We enjoyed a tremendous turnout for this live event Wednesday afternoon. Now active traders can watch the on demand version by clicking below:

How to Trade Options with the POWR Ratings

The title kind of says it all. This is where we blend the timeliness of the POWR Ratings model with the unique risk controls found with options trading.

Truly we are talking about bigger gains with lower risk.

This presentation was hosted by myself, Steve Reitmeister, and options guru Tim Biggam where we show you how you can consistently find the best options trades.

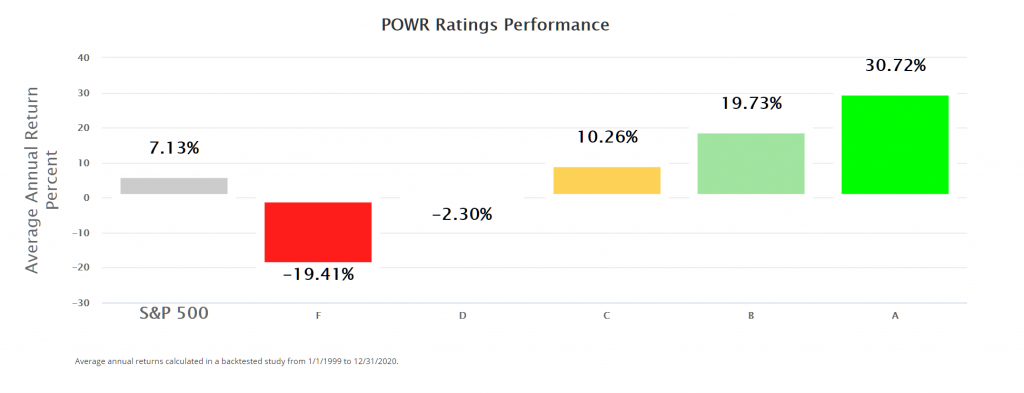

Not only will we lean into the outperformance from the POWR Ratings A rated stocks for the Call options, but check out the nasty losses for F rated stocks. Those make for the ripest Put trades.

Beyond learning these easy to implement strategies, Tim Biggam shares his 2 top options trades for today’s market.

If that appeals to you, then click below to get access to this timely investment presentation:

How to Trade Options with the POWR Ratings

Wishing you a world of investment success!

Steve Reitmeister

…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com & Editor, Reitmeister Total Return

Want More Great Investing Ideas?

SPY shares . Year-to-date, SPY has gained 25.22%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |