(Please enjoy this updated version of my weekly commentary from the Reitmeister Total Return newsletter).

The bear market was reaffirmed in September as the market retested the June lows…and then found lower lows.

Next thing you know October kicks off with a 2 day “rip your face off” rally which only has investors scratching their heads once again on the primary question…

Are we still in a long term bear market or has the new bull market begun?

We will explore this central concern for investors along with appropriate trading plan in this week’s Reitmeister Total Return commentary.

Market Commentary

The longer and much more eloquent version of this stock market conversation was accomplished in my Updated: Bear Market Game Plan webinar where I discussed:

- 3 Reasons Why STILL a Bear Market

- How Low Do Stocks Go?

- 9 Picks to Profit on the Way Down

- How to Bottom Fish for the Next Bull Market

- And much more

You could see this early October bounce coming from a mile away. Stocks have been heading lower for six straight weeks capping off a nearly 16% decline in the S&P 500 (SPY - Get Rating) from the end of the suckers rally in mid August to Friday’s lows.

This made the market oversold in the short run giving active traders an opportunity to come in and have some fun playing a quick bounce. However, until we see the true depths of the economic pain which is to come as the Fed works hard to rein in inflation by proactively raising rates to slow down the economy, then hard to believe we have found bottom.

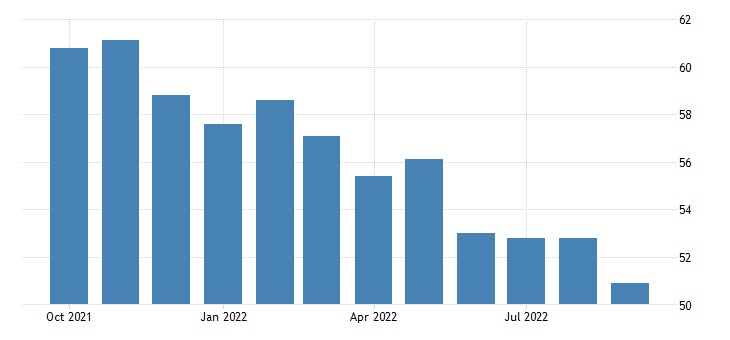

We may have had a little taste of what is to come on Monday with the release of the ISM Manufacturing report which fell from 52.8 to a post Covid low of 50.9. That is barely in expansion territory. And as you can see clearly by the chart below, the trend is not favorable.

Even worse, the forward looking New Orders component slid into contraction territory at 47.1. That foreshadows even lower economic activity in the manufacturing sector in months to come.

Please don’t forget that manufacturing is often called “the canary in the coal mine of the economy” as it often shows weakness first before it comes around to devastate the larger services sector. (Note that ISM Services comes out this Wednesday).

One more thing to point out in this nasty report… the employment index fell all the way from 54.2 to 48.7. This is one of the first signs of weakness in the employment market which has been surprisingly robust even after 2 straight quarters of negative GDP growth.

It will be interesting if any of that employment weakness shows up in the ADP Employment report on Wednesday or the Government Employment Situation report on Friday. Remember that the Fed has said that their actions to raise rates WILL in time lead to a weakening of the employment market. Just a matter of when it starts showing up in these monthly reports.

Then again, here is the note I shared this Friday with POWR Value members on what may happen with the monthly Government Employment report:

“Oddly this report could be a negative no matter what happens. If too strong, then just like Jobless Claims this past Thursday, it could spook investors that the Fed will be overly aggressive with rate hikes. On the other hand, if it starts to show weakness then it increases the odds of recession and with that further bear market downside.”

Now let’s shift our attention to another potential catalyst for the overall market in coming weeks. I am referring to October earnings season that kicks off mid month.

The early preview of companies reporting early is downright awful. This includes a dreadful showing for FedEx which is a pretty good proxy for international commerce.

This may finally be the quarter where Wall Street gets the wakeup call that leads to massive cuts in earnings outlook. And yes, that should naturally lead to a lowering of stock prices as earnings outlook and price are so intimately connected.

Here is what my friend Nick Raich of EarningsScout.com had to say about earnings this morning:

- Sixteen S&P 500 companies have reported their August quarter ends.

- Their next quarter (i.e. 4Q 2022) EPS estimate changes are the worst we have measured since the economy was being shut down for Covid in 2020.

- Steep cuts at CarMax, FedEx, Micron and Nike are the primary culprits for the negative revisions.

- What’s more five of the sixteen companies reporting had their stock prices fall by more than -20% after releasing results.

- The EPS estimate revision trends of the early reporters reinforce our forecast that the worst of S&P 500 EPS estimate cuts are not yet over.

- Stay underweight stocks until we can determine when the worst of the cuts will occur.

Lastly, let come back around to the topic of price action. Yes it was time to bounce higher even though few people believe that the bear market is over. So now the question is how much could we bounce before we get back to testing the lows.

Here are some of the key resistance points above us at this time that could stop this bounce in its tracks:

3,855 = bear market dividing line (20% below all time high of 4,818 for the S&P 500 (SPY)

3,961 = 100 day moving average

4,002 = 50 day moving average + major psychological resistance at 4,000

4,203 = 200 day moving average

The moving averages keep changing daily and thus the eventual test of those levels will be at slightly different prices than noted above. However, I don’t believe that we are due for another test of conviction like back in August where we made it all the way to the 200 day moving average before the bears too over again.

I sense that 4,000 will likely be the lid on this move…if not lower.

Yes, some will want to trade these short term ripples in the market yet I think that is often a “fool’s errand”. Meaning when the primary trend is bearish then all rallies are living on borrowed time as just about anything can happen to tilt the mood back bearish.

Meaning we will stay with our current portfolio strategy that is built for us to explore lower lows. With likely bottom somewhere between 3,000 and 3,200.

So let the bulls have their fun for a few days. We know why the fundamentals point to a bear market. And given history how low we will likely go. Thus we can be patient for it to unfold in due time.

What To Do Next?

Discover my special portfolio with 9 simple trades to help you generate gains as the market descends further into bear market territory.

This plan has been working wonders since it went into place mid August generating a +4.65% gain as the S&P 500 (SPY) tanked over 15%.

If you have been successfully navigating the investment waters in 2022, then please feel free to ignore.

However, if the bearish argument shared above does make you curious as to what happens next…then do consider getting my “Bear Market Game Plan” that includes specifics on the 9 unique positions in my timely and profitable portfolio.

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, Stock News Network and Editor, Reitmeister Total Return

Want More Great Investing Ideas?

SPY shares were trading at $377.77 per share on Tuesday afternoon, up $11.16 (+3.04%). Year-to-date, SPY has declined -19.54%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |