In this commentary, I want to focus on the latest developments that have happened since last week and provide more reasoning behind recent decisions.

But, I want to reiterate 3 things:

- The macro backdrop remains favorable due to earnings growth and low interest rates.

- We are likely in a high-growth, high-inflation world for the next 3 to 5 quarters, which we’ve only experienced for brief spurts of time in the past few decades.

- Another remarkable aspect of this period is that nearly every segment of the economy is in expansion mode – industrials, housing, consumer spending, government spending, monetary policy, etc. Parts of the economy that are offline should come online in the next few months, creating another catalyst.

We’ve covered these factors with more depth in previous commentaries and our first webinar, so any new subscribers can check those out if interested.

So, the last few days have been rough for the stock market.

The weakness in frothy and growth stocks has infected the broader market – even the industrial and commodity stocks which were breaking out to new highs late last week and early this week.

In our first webinar, I discussed some of the risks facing the market and mentioned that tax selling could pose a headwind at some point. This does seem to be materializing to some degree especially as some of the weakest stocks over the past few weeks have been the biggest winners of 2020 that were dominated by retail traders like the cryptocurrency mining stocks or the cannabis sector.

This will not be a headwind next week. It could lead to things getting even messier later this week but more likely, this will be front-run.

Given that nothing has happened to shake our conviction that we are in a bull market, this is looking like a compelling entry point based on many indicators.

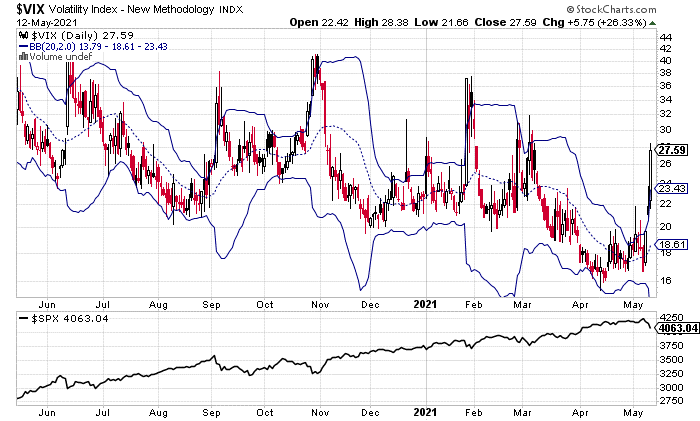

VIX

The VIX is above its Bollinger Band by more than 20%. The Bollinger band measures the 20 day moving average and 2 standard deviations above and below to try to measure when an asset is oversold or overbought.

Over the past year, buying at similar points has been rewarded, and you only get a chance every couple of months. As long as the fundamentals are supportive, I believe this strategy will continue to work.

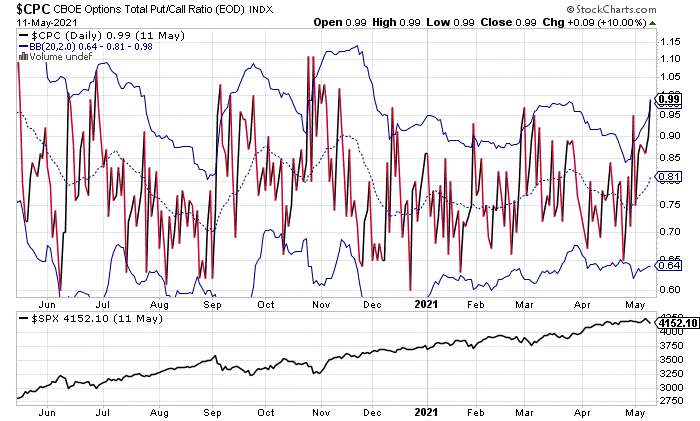

Put/Call Ratio

The put/call ratio is sending a similar message of reaching extremes which have worked as good entry points over the past year.

Price Action in Growth Stocks

Another development that I’m watching is that we may have seen a climax low in growth stocks. Many of these stocks opened on Tuesday with a gap down but then closed higher on strong volume.

Today, they fell with the market but did make a higher low. It’s way too early to call it a trend, but I will monitor this development.

I believe the next best opportunity in the market is to sift through this wreckage to find the companies that have been unfairly punished. There are several on my radar screen with prices down more than 35% that delivered strong earnings reports and are quite attractive from a value and growth perspective.

Market Commentary: Conclusion

To sum up, the broad macro backdrop remains favorable. This means that we should be look to buy on dips. And, we seem to be in the midst of a dip which is in-line with some of the best buying opportunities over the past year.

Yet, tax loss selling could mean that the market is going to get messier THIS WEEK as it does tend to be when the VIX is elevated.

What To Do Next?

The POWR Growth portfolio was launched in early April and is off to a fantastic start.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stock strategy which has stellar +46.42% annual returns.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

Want More Great Investing Ideas?

SPY shares rose $0.52 (+0.13%) in after-hours trading Thursday. Year-to-date, SPY has gained 10.10%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |