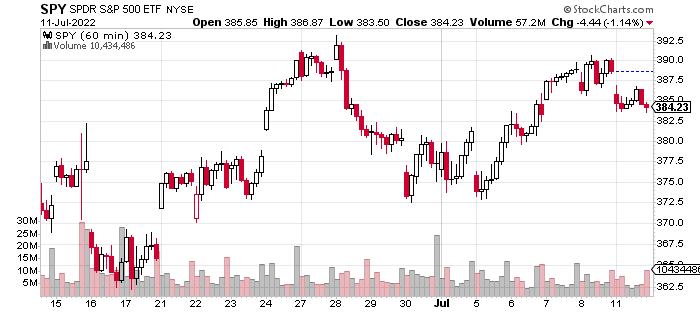

Here is an hourly, 3-week chart of the S&P 500 (SPY - Get Rating):

From last week, we are up a little less than 1%. The market bounce that began in mid-June is continuing, but it does seem to have found resistance just under the 4,000 level.

If we take a quick look back at 2022, these types of double-tops have reliably led to a negative reaction lower which would imply a retest of the June lows.

This is quite probable, but it’s likely that the CPI report on Wednesday could be the trigger for such a breakdown or a break above the 4,000 level.

Over the last month, there has been a serious reduction in prices of many commodities and a sharp slowing in economic activity. As we have been covering, it’s inevitable that it will cause inflation to slow.

Economic Whiplash

And as discussed last week, these Fed-engineered recessions whether in the 80s, 70s, or 40s were quite effective in quickly bringing inflation lower. That’s what I’m certain about with 90% confidence.

My confidence is 70% that the descent in inflation will be a mirror image of its ascent. In fact, we can see that with so many asset prices which are now below January 2022 levels.

None of this should be surprising to anyone paying attention to what’s happening in the S&P 500 (SPY - Get Rating) on a bottom-up level.

Of course, this is simply exchanging an inflation problem for a growth problem. But just like the market and economy were able to thrive while inflation was increasing from low levels to moderate levels, inflation going down is a boost to stocks as it leads to lower rates which trigger multiple expansion.

The ‘Goldilocks’ scenario is inflation comes down which provides a positive tailwind that is enough to offset the headwind of a slowing economy. This remains a low-probability outcome, but I do think the odds of this have improved from ‘very unlikely’ to ‘pretty unlikely’.

This is a reflection of the economy adding 1 million jobs in Q2, continued strength in a variety of economic indicators, and resilience in corporate earnings. Of course, much of this data is of the lagging variety so it doesn’t count what seems to be a sharp slowing in the economy.

But again, this slowing is a man-made phenomenon rather than the result of pure economics. Therefore, this damage can be undone when the Fed pivots (or inflation falls enough).

Applications

In terms of our portfolio, we did increase our exposure, specifically biotech and pharmaceuticals. But, the bulk of these positions is defensive and less correlated to economic growth. In fact, their ideal scenario would be low inflation with slow but positive economic growth.

So, the second half of 2021 and the first half of 2022 were brutal for these stocks. These companies didn’t benefit from the boom in growth, but they did suffer from higher rates which caused multiple compression.

I believe these stocks are at interesting inflection points and very attractive valuations. In fact, the biotech sector has gone sideways since 2015 even though earnings and revenues have gone up between 2-5x for the biggest companies in the sector.

What To Do Next?

The POWR Growth portfolio was launched in April last year and since then has greatly outperformed just about every comparable index…including the S&P 500, Russell 2000 and Cathie Wood’s Ark Innovation ETF.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +49.10% annual returns. I then take the very best stocks from this strategy and tell you exactly what to buy & when to sell, so you can maximize your gains.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

Want More Great Investing Ideas?

SPY shares were trading at $383.95 per share on Tuesday morning, down $0.28 (-0.07%). Year-to-date, SPY has declined -18.56%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |