Even with the recent correction in hand, there is not much argument amongst experts on the long term picture for stocks. That being the bull market will return and new highs will be recorded in 2022.

Let’s also remember that the average bull market lasts for over five years and the current one is only 22 months into its journey. So there is still plenty of time on the clock.

Unfortunately one should not fool themselves into thinking that the 120% gain since the beginning will be the pace of gains going forward. As we have seen the last several months gains have slowed down considerably along with an serious spike in volatility.

For some investors this means the solution is to buy index funds and let the chips fall where they may. However, for most of us, we want to find an edge to outperform to enjoy superior results. That is the focus of my commentary today.

Research Method 1.0

In order to tell you the solution, I first need to point out the problem. And that is the flawed way that most of us research stocks. For that purpose I will give you an outline on how the average person handles this vital task…then I will point out a better path.

Let’s say you read an article where some expert is touting 3 stocks they think are terrific. From there we will likely surf your favorite investment websites for additional information which is some combination of the following:

- What does the company do? (Industry/Sector)

- Review recent price action

- Explore a few key metrics on growth, value or company financials

- Read additional articles that tell us a bit more of the growth story for the company that gives us confident it is an attractive investment going forward.

So what’s the problem with this approach?

First it’s pretty time consuming as you realize this manual method will be applied to every stock under review.

Second, and most importantly, you are really not covering that much ground. Meaning there are literally thousands of data points that you could investigate for every stock to appreciate how healthy they are…and how they stack up to the competition.

Yet if we are being honest, this antiquated method only leads to a review of 5-10 aspects of a company before we decide to place a trade. It’s simply not a complete enough review to put the odds in your favor which leads to…

Research Method 2.0

The solution is to automate this approach. Like using computer models to scan more factors of these companies in milliseconds. This is why so many investors have turned to quantitative ratings as a means to find the best stocks.

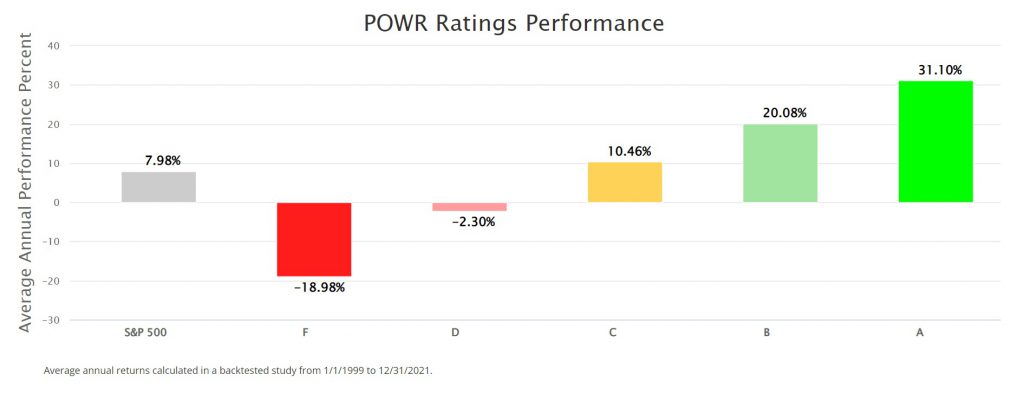

In that realm our proprietary POWR Ratings model is helping thousands of investors do exactly that. To scan each stock based upon 118 different factors in a range of areas from growth to value to sentiment to momentum to stability and fundamental strength (quality).

Why these 118 factors?

Because the Data Scientist who created the POWR Ratings proved that each of these individual 118 factors leads to stocks more likely to outperform the market. So what we are saying this model gives you 118 advantages to find stocks that should rise above the pack.

The proof of that statement is clearly verified in the following performance chart where our top rated stocks have outpaced the overall market by a wide margin:

Yes, I could end the article here. Because using our POWR Ratings will fulfill the promise of this article…to help you find stocks to outperform in the year ahead.

However, there is still one glaring problem left to solve. That’s because using the above method will still leave you with about 1,300 Buy rated stocks to review. Just too many for the average person to sort in reasonable time frame. That is why we created…

Research Method 3.0

I realized as the CEO of StockNews.com that we needed to go further for clients. To breakdown these 1,300 stocks into a more digestible form so investors can more easily enjoy outperformance.

This came together in creating an array of market beating newsletters that harness the POWR Ratings for the main styles of stock investing. See the list of newsletters below and the current # of picks in each service to appreciate what I mean:

| Newsletter | # of Stocks in the Portfolio |

| POWR Stocks Under $10 |

11 |

| POWR Growth |

11 |

| Reitmeister Total Return |

12 |

| POWR Value |

14 |

That is only 48 stocks in total. All computed as winners by our proven quant model. All hand-picked by our Editors to be the best of the best.

Here is 1 More Innovation

Historically we had customers take 30 day trials to each newsletter individually because that is the standard industry practice. But what if you are curious in seeing all the services to appreciate which are the best ones for you in the future?

And that is why we created POWR Platinum. This is a bundle that gives you access to all of our active trading newsletters at one time.

Not just the four newsletters and their 48 stock picks noted above. POWR Platinum also includes 2 other newsletters with active trading ideas:

- POWR Options– Harness the POWR Ratings through options trading to enjoy higher rewards with lower risk. Service is led by options guru, Tim Biggam.

- POWR Trends– In depth commentaries and top picks from the most exciting growth trends from EV to Space Exploration to Internet of Things to Genomics and more.

Plus, as an extra bonus you also get a subscription to POWR Ratings Premium, giving full access to our coveted POWR Ratings for over 5,300 stocks and 2,000 ETFs. This is the perfect complement to the 6 newsletters making POWR Platinum a complete investment resource.

There really is something here for every style of investor. Whether you want growth, value, technical analysis, market timing and more.

$1 for a 30 Day Trial of POWR Platinum

Yes, only $1 for a 30 day trial to all our market beating services. And while it’s not going to be $1 forever, you’ll be amazed by the low-cost options after the trial concludes.

I truly believe POWR Platinum with its 7 market beating services in total is the ultimate investor toolkit and a real game changer for individual investors.

In fact, I believe so strongly that POWR Platinum has the ability to significantly impact your investing results, and help you outperform the market the rest of the year, that I want to remove all possible barriers so you can experience it first hand and risk-free.

If you chose to continue after the 30 day trial (and we think you will), I’m offering a 100% money-back guarantee after the trial converts to a paid subscription.

Put another way, if 30 days doesn’t feel like long enough to make a decision on whether POWR Platinum is the best value investment resource out there, then take up to 90 days longer to decide, at no-risk to you.

I think the choice is clear. So get started with your trial today and start beating the market the rest of the year!

Start My No-Risk 30 Day Trial for Just $1 >>

Wishing you a world of investment success!

Steve Reitmeister

…but everyone calls me Reity (pronounced “Righty”)

CEO, Stock News Network and Editor, Reitmeister Total Return

Want More Great Investing Ideas?

SPY shares were trading at $433.90 per share on Thursday afternoon, up $0.52 (+0.12%). Year-to-date, SPY has declined -8.64%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |