(Please enjoy this updated version of my weekly commentary from the POWR Growth newsletter).

In last week’s commentary, we discussed the strong start to earnings season, improving economy, and favorable interest rate environment. And, why these factors support a bullish stance despite the choppy market environment.

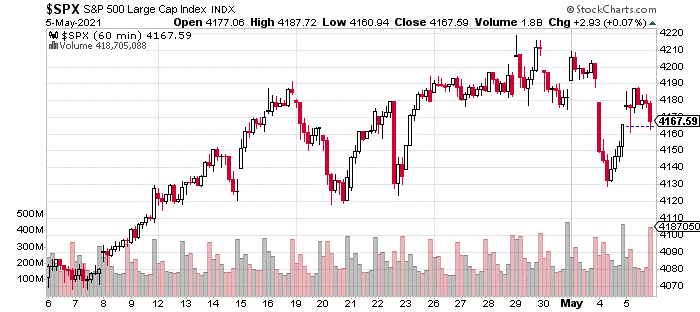

Over the past week, we got tons of earnings releases, a steady stream of economic data, and an FOMC meeting, however, there was little impact in terms of the market as the S&P 500 remains stuck in a range between 4,100 and 4,200.

See chart below:

However, the new information in the form of earnings, economic data, and a FOMC press conference confirmed our economic and market outlook.

With earnings season about 70% over, 86% of S&P 500 companies topped earnings, while 76% beat revenue expectations. Recent data in terms of housing, industrial production, and labor market gauges continue to come in strong and in-line with continued economic expansion across multiple parts of the economy.

Finally, the FOMC made it clear that it was not ready to start raising rates or tapering asset purchases despite raising its growth forecast and acknowledging inflationary pressures.

Given that all these great things are happening – why is the market not reacting?

First of all, I do believe that the market will eventually respond to these fundamentals – like it always has in the past.

As regards to its current state, the market remains in consolidation mode. This choppy market environment lets the market reset on a sentiment and technical basis following its blistering performance from March 8 to April 13 in which the S&P 500 gained 12%.

Once this reset is over, the market should once again start moving higher in response to its improving fundamentals in the intermediary period.

What To Do Next?

The POWR Growth portfolio was launched in early April and is off to a fantastic start. Not only are there 8 stocks already in the plus column, but 2 of them are already double digit winners.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stock strategy which has stellar +46.42% annual returns.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

Want More Great Investing Ideas?

SPY shares were trading at $417.82 per share on Thursday afternoon, up $2.07 (+0.50%). Year-to-date, SPY has gained 12.12%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |