(Please enjoy this updated version of my weekly commentary published April 7th, 2022 from the POWR Stocks Under $10 newsletter).

First, let’s review the past week…

Over the past week, we are down by a little less than 1%, although at today’s low, the max drawdown was 2% on a weekly basis.

There was significantly more weakness in the Russell 2000 which was down 3% over the last week and was down nearly 5% at today’s low before the afternoon rally.

As stated in the intro, we have retraced about ¼ of the advance. Quick gains are always fun but in my experience they are often given back, while slow and steady gains are more resilient.

In terms of the market, I don’t necessarily see what the catalyst is to get us out of this chop. And, I expect it to continue into the next Fed meeting in the first week of May.

There’s also increasing chatter about the Fed getting more hawkish as they discuss their various tools to fight inflation. 2 that are on the table are hiking by 50 basis points rather than 25 and starting to reduce the balance sheet by selling assets into the open market, thus absorbing liquidity.

I think the Fed is in a tough situation, because it’s quite difficult to slow an economy without tilting it into a recession. Also, the Fed doesn’t want to impede investment in new production and capacity that is at the root of inflation.

In essence, the country’s productive capacity and infrastructure (in a physical sense not digital) has been stagnating even while the population has grown.

It was masked by an economy where there was weak aggregated demand, low levels of household formation, and an overhang from the Great Recession.

Now, these deficiencies are coming to light as we are in the midst of a period of strong aggregate demand.

So, this is the market’s big worry at the moment. The Ukraine-Russia issue has receded in the background for a bit as the conflict seems to be contained. Of course, this can change at any moment, and its already had major implications for food and energy prices.

So, it makes sense that the market will continue to be choppy in the near-term. Therefore, we will continue to be aggressive in terms of risk-management and very selective when it comes to entering new positions.

Now, let’s zoom back for a bit…

I’m not a proponent of any school of market analysis. I think all of them have value and are like tools in a toolbox.

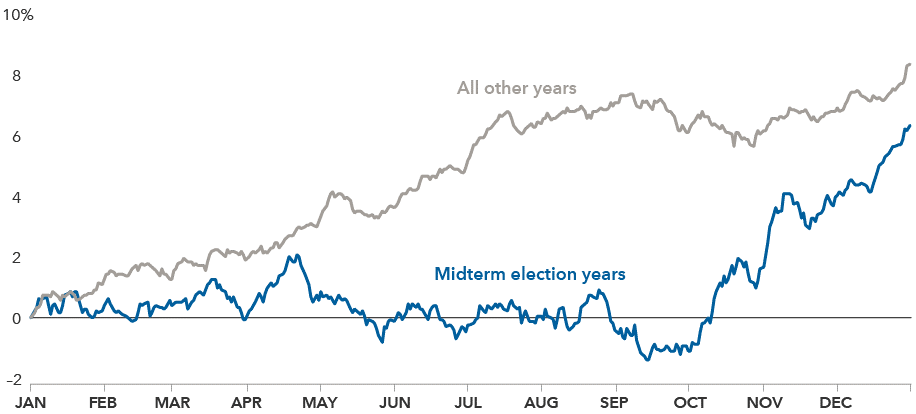

One method of looking at the markets is by looking at historical cycles to kind of give a roadmap for what may be ahead for the market. The logic is that although times and technology change, human emotions won’t.

This image from Capital Group shows the typical pattern for stocks in other years vs midterm election years. There’s much more weakness which really doesn’t resolve until the election.

This isn’t something carved in stone, but it’s simply what the averages are saying. It also ratifies my belief that this is a season for more modest trading, while the time to ramp up aggression is later down the road.

Today’s Trades

Today’s trades were about taking some profits and reducing risk in the portfolio. Other than energy, materials, and agriculture, profits in the stock market have turned out to be mostly ephemeral.

So, I feel a need to lock in some gains when the opportunity arises, and we did that twice. The next factor is that as the market’s breakout attempt was rejected, it was my cue to reduce portfolio risk.

We did this by reducing cyclical exposure which is now at a normal-weight from overweight. We also picked up a pharma stock which is not going to be affected by issues like inflation, the Fed, or Russia.

What To Do Next?

If you’d like to see more top stocks under $10, then you should check out our free special report:

What gives these stocks the right stuff to become big winners?

First, because they are all low priced companies with explosive growth potential.

But even more important, is that they are all top Buy rated stocks according to our coveted POWR Ratings system and they excel in key areas of growth, sentiment and momentum.

Click below now to see these 3 exciting stocks which could double (or more!) in the year ahead.

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Stocks Under $10 Newsletter

Want More Great Investing Ideas?

SPY shares were trading at $448.86 per share on Friday afternoon, up $0.09 (+0.02%). Year-to-date, SPY has declined -5.20%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |