(Please enjoy this updated version of my weekly commentary published November 15th, 2022 from the POWR Growth newsletter).

As usual, we will start by reviewing the past week…

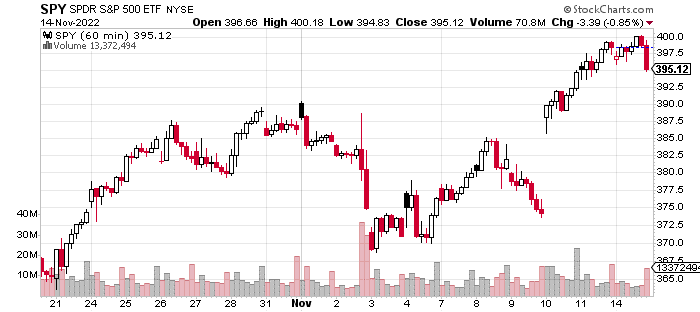

Here is an hourly, 3-week chart of the S&P 500 (SPY):

Over the last week, the S&P 500 is up by just under 7% with the major catalyst being a softer-than-expected CPI report.

Inflation Report

[This section is from the POWR Stocks Under $10 commentary but modified to make it more appropriate for growth stocks.]It should be obvious to anyone why falling inflation is a big deal and bullish for asset prices as it basically would mean that a massive market headwind turns into a tailwind.

Falling inflation, on its own, would bring relief to consumers and lead to margin expansion for companies. In addition, it would result in rates turning lower which would also boost the housing market and reduce borrowing costs for corporations.

Not to mention that falling rates would automatically boost growth stocks… even if the economic outlook deteriorates.

In essence, it would reverse a lot of the market pain.

And that was evident in Thursday’s action which saw leadership from both homebuilding stocks and speculative tech stocks as both groups have been hammered by rising rates even though these sectors have little connection to each other on a fundamental basis.

Thus, it makes sense that if rates are going to reverse and turn lower, these are the groups that will outperform on the upside.

In hindsight, it’s quite possible that inflation peaked this summer and is now plateauing or rolling over. And, it’s possible that the stock market successfully sniffed this out as it bottomed along with the high reading in the CPI.

Then, these lows were re-tested and undercut in October with a lower high for the CPI but a higher high for core CPI, before once again recovering higher the last couple of weeks.

Going into the CPI report, I was of mixed opinion about the number but leaning bearish on the market due to a hawkish Fed and a slowing economy. The inflation reading neuters the former factor at least for the short term.

This is evident with the big decline in yields, and it would take higher highs in inflation to get new highs in yields.

In fact, it’s possible that we have seen the cycle high in yields, especially if the economy starts to seriously slow.

This means the bearish case rests on seeing a contraction in earnings which causes another leg lower in stock prices.

And on a longer-term basis, the path that inflation takes will now be the major focus of Fed policy and be the main factor in determining whether we are in the end stages or middle stages of the bear market.

Bear Market Blowups + Gameplan

The bear market for the overall market (SPY) began in January 2022 but the bear market for tech and specifically high-multiple, speculative, and crypto began in early 2021.

Over the course of many months, we have seen all the leveraged players in the crypto space blow up, while many prominent startups have been unable to get funding or have seen their valuations dramatically diminish.

In terms of public markets, there are so many carcasses like Carvana, ARK, Peloton, Teladoc, Zoom, etc. Many of these companies continue to lose money and have no viable path to profitability or positive cash flow.

They simply had the fortune to raise money at inflated valuations which is giving them a long runway.

This happens in every bear market as we see fraud and rot taken out of the system, setting the stage for the next bull market. The negative price action leads to bearish sentiment and very favorable valuations.

For example, after the 2008 Great Recession, there was a great chance to buy innovative and game-changing stocks like Apple, Amazon, Netflix, Green Mountain Coffee, etc., at attractive valuations.

My ultimate gameplan is to take advantage of these opportunities and maximize our capital to be aggressive when the time is right. Of course, we’ve accomplished the first step of the plan by avoiding these blowups in the first place which have destroyed so many portfolios.

What To Do Next?

The POWR Growth portfolio was launched in April last year and since then has greatly outperformed just about every comparable index…including the S&P 500, Russell 2000 and Cathie Wood’s Ark Innovation ETF.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +49.10% annual returns. I then take the very best stocks from this strategy and tell you exactly what to buy & when to sell, so you can maximize your gains.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

Want More Great Investing Ideas?

SPY shares . Year-to-date, SPY has declined -15.13%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |