(Please enjoy this updated version of my weekly commentary published May 23rd, 2022 from the POWR Growth newsletter).

As usual, we will start by reviewing the past week…

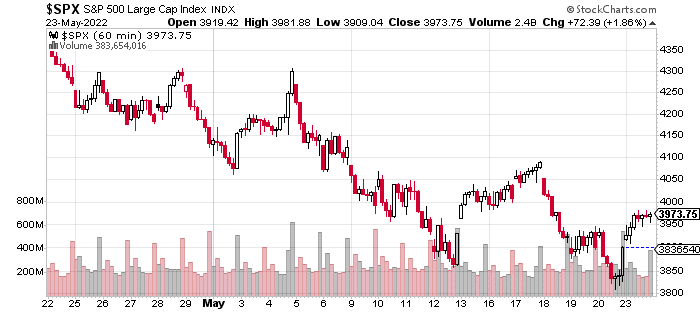

Here is an hourly, 3-week chart of the S&P 500:

Over the last week, the S&P 500 is down by a little less than 1%. The Russell is up by about a half-percent, and the Nasdaq was down by a little more than 1%.

This belies how volatile the week was, as we had a rally attempt that was quickly met by selling. Then, a breakdown late last week as we broke below the 3,850 level. However, this also turned out to be a head-fake and we are firmly back in the middle of our most recent range.

From last Friday’s lows, the S&P 500 is up more than 4%.

What’s Next…

As discussed in our recent trade alert, despite the bearish price action, I think this is a time to tentatively get more bullish. Some of the positives are bonds finding a bid, stability in growth stocks, and a strong earnings season. This is in addition to the market becoming oversold by many measures including 7 straight declines on a weekly basis.

Basically, we are very due for an oversold bounce or a bear market rally which could be quite significant given the extent of the damage. Above last Friday’s lows and we can be comfortably bullish. Below, the focus has to shift to ‘return of capital’ rather than ‘return on capital’.

The Recession Debate

If we zoom back and take a bigger-picture perspective, it becomes easier to understand the market action. In January, we had an inflation scare which led to a 10%+ drop in the major averages despite strong earnings.

This is because higher inflation leads to multiple compression as the Fed is forced to wring liquidity out of the system.

The market bottomed in late January and was quite choppy for a couple of months with several failed breakout and breakdown attempts. In mid-April, the inflation scare receded and we got a growth scare which is leading to weakness in cyclical stocks and expectations of a decline in earnings.

Many are speculating that a recession is imminent. In fact, I would argue that many stocks in the market are priced as if a recession is a certainty rather than a possibility.

My Take

This is a controversial take. First of all, recessions are fantastic buying opportunities for stocks. So, when people start openly talking about recessions, you should start getting excited.

I’m going to make another claim.

When there is no systemic risk, it’s better to buy early as there is a greater chance of a V-shaped bounce. If there is systemic risk, then it’s better to be patient as there is a greater chance of a market crash or more liquidations.

Currently, we don’t have systemic risk. Not like what we had in 2008 with banks leveraged at 30:1. Yes, there are pockets of froth and overvaluation, but these markets could be liquidated and would hurt holders of these assets, but there would be limited damage to the broader economy.

To be specific, here’s what I think is happening. Two parts of the economy are in a recession – tech and discretionary spending. Depending on your bias, some, most, or all of it is due to incredible growth in 2020 and 2021 due to one-offs like the pandemic and stimulus payments.

On a 2-year basis, both segments have strong double-digit growth. But, it’s slowing sharply and going negative in many instances. (on a year-over-year basis).

These are both massive parts of the economy, so a contraction would be meaningful enough to put the economy in a recession or a near recession.

However, I believe other parts of the economy will remain in growth mode like the industrial sector, housing, energy, steel, materials, autos, etc.

In fact, we had a very similar circumstance during 2015-2016 when we had a recession scare. Except during this time, steel/energy/materials were in a major bear market. Oil was around $30, and copper was at $2.

Supply was strong due to large investments in production that were made from 2007 to 2011, and aggregate global demand had never meaningfully recovered after the Great Recession.

Real GDP growth dipped from 3% to below 1.4% but never went negative. The major reason is that other parts of the economy saw a slowdown but didn’t go negative. Examples are housing, tech, and consumer spending. Another source of support was that interest rates were falling.

So, this is similar except larger components of the economy are vulnerable, and there won’t be as much support from interest rates. Therefore, I anticipate more volatility and think a *technical* recession is likely.

However, just like the last recession scare which kind of crested between February 2016 and June 2016, this will turn out to be a fantastic buying opportunity.

In next week’s article, I want to include some historical analogs that are similar to the current economic and market environment to give greater context.

What To Do Next?

The POWR Growth portfolio was launched in April last year and has significantly outperformed the S&P 500 since then.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +49.10% annual returns.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

Want More Great Investing Ideas?

SPY shares were trading at $394.60 per share on Tuesday afternoon, down $2.32 (-0.58%). Year-to-date, SPY has declined -16.66%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |