December was tough enough for stocks. Yes, hard to see that with only modest losses for the S&P 500 (SPY)…but once again it was really only Mag 7 stocks getting any love from investors.

Nothing is that surprising about his action given how large caps are getting pretty fully valued. And Mag 7 stocks are flirting with “irrational exuberance” levels.

This leads to 2 possible outcomes in 2025 which we will discuss in this week’s Reitmeister Total Return commentary.

Market Outlook

Path 1: The Logical Choice

Sometimes the stock market is orderly and investors make fairly rational decisions. Especially if they are faced with this curious valuation quandary:

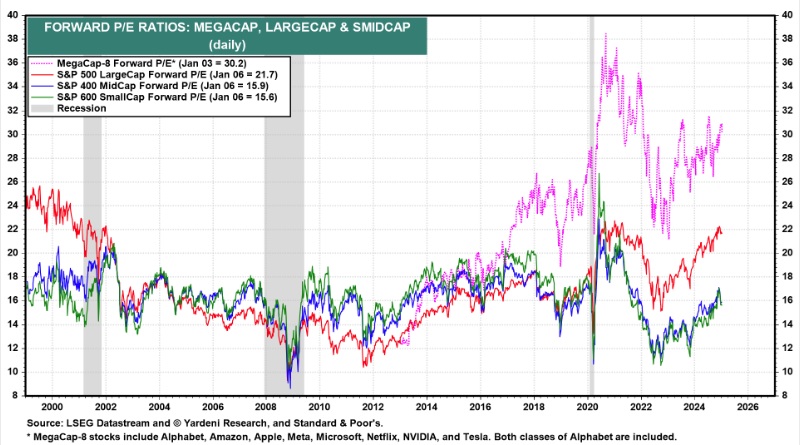

There is no denying what is found in this PE chart.

Mega caps (aka Mag 7) are bloated…even above 1999 tech bubble level.

Large caps are pretty much fully valued.

Small and Mid Caps are not only attractively valued versus their larger peers… but actually attractive versus their historical average at this stage of a bull market.

The rational thing would be to take profits on large and mega caps and rotate that money to more deserving small and mid cap names.

This is what I assume will happen in 2025 and why I only have a 6,300 year end target for the S&P 500. And to be honest, a breakeven finish tussling with 6,000 the entire year would not surprise me at all. The early January results seem to confirm that narrative.

Gladly, we can lean into small and mid caps that should be set to outperform. In fact, it is the strength of the POWR Ratings to discover this kind of “under the radar” stocks with sparkling fundamentals.

Unfortunately we still have to contend with the real fact that things could go on the less desirable next path…

Path 2: Valuation Bubble

As famed economist John Maynard Keynes reminded us a long time ago “the market can stay illogical a lot longer than you can stay solvent”.

And yes, this is coming from a guy that twice over went bankrupt in the stock market making bad bets.

Studies of Behavioral Finance have shown that the longer something has been true…the longer people assume it will stay true.

This logic created the Tech Bubble of 1999 followed by the housing bubble of 2008.

I remember early in 2008 they did a survey of residents in Los Angeles about their expected rate of returns on their homes for the next 5 years. The answer was 22% increase.

So even though going back the last 70 years the average increase of home values was only +2.7% (about the rate of inflation) people were fixated on the most recent results expecting them to continue into the future.

This leads to “irrational exuberance”…where people bet more and more on this outcome leading to a more disastrous day of reckoning down the road when it implodes.

Typically when the feature stocks get punished…they take the rest of the market with them.

However, in 2000 it was interesting that the average stock was higher that year even though tech stocks were tumbling down. (I checked my records to find that I gained a little over +16% on the year).

This last part gives me hope that the unwinding of Mega Caps can be orderly. But sometimes when everyone heads to the exists at the same time it leads to calamity.

Again, I think Path 1 is the more likely outcome…but we will sleep with 1 eye open in case Path 2 emerges. Gladly we have a proven playbook during those times that should have us stay on the right side of the action.

What To Do Next?

Discover my current portfolio of 10 stocks packed to the brim with the outperforming benefits found in our exclusive POWR Ratings model. (Nearly 4X better than the S&P 500 going back to 1999).

All of these hand selected picks are all based on my 44 years of investing experience seeing bull markets…bear markets…and everything between.

And right now this portfolio is beating the stuffing out of the market.

If you are curious to learn more, and want to see my top 10 timely stock recommendations, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top 10 Stocks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

Editor, Reitmeister Total Return

Want More Great Investing Ideas?

SPY shares were trading at $588.63 per share on Tuesday afternoon, down $6.73 (-1.13%). Year-to-date, SPY has gained 0.44%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |