(Please enjoy this updated version of my weekly commentary published July 25, 2022 from the POWR Growth newsletter).

As usual, we will start by reviewing the past week…

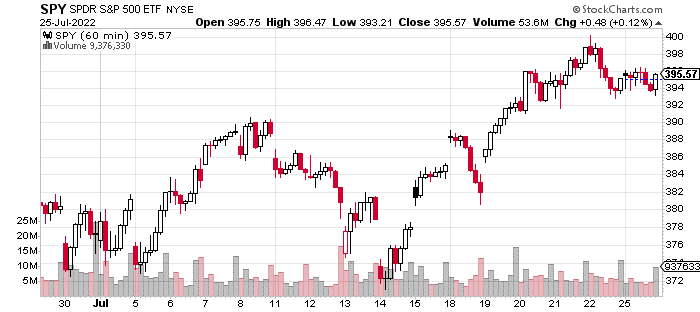

Here is an hourly, 3-week chart of the S&P 500 (SPY - Get Rating):

From last week, we are up 3.6%. Gains are broad-based, although there is a bit more strength in the Russell 2000.

The bigger picture is that our expectations of a bear market rally were validated. And, this type of grind-up is exactly what we want to see as it’s evidence of short-covering.

Those in the TA world would call it a ‘lockout rally’ which is basically when the market is moving higher, but people are underinvested which means bulls and bears are both rooting for lower prices.

I think this bullish setup remains intact. We are primed for continued gains in the event of news that is less bad than expected given that expectations and sentiment are so negative.

But, there is also the risk of worse than expected earnings or the Fed coming out more hawkish than expected which could cause a sudden drop. And, this drop would likely be another attractive, low-risk, entry point.

So, this is certainly a challenging environment. It’s entirely possible that in terms of the bear market rally… this is it.

And, we are going to roll over to new lows. It’s also possible that this ‘lockout rally’ persists. I’m leaning towards the latter outcome but prepared to quickly change my mind if the facts prove me wrong.

Sometimes, we can come up with elegant, complete theories such as when we identified early this year that the Fed’s hawkishness and a slowing economy was a brutal combination for the stock market. This is not a time, where there is a simple way to encapsulate what’s going on.

Instead, we have what are most likely going to be bearish forces hitting the stock market (SPY - Get Rating) in terms of earnings and the Fed, but this is offset by the bullish forces of falling inflation and extreme levels of bearish sentiment.

Autos

In previous commentaries, I’ve talked about the auto sector. There is one silver lining for the economy in that auto production is finally returning (or will soon) to pre-pandemic levels as the chip shortage has eased.

Auto stocks really haven’t rallied as they are more impacted by the risk of rising recession. It’s kind of a similar situation to the travel stocks where the market is looking past the short-term jump in earnings and focusing on a longer-term outlook.

I do think this sector has a strong upside if/when the market fully priced in the recession and starts to price in the inevitable recovery. I think this should happen sometime at the end of the year or the first half of next year.

In particular, I like the auto parts stocks which are trading at ridiculously low valuations and would experience the biggest gain in earnings. This is a theme we will continue to monitor.

Final Thoughts

Last week, I wrote:

To sum up my thinking: We are in a bear market. The economy is slowing which means more pain is coming. However, I believe that the ‘window is open’ for a bear market rally.

In terms of the portfolio, we have marginally increased exposure but are ready to get back to a more neutral position if we break below the mid-June lows.

Everything about this continues to be correct, although we are now nearly 10% higher than the mid-June lows. This means there is more risk in terms of taking new positions especially given the context of a bear market.

Therefore, I’m inclined to move up the level at which I would go back to neutral to 3,720 which is the July low and shouldn’t break if the bear market rally is intact.

What To Do Next?

The POWR Growth portfolio was launched in April last year and since then has greatly outperformed just about every comparable index…including the S&P 500, Russell 2000 and Cathie Wood’s Ark Innovation ETF.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +49.10% annual returns. I then take the very best stocks from this strategy and tell you exactly what to buy & when to sell, so you can maximize your gains.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

Want More Great Investing Ideas?

SPY shares were trading at $391.71 per share on Tuesday afternoon, down $3.86 (-0.98%). Year-to-date, SPY has declined -16.91%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |