November bounce is getting mighty impressive. Gladly it is no longer just the usual suspects in the mega cap group having all the fun. This beneficial shift was on prime display Tuesday when the small caps in the Russell 2000 led the stock parade at +5.44% (SPY - Get Rating).

This broadening out of stock gains is the healthiest development for the market this year and bodes well for what lies ahead. Let’s talk about what is driving these gains and our game plan to maximize our personal gains.

Market Commentary

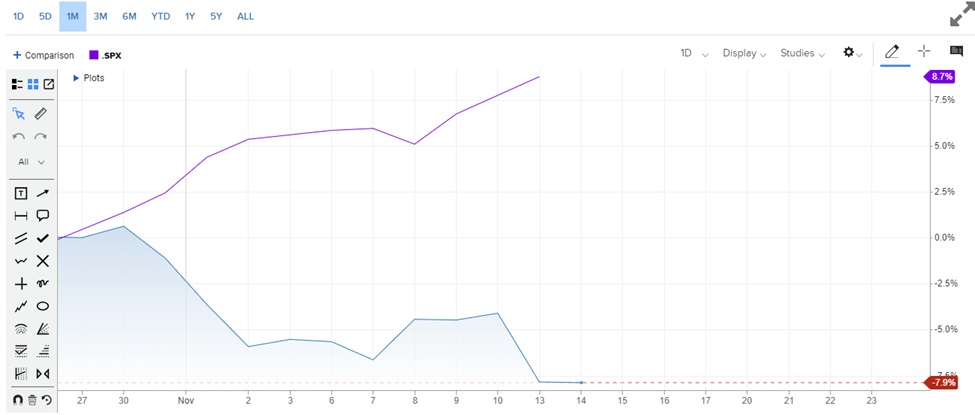

Let’s simplify our discussion with pictures. That starts with rising bond rates from the end of July to late October that was the main reason behind a nasty correction.

(Blue = 10 Year Treasury Rates / Purple = S&P 500)

Yes, a dramatic 27% rise in Treasury rates in just three months time was ample ammo for investors to shift out of stocks. And just as things were getting their ugliest the Fed came to the rescue with Powell’s 11/1 speech.

He said nothing particularly dovish that would make one think rates were going lower any time soon. It was more about what he didn’t say that made investors feel that they are getting near the end of their rate hike regime leading to lower rates, healthier economy and better stock prices in 2024.

This explains the glorious rally over the past couple weeks that got turbo charged Tuesday thanks to another lower than expected inflation reading from the Consumer Price Index that points to the battle over high inflation nearly being over. With that 10 year Treasury rates headed under 4.5% and stocks exploded higher.

(Blue = 10 Year Treasury Rates / Purple = S&P 500)

The only bearish concern about these lower bond rates is whether they are coming about because a recession may be forming on the horizon. I tackled that in my last commentary you can read here: The Dark Side of the Recent Stock Rally.

The nutshell version is that the economic readings are soft…but not recessionary at this time. Thus, game on for stocks.

Since that article, the GDPNow estimate for Q4 GDP has risen from +1.2% to +2.1% which is a healthier clip. Further, we have keen insights from other respected sources like Goldman Sachs. Here is one of their headlines from last week with key section from that research note:

“The global economy will perform better than expected in 2024

That outlook is based on our economists’ prediction for income growth (amid cooling inflation and a robust job market), their expectation that rate hikes have already delivered their biggest hits to GDP growth, and their view that manufacturing will recover. Central banks, meanwhile, will have room to reduce interest rates if they’re concerned about the economy slowing. “This is an important insurance policy against a recession,” Goldman Sachs Research Chief Economist Jan Hatzius writes in the team’s report.”

Yes, these types of predictions are a dime and dozen…and often look quite foolish in hindsight. But I have to be honest that the Goldman team has been calling it right for quite a while including their ability to see early on that the raising of rates in the US was not going to create a recession which made them bullish on stocks early in 2023. So far, so good on that insight and think they are on target with their view going forward.

Price Action & Trading Plan

Stocks have bounced aggressively from bottom quickly removing the correction from our collective memory. Now we have stocks only 2% away from the previous highs set in July. Given the bullish momentum in hand, plus upward bias of the holiday season, then I think it’s fair to say that stocks will touch the previous highs and maybe even go a tad above 4,600 to close out the year.

Gladly we quickly got more bullish as stocks broke back above the 200 day moving average at the start of the month. This includes the addition of 4 new stocks that all have impressive green arrows next to their names. But even better, is the further upside potential they have as the bull market progresses higher.

Long story short, this is a time to be aggressive in the stock market. The key is having the right picks to outperform. And that is what you will find in the Reitmeister Total Return portfolio. More details on that below…

What To Do Next?

Discover my current portfolio of 7 stocks packed to the brim with the outperforming benefits found in our POWR Ratings model. (That includes 4 recently added stocks with stellar upside potential)

Plus I have added 4 ETFs that are all in sectors well positioned to outpace the market in the weeks and months ahead.

This is all based on my 43 years of investing experience seeing bull markets…bear markets…and everything between.

If you are curious to learn more, and want to see these 11 hand selected trades, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

Want More Great Investing Ideas?

SPY shares rose $0.48 (+0.11%) in after-hours trading Tuesday. Year-to-date, SPY has gained 18.64%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |