(Please enjoy this updated version of my weekly commentary published September 13, 2021 from the POWR Growth newsletter).

First, a programming note:

Yes, this commentary is coming to you on Monday rather than on a Wednesday. The reason is that we are launching the POWR Stocks Under $10 service which I will also be leading and that commentary will be on Thursday. So this will give us some breathing room between the two especially as many of you will be subscribing to both.

The POWR Stocks Under $10 is going to specialize in low-priced stocks. Most of the stocks in this universe will be poor investments but at the same time, the best-performing stocks in the market will also emerge from this group.

Thus, we will be using a variety of quantitative and qualitative tools to dig up these names by zooming in on stocks that are inflection points in terms of their earnings, revenue, and overall prospects.

If you are not already a POWR Platinum member (meaning someone who has access to ALL of our trading services including the POWR Growth and POWR Stocks Under $10 that launched yesterday) then please reach out to our team at the email address below to request a free 30 day trial.

This will give you 30 days full access to all our services…all our best insights…all our best trades. Again, just email the team at the email address above with the subject line of “30 day free Platinum trial”.

Now, back to the market commentary:

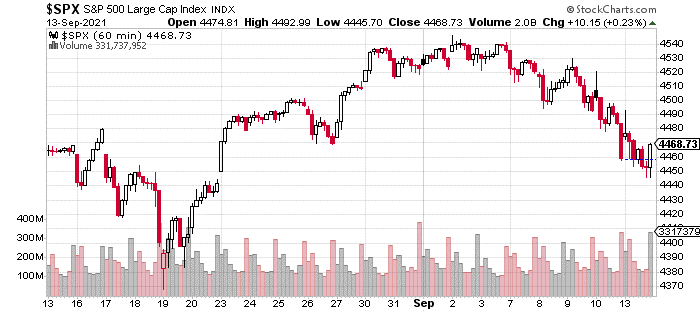

Let’s start with our usual look at the one-month, hourly chart of the S&P 500:

Since last Wednesday, stocks have weakened further. In fact, we’ve given back more than half of the advance that begun in mid-August. In terms of market leadership, we’re seeing reflation stocks leading higher, while growth stocks have been the weakest. Essentially, it’s been a reversal of what happened during August.

Still a Muddled Market

The overall takeaway is that this remains a messy, muddled market. The market’s ascent is masking a vicious rotation going on under the surface. We haven’t had nice, trending conditions since November of last year which lasted till mid-February. Since then, different parts of the market have been punished and sold off.

The good news is that this is a much healthier way of resolving overbought conditions to digest the huge gains from last year rather than a correction which typically tends to happen.

In terms of our portfolio, we are up about 11%, while the Russell 2000 is essentially flat since the portfolio’s inception. We will continue to remain agile with our positioning and look for singles and doubles rather than home runs.

One Glimmer of Optimism

I do want to point out one development which I want to take advantage of – it seems likely that the Delta variant has peaked. The seven-day moving average is now about 6% below its peak, and the hardest-hit states like Florida and Texas are down much lower.

This also tracks with the experience of other countries which dealt with the Delta variant which saw a peak after about 2 months. It also led to a surge in vaccinations, and the country seems to be about 4 months away from reaching “herd immunity” in terms of vaccinations + prior infections.

The rise in the delta variant has certainly led to profit-taking in many travel stocks, but this is an opportunity for us to take advantage of the dip.

What To Do Next?

The POWR Growth portfolio was launched in early April and is off to a fantastic start.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +46.42% annual returns.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

Want More Great Investing Ideas?

SPY shares were trading at $443.83 per share on Tuesday afternoon, down $2.75 (-0.62%). Year-to-date, SPY has gained 19.49%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |