(Please enjoy this updated version of my weekly commentary published November 15th, 2021 from the POWR Growth newsletter).

First, let’s take a look at the past week:

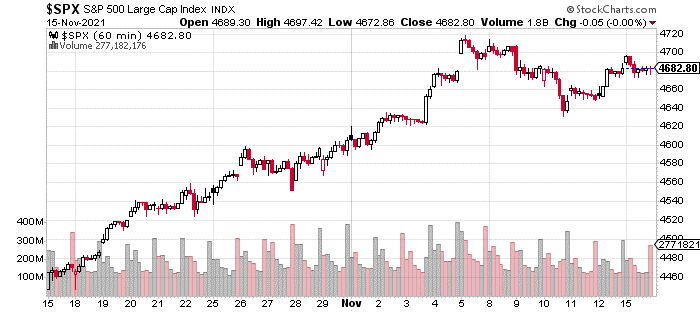

As the chart above shows, the S&P 500 didn’t do much over the past week. It was a healthy and well-deserved breather following the index’s nearly 8% gain from mid-October to early-November.

Given the duration of the rally, I think it’s likely we could get another week of chop or back-and-forth price action that would retest the 4,630 levels of last week.

Fortunately for us, we are already fully invested so don’t need to to worry about navigating such an environment. Instead, I’m continuing to notice positive action in terms of small-cap performance and market inflows that are supportive of continued strength in small and mid-cap stocks.

This is a difference in behavior compared to the summer months when small and mid-cap stocks would be under distribution when the market dipped or consolidated.

Big Picture

In terms of the big picture, the bullish picture has only gotten stronger. Remember that the fundamental drivers of stock prices are earnings and interest rates. Well in Q3, we found out that we had the 3rd best quarter of earnings growth in history at 39%.

Interest rates are somewhat of a headwind as the Fed’s taper means that rates are no longer trending lower or stuck at zero. Instead, rate hikes are now on the horizon, likely sometime at the end of 2022 to the middle of 2023.

So, the overall picture remains bullish as rates remain quite low on an absolute basis with the 10-Year yield @ 1.62% and the 2Y @ 0.5%. AND earnings continue to grow at a healthy clip as well.

2 Bearish Notes

Over the last couple of notes, I’ve struck a pretty, bullish tone in the commentaries and in the positioning of our portfolios. And, I do remain bullish, but I want to note 2 developments which are not ideal.

We will continue monitoring them, and if they keep trending in the right direction, it may be necessary to take action.

One is that coronavirus case counts have stopped their descent and are starting to tick higher. Could be a blip. But, there’s a theory out there that the vaccines are losing their efficacy after 6 months. I’m not seeing many restrictions on travel this year in terms of large gatherings, holidays, travel, etc.

Of course, people getting together in large groups increases the chances of a flare-up in new cases. We’re well past the point of COVID cases hurting the stock market, but it would likely lead to a reversal of recent gains on case counts dropping.

Thus, it could be a catalyst for us to take profits in our reopening trades.

The second bearish item is that supply chain issues are not improving at the pace I was expecting with economies reopening. I was expecting a big improvement in simply ports staying open and working longer to work through the backlog. So far, there is no evidence that this is happening.

I wish this were not the case. This also ties into inflation and bears watching. We would want to cut positions in stocks that are being impacted by supply chain issues. Instead, it could be an opportunity to buy stocks that would see earnings growth from these bottlenecks like shippers.

Market Commentary Summary

My goal is to always be identifying opportunities and risks. Over the last few weeks, it’s been 90% opportunities and 10% risks. Now, it’s more like 70% opportunities and 30% risks.

Still, there’s little reason to be bearish here given the market’s bullish price action and fund manager positioning which means that money should continue to flow into stocks.

What To Do Next?

The POWR Growth portfolio was launched in early April and is off to a fantastic start.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +46.42% annual returns.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

Want More Great Investing Ideas?

SPY shares were trading at $469.10 per share on Tuesday morning, up $1.67 (+0.36%). Year-to-date, SPY has gained 26.70%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |